Raul Pal, known for his provocative macroeconomic views, has sparked interest with his recent comments on the trajectory of the cryptocurrency market. In a thought-provoking post, Pal dove into the nuances of what he calls “The Everything Code,” explaining how the global liquidity cycle since 2008 has shaped macroeconomic trends.

Raul Pal, known for his provocative macroeconomic views, has sparked interest with his recent comments on the trajectory of the cryptocurrency market. In a thought-provoking post, Pal dove into the nuances of what he calls “The Everything Code,” explaining how the global liquidity cycle since 2008 has shaped macroeconomic trends.

According to Pal, this cycle, characterized by near-perfect cyclicality, has been instrumental in driving growth assets, particularly tech stocks and cryptocurrencies, to new heights.

Central to Pal’s thesis is the idea that fiat currency depreciation, caused by increased liquidity to pay off debt obligations, serves as a catalyst for rising asset prices. He maintains that this phenomenon, combined with the rapid adoption of cryptocurrencies, similar to the exponential growth of the Internet, could pave the way for a monumental increase in cryptocurrency market capitalization.

Pal foresees staggering growth from $2.5 trillion to $100 trillion, supported by the Metcalfe Act and fueled by unprecedented levels of adoption.

Chris Burniske, former head of cryptocurrency at ARK Invest, agreed with Pal’s bullish outlook and stated that the cryptocurrency market could see monumental growth, reaching $10 trillion in the near term and skyrocketing to $100 trillion in the near future. the future.

Pal enthusiastically supported Burniske’s opinion and emphasized that there is a consensus in certain sectors of the financial community about the transformative potential of cryptocurrencies.

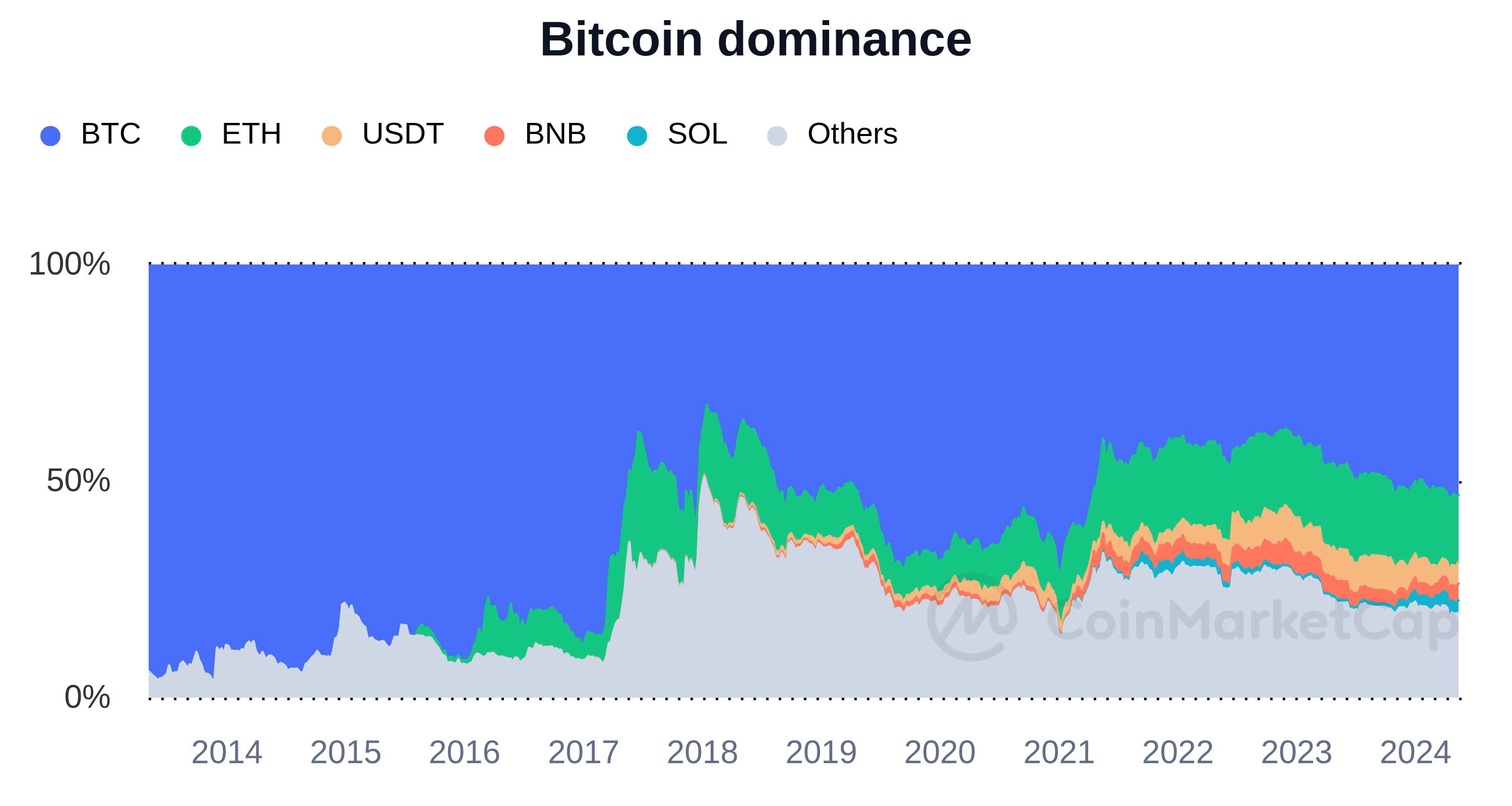

As of now, according to TOTAL Index Group, the cryptocurrency market capitalization is estimated at $2.213 trillion, of which Bitcoin (BTC) holds $1.22 trillion, accounting for more than 55% of the total figure. . Ethereum (ETH) occupies just over $350 million, with the remaining $640 million spread somewhat across all other altcoins.