In the late presentation on Wednesday, the US Securities and Exchange Commission officially began its appeal in its legal struggle with Ripple Labs. Nevertheless, this step did not weaken the enthusiasm of investors for XRP Ripple, whose cost did not exceed the price of $ 3 for the first time since 2018.

Still trading above 3 dollars with significant bull bias during the press, XRP seems to be ready to expand their benefits in the short term.

SEC File is introduced

In his appeal in court on the court of appeal, the second district SEC seeks to turn the judge Analisa Torres in July 2023. The regulator claimed that the New York district made a mistake in his decision that XRP sold to retail investors, and did not represent an unregistered securities offer.

SEC quoted Haui’s test and claimed that Ripple’s advertising activity contributed to the expectation of profit among investors, thereby classifying XRP as an investment agreement.

The ongoing legal battle began in December 2020, when the SEC filed a lawsuit against Ripple, claiming that the payment service provider used his XRP token as unregistered security for the collection of funds.

XRP is not concerned

The introductory summary of the SEC marks the official step in the appeal process, in which the regulator hopes to challenge the earlier court decision. Despite this, XRP remains calm, since it continues its upward trend. Trade at the level of $ 3.13 during the press, the cost of Altcoin has increased by 9% over the past 24 hours.

During the session on Wednesday, the XRP intra -day trading session grew higher than $ 3 for the first time since 2018. While submitting the SEC application, as expected, will cause a sale that will push the price of token below $ 3, occurred the other way around. Instead, market participants increased the accumulation of the asset.

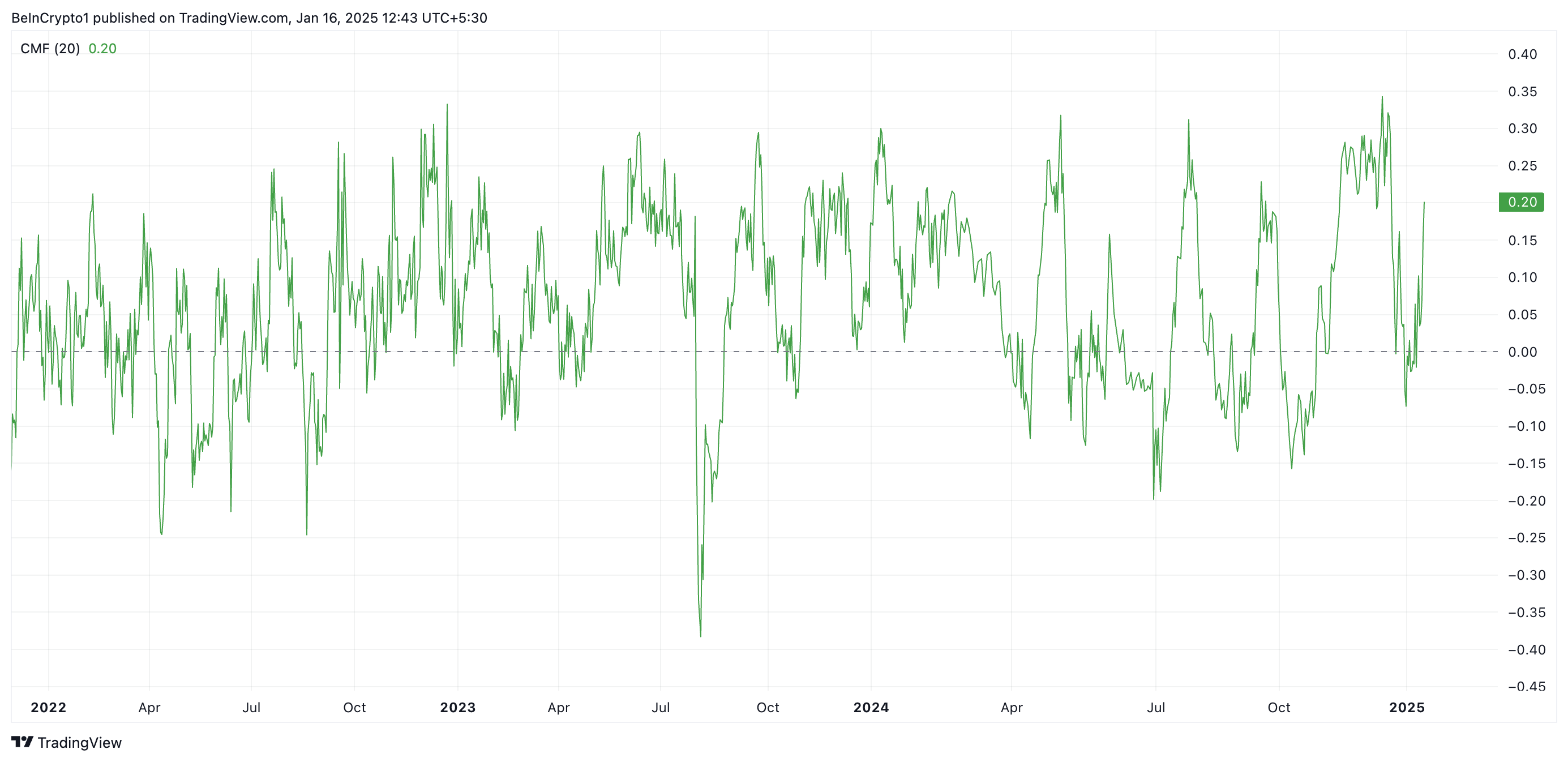

This is evidenced by Rising Chaikin Money Flow (CMF). At the time of writing this article, this pulse indicator is in an increase in a trend of 0.20.

