Over the past seven days, the price of XRP has increased by 39%, while its market capitalization of about 190 billion dollars and a 24-hour trade volume reached $ 20 billion. The market shows strong activity signals, and the addresses of whales from 10 to 100 million XRP remain at increased levels, which reflects confidence among the main holders.

Meanwhile, the cash flow of Chaikin (CMF) returned to a positive territory by 0.11, which indicates moderate accumulation after a short fall. Thanks to the bull lines and a strong impulse, XRP could check new record maxima, but the key support levels should be held to avoid potential sharp correction.

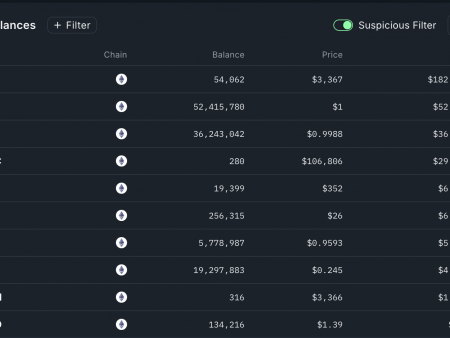

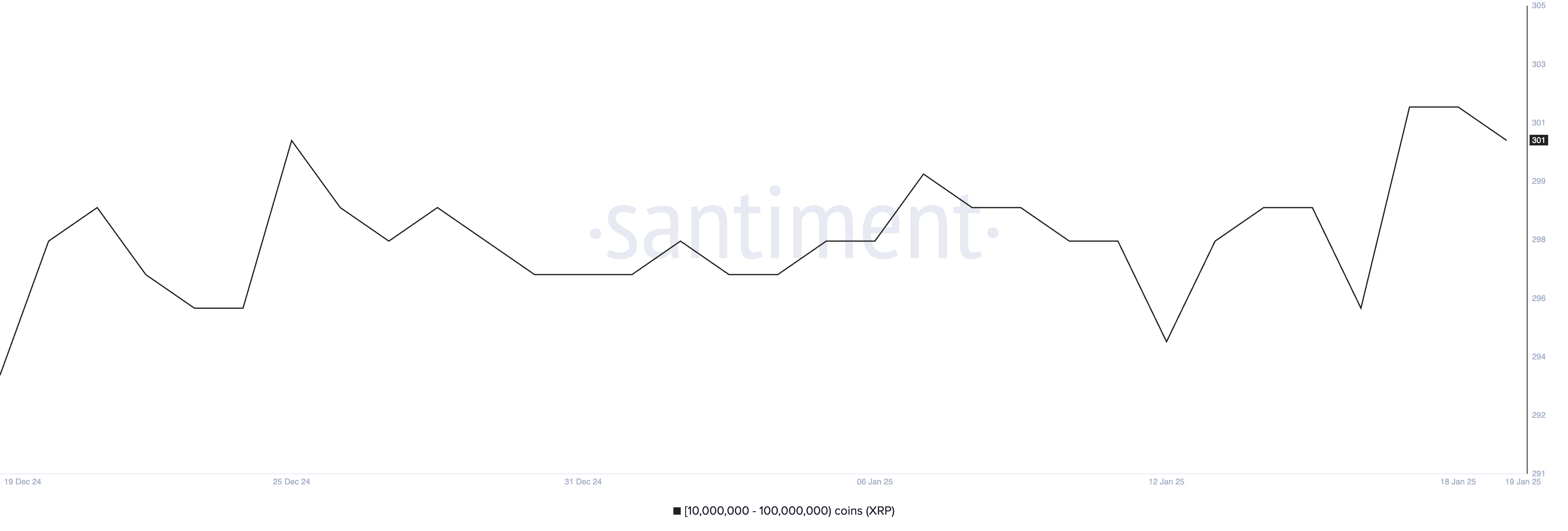

The addresses of X -ray whales remain at increased levels

The number of XRP whales – addressees, which contains from 10 to 100 million XRP – reached 302 January 17, which marked one of the highest levels in its history. Although this figure has slightly reduced to 301, it remains at an increased level, which indicates constant confidence among large holders.

The tracking of these whales is crucial because their actions can significantly affect the market trends. Their solutions to buy or sale often signal the shift in the mood or expected prices.

Level 301 addresses of whales are noticeably high, demonstrating great interest and accumulation of large players in the XRP market. This increased number suggests that these large holders can position themselves for potential prices, reflecting long -term optimism.

If these whales continue to hold or accumulate further, they can stabilize and maintain the price of XRP, reducing the likelihood of a sharp decline and potentially lay the way for sustainable pulse growth.

XRP CMF is positive after a brief achievement -0.05

XRP Chaikin Money Flow (CMF) is currently 0.11, bouncing from recent fall to -0.05 only a day ago. This follows the nine -day strip of positive CMF readings, which reached a peak at 0.33, when the XRP price reached a new record high level.

CMF measures the flow of money in the asset and beyond, while positive values indicate the accumulation and negative values of the signal distribution.

At 0.11, the positive CMF suggests that buyers still have an advantage, although the impulse weakened compared to its recent peak. This level indicates a moderate accumulation, which can provide support for the price of the XRP in the short term.

If CMF remains positive or strengthened, this can signal the updated bull activity, while a return to a negative territory may indicate a sales pressure and a potential reduction in prices.

XRP price forecast: in the near future a new record maximum?

The XRP EMA lines are currently displaying bull setting, with short -term lines located above the long -term, signaling the ascending pulse. If this positive trend is intensified, the price of XRP can grow to test levels above $ 3.40, which potentially sets new record high indicators.

However, if the trend changes, XRP may face a sharp correction, with its closest strong support of $ 2.60. A break below this level can reduce the price of XRP to $ 2.32, and if there is further pressure on sale, the price may fall to $ 1.99, which notes its lowest level since December 2024.