Bitcoin’s price has been in a tight range since it hit a new all-time high of $103,647 on December 5th. It has since faced resistance at $101,509 and found support at $94,306.

The leading coin is currently trading around $98,000, but in the meantime, the leading coin may struggle to break the $100,000 mark. This analysis delves into the reasons for this resistance.

Profit for Long-Term Bitcoin Holders

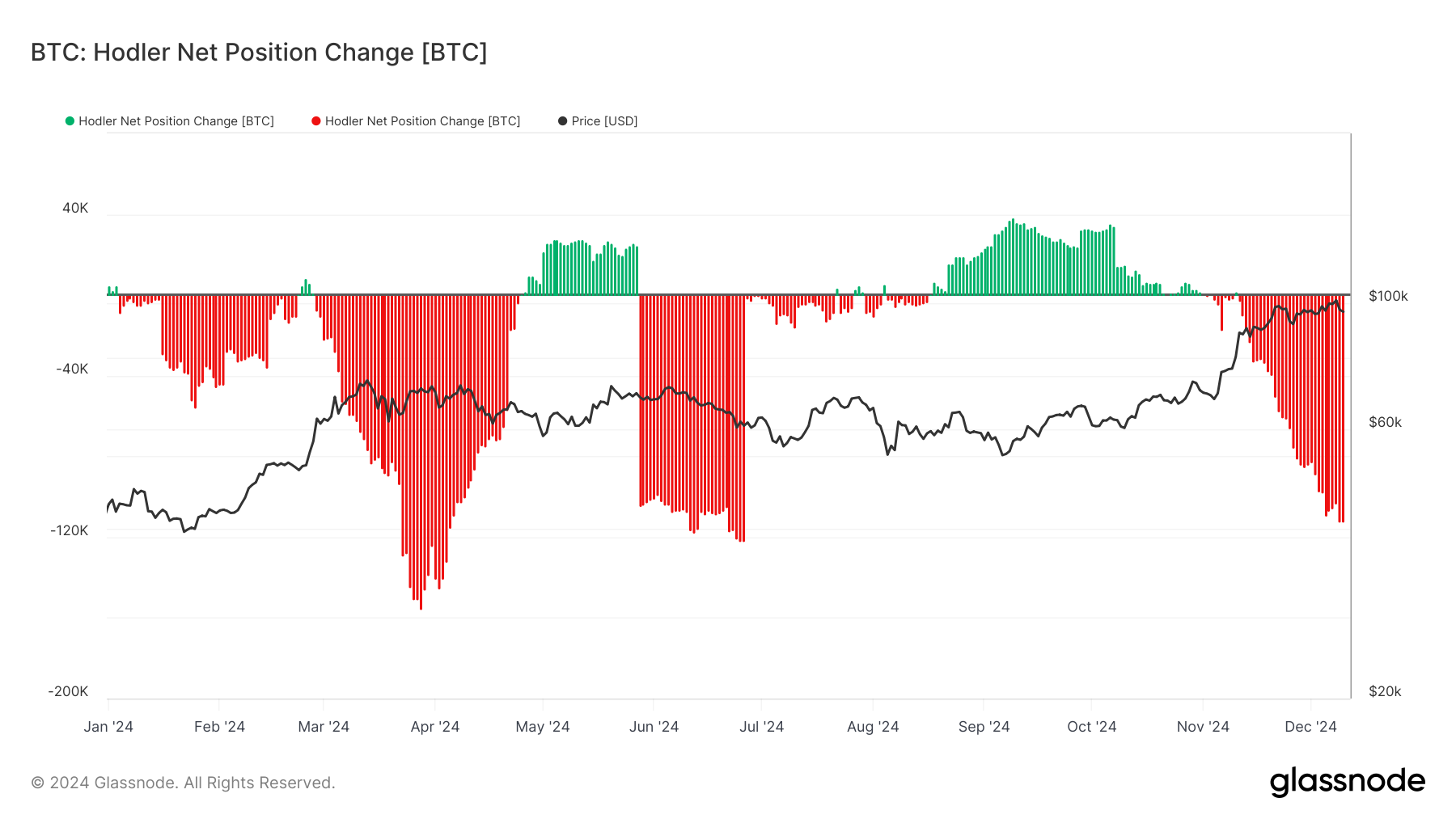

Hodler’s negative change in BTC net position confirms that his long-term holders (LTH) have been actively selling their holdings, potentially contributing to price consolidation. According to Glassnode, on November 10, the value of the indicator fell to a five-month low of -112,471 BTC.

Hodler’s net position change tracks monthly changes in the number of long-term holders of Bitcoin. A positive value suggests that these coin holders are accumulating. On the other hand, when the change in Hodler’s net position is negative, LTHs sell more of their assets, indicating profit taking.

Moreover, the shorter holding periods of these investors confirm their habit of making profits. According to IntoTheBlock, LTH BTC has reduced its coin storage time by 0.06% over the past 30 days.

Longer holding periods reduce selling pressure, increase market scarcity, and often reflect investor confidence in a coin’s price growth potential. In contrast, shorter holding periods can increase market liquidity and selling pressure. This usually signals uncertainty or a focus on short-term gain.

BTC Price Prediction: It All Depends on LTH

At the time of publication, BTC is trading at $98,240. If selling pressure intensifies, the price could test support at $94,306. Failure to hold this level could lead to further declines to $92,076.

Conversely, renewed accumulation by long-term holders (LTH) could push the stock above $100,000, potentially reaching an all-time high of $103,647.