This indicator measures the amount of money entering the asset or from the asset during a certain period, taking into account its price and volume. When it is positive during a price rally, this involves the strong pressure of the purchase, which indicates that the rally is supported by significant demand and will probably continue.

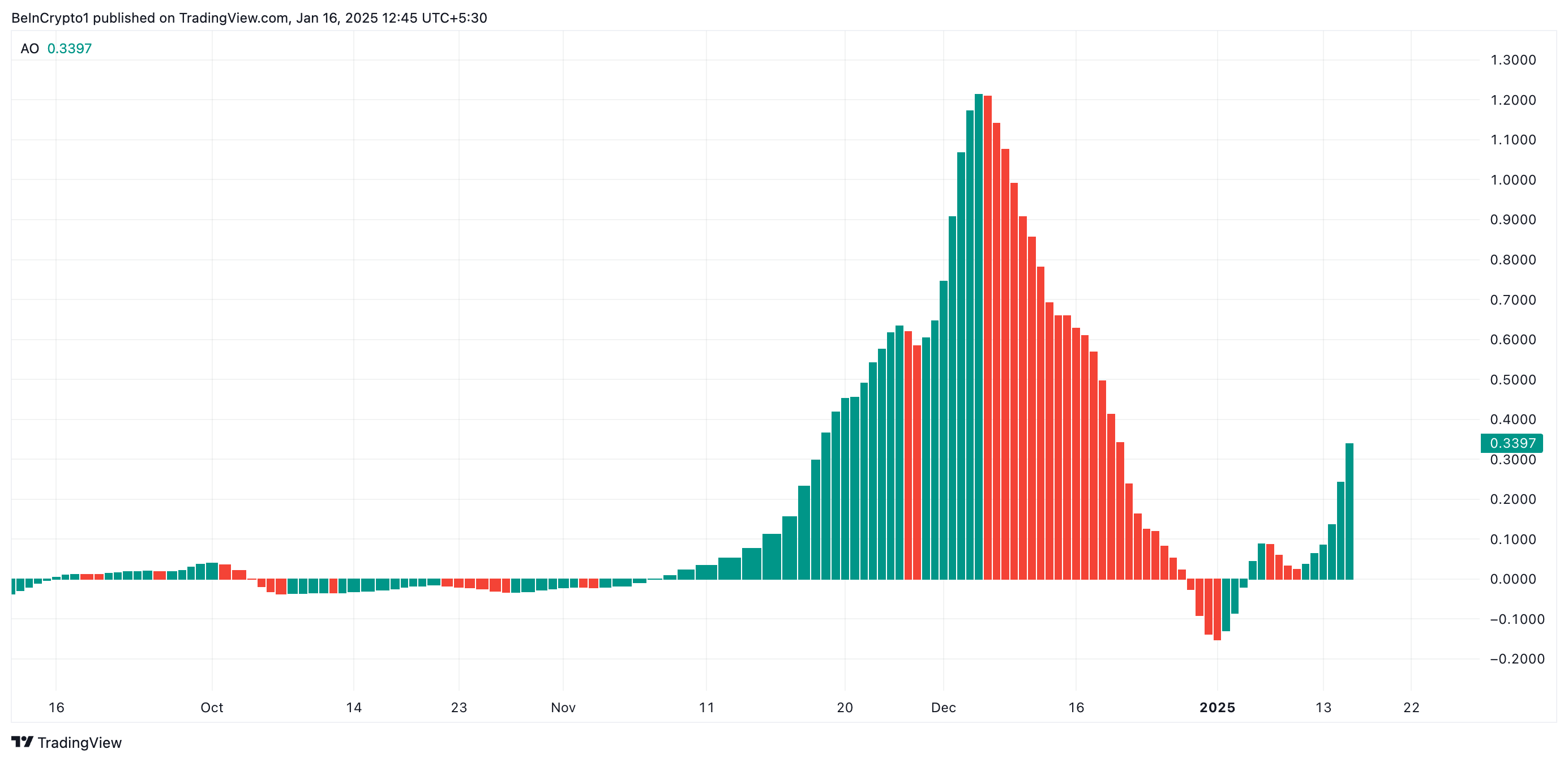

The amazing XRP generator reflects the increased accumulation of token. During printing, the indicator returns a green histogram facing up, with its value by 0.33.

This indicator measures a market impulse, comparing the short -term and long -term sliding average asset prices. When he returns a green bar with an upward upward, he signals an increase in a bull impulse, indicating that the market is gaining strength and can continue to grow.

XRP price forecast: all the time within reach

If the current trend for accumulation remains, the price of XRP can increase to its maximum of $ 3.28, which was last reached in January 2018.

However, a change in market mood can undermine this bullish look; If the pressure on sale is increasing, XRP can lose its recent achievements and fall below $ 3 to potentially bargain about $ 2.60.