In the last 24 hours, Shiba Inu has seen a absence of large transactions exceeding $1 million, indicating a period of unusually low trading activity. This lack of activity often implies a temporary drop in liquidity and volatility.

In the last 24 hours, Shiba Inu has seen a absence of large transactions exceeding $1 million, indicating a period of unusually low trading activity. This lack of activity often implies a temporary drop in liquidity and volatility.

Weekends are typically known for lower trading volumes in financial markets, and the cryptocurrency market is no exception. During these times, many merchants and institutions reduce their activities, leading to a decrease in transaction volume.

For a volatile asset like SHIB, which is heavily influenced by retail investors and larger market players, such a drop in activity can lead to reduced liquidity. This slowdown is not inherently negative, but rather a cyclical aspect of market behavior that experienced investors anticipate.

The current state of low liquidity and declining whale transactions could lead to several potential outcomes for SHIB. The most immediate effect could be a stabilization of prices, as fewer large-scale buy or sell orders prevent sudden swings in market valuation. However, this could also set the stage for higher volatility when normal trading resumes, as backlogged orders and pent-up market sentiments could result in wild price movements.

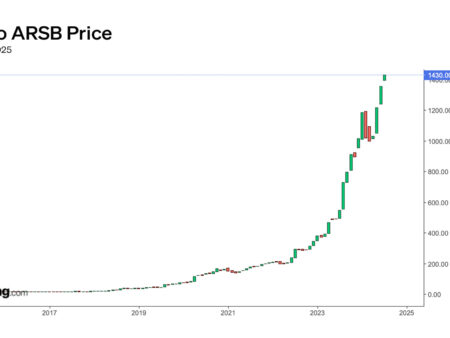

A look at the SHIB price chart reveals that a consolidation pattern is forming, with prices declining in an increasingly tight range. This type of market behavior is usually an indicator of an upcoming volatility spike, as the convergence of trend lines suggests that a breakout could be just around the corner.

For now, Shiba Inu investors shouldn’t worry too much about the lack of whale transactions. This phenomenon is relatively common during quieter trading periods, such as weekends. It makes more sense to monitor the market on Monday, when trading opens and market volume returns.