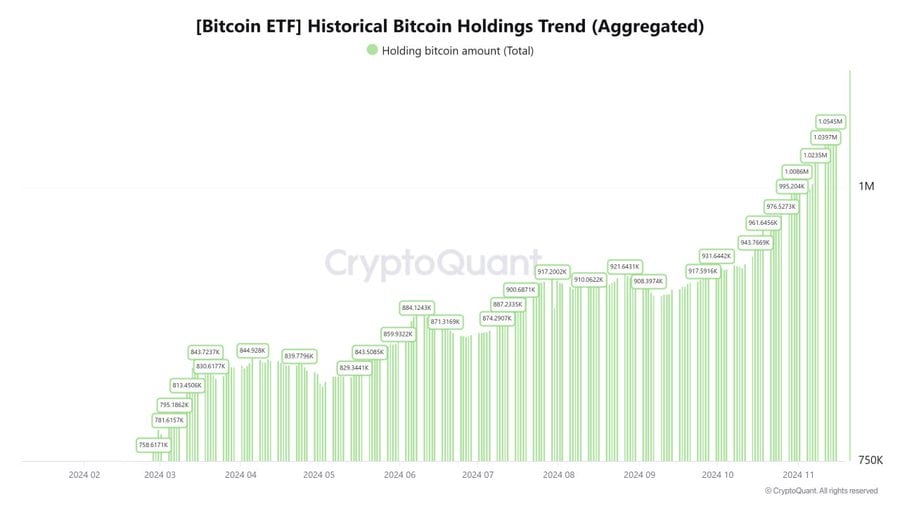

Spot Bitcoin ETFs have accumulated 5.3% of all Bitcoin in existence. in accordance with Analyst at CryptoQuant MAC_D.

According to the analyst, holdings in physical Bitcoin ETFs increased from 629,900 BTC on January 1 to 1.05 million BTC, representing an increase of 425,000 BTC. This expansion increased the ETF’s ownership from 3.15% to 5.33% of the total 19.78 million BTC mined in 10 months.

Data tracked by MAC_D also shows a correlation between Bitcoin accumulation through spot Bitcoin ETFs and price movements, especially during the March and November price surges.

Net inflows from U.S.-listed Bitcoin ETFs totaled about $4 billion by the end of March, according to Farside Investors. data show. March also saw a sharp rise in trading volume for these ETFs, reaching $111 billion, nearly tripling the roughly $42 billion recorded in February, according to Bloomberg ETF analyst Eric Balchunas.

The influx into Bitcoin ETFs coincided with a rise in Bitcoin prices, which peaked at over $73,000 during the period.

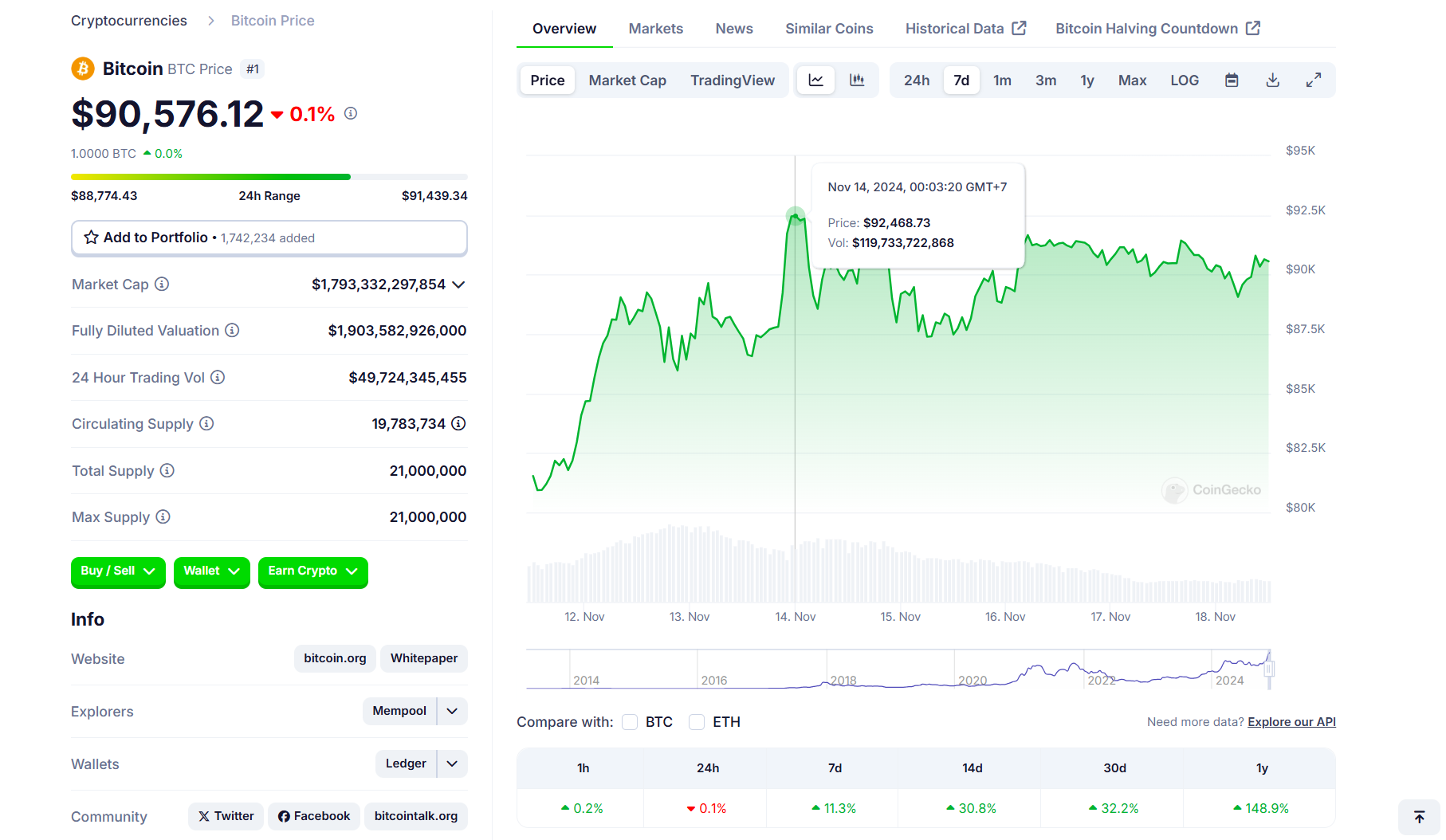

Similar to March, November saw a significant increase in Bitcoin ETF inflows and trading volumes, driven by positive market sentiment following Donald Trump’s election victory and expectations of favorable regulation for the crypto sector.

Trump’s re-election led to a surge in financial markets, including significant gains in stocks and crypto assets such as Bitcoin. Bitcoin set a new all-time high above $92,000 following Trump’s victory.

U.S. spot Bitcoin ETFs have received net inflows of about $3.9 billion since November 6. BlackRock’s iShares Bitcoin Trust (IBIT) continues to lead the pack, with more than $3 billion in inflows. The Foundation also has assets exceeded $40 billion. following recent market activity.

This week alone, IBIT net inflows totaled more than $2 billion, while the broader U.S. Bitcoin ETF market posted mixed performance.

These funds recorded net inflows of $2.4 billion during the first three trading days, but they withdrew more than $770 million on Thursday and Friday. Overall, the funds reported net inflows of about $1.6 billion.