The Bitcoin market is preparing for a seismic shift as the reality of its scarcity becomes increasingly apparent. Recent data has illuminated a surprising fact: a whopping 88% of the total Bitcoin supply has not moved in at least three months. This holding trend, known colloquially as “HODLing”, shows long-term investors’ unwavering belief in the intrinsic value of this pioneer cryptocurrency.

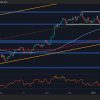

A Glassnode chart illustrating Bitcoin HODL Waves reveals layers of investor behavior over time, with the colors representing different periods in which Bitcoins have been held. The predominance of cooler tones confirms that the majority of Bitcoin has not been traded or sold for extended periods, reinforcing the scarcity narrative.

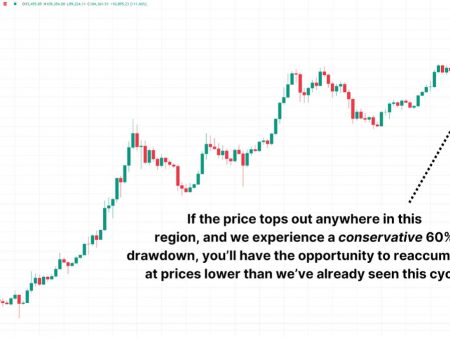

As the market accepts that 12% of Bitcoin is actively circulating, the scarcity principle suggests an inevitable rally in value. Economics 101 dictates that as a good becomes scarcer, its demand-price ratio experiences pressure. With only a small portion of the supply available to potential buyers, the competition to acquire Bitcoin is about to intensify.

The second chart, a snapshot of Bitcoin price action, indicates an upward trajectory, with the price supported by rising moving averages, a bullish indicator for market analysts. This chart is a testament to the growing momentum as Bitcoin rises within its bullish channel, suggesting that the market is responding to the shortage.

The narrative is clear: Bitcoin is becoming a scarce asset. As more of the supply becomes illiquid, those looking to purchase Bitcoin may face stiff competition, driving up prices. The market has spoken; It's not just about who will buy Bitcoin but who can afford it.