Over the past 24 hours, GALA stock has fallen 7.02% and is currently valued at $0.0481 with a market capitalization of $1.75 billion. Despite this adverse price action, market interest has seen a wave of price declines as 24-hour volume coin trading increased by 7.98% and amounted to $272.5 million.

However, the token still has a long way to go, and given its important role in the decentralized gaming space, the long-term prospects look good. This is evident as from its August low of $0.0134, the cryptocurrency has jumped over 263% to its current market value of $0.0481. This represents a 94.24% deficit from the November 2021 all-time high of $0.8367. Flash forward to today, the GALA token is now range-bound, consolidating in the $0.467 and $0.52 zones.

GALA Price Action: Key Levels to Watch

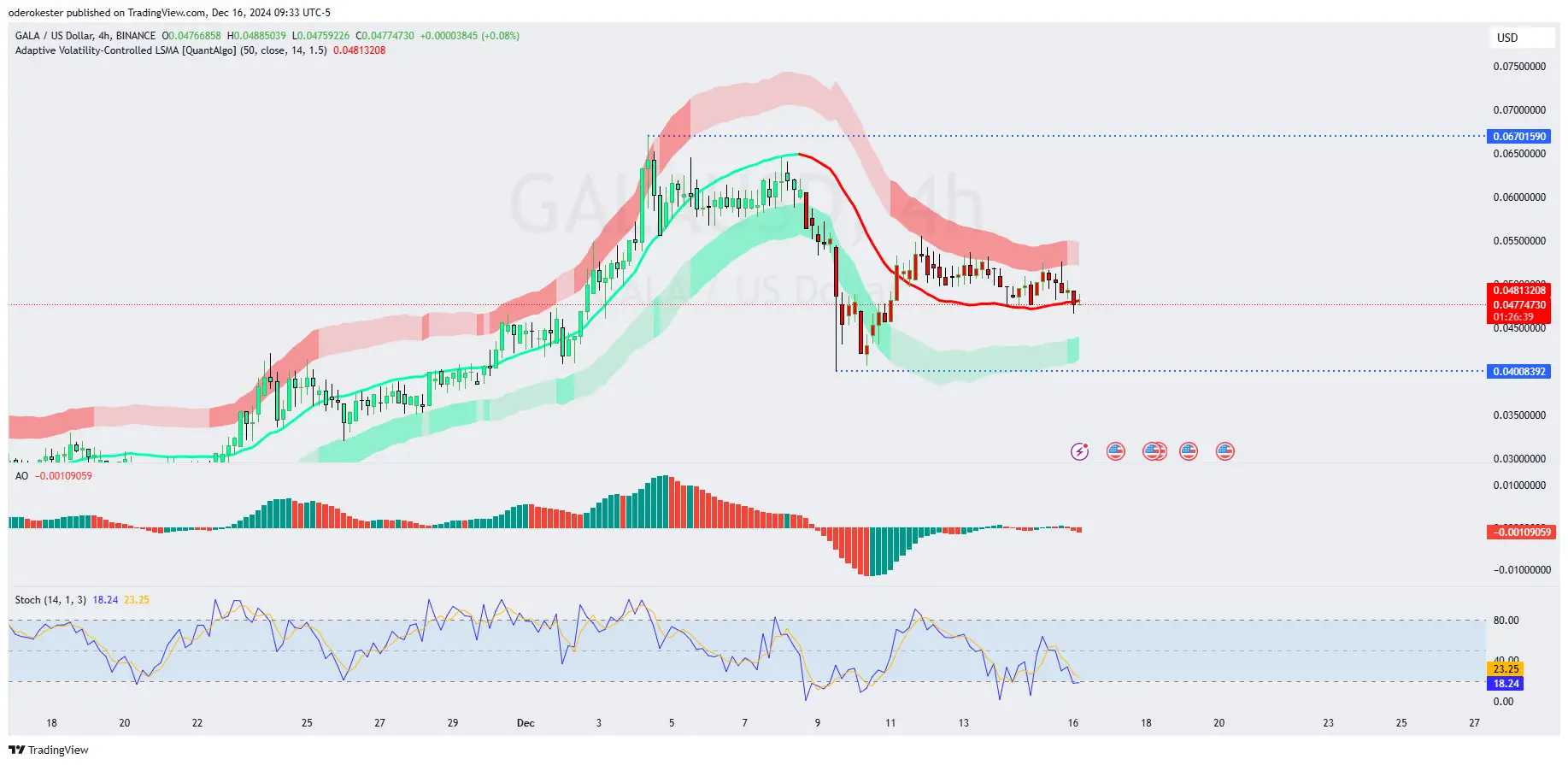

On the daily chart, GALA has support at $0.0477 and resistance at $0.065. The cryptocurrency’s support zone is currently being tested, and a strong bounce could push higher towards the $0.06 resistance level, which currently coincides with the 0.618 Fibonacci retracement level. If GALA can break through this resistance, it could reach the $0.09 yearly high zone, which also serves as a critical resistance point.

On the other hand, if support breaks, GALA price could return to the November 2024 low of $0.0150, foreshadowing a massive fall. However, the market seems unsure about the next cryptocurrency rally. A break above $0.055 could support further gains, while a break below current support could trigger a sell-off to lower levels. The price of GALA must now contend with these key levels, representing the decisive line in the sand that will determine the altcoin’s eventual rebound or further decline.

Oversold conditions signal the possibility of a reversal

An LSMA with adaptive volatility control indicates that current volatility is low as the token price stabilizes close to the line. With weak momentum at Awesome Oscillator -0.0010, further consolidation or a slight decline could occur.

On the other hand, the Stochastic Oscillator is showing readings of 18.24 and 23.25, indicating that GALA is oversold and could be eyeing some kind of short-term reversal. If current momentum shifts in favor of GALA bulls, the cryptocurrency’s market price could rise to resistance levels, or we could see continued consolidation.

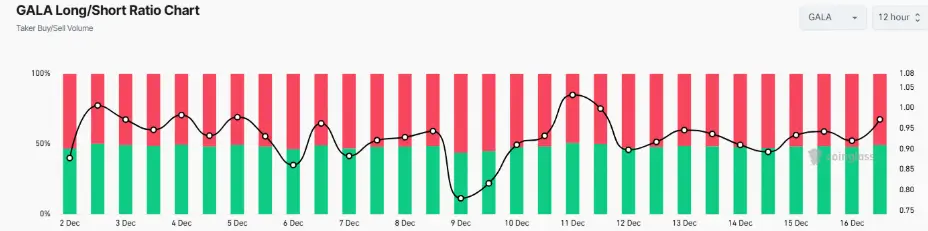

Ratio of long and short positions GALA: stabilization of market sentiment

Looking at the GALA long/short ratio chart from December 2 to December 16, market sentiment shows increased volatility. However, there was significant bullish and bearish pressure, with longs holding the reins for most of the period. According to CoinGlass dataOn December 9, the long side ratio rose sharply, exceeding 1, which means traders are more optimistic.

However, since December 16, the relationship has changed and become more balanced, with longs slightly outperforming positions. This shift in ratio indicates that market sentiment is improving and the market is in balance with respect to long and short positions. Moreover, this stabilization suggests that traders are becoming more cautious and are looking forward to clearer signals regarding how the GALA price will move.