The price of the XRP: $ 2.23, increasing by 3.9% over the past 24 hours, with a market capitalization of $ 129.31 billion and a bidding volume of $ 2.71 billion, since cryptocurrency was moved as part of the intraday range from 2.14 to $ 2.29.

XRP

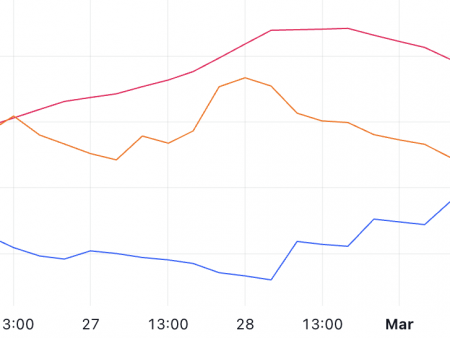

On the 1-hour diagram, XRP showed a bull tendency, since a short-term impulse showed a continuation of the pressure pressure. The relative force (RSI) index amounted to 62 years, assuming that the XRP is approaching the conditions of bite, but there was a place for further growth. The divergence of convergence of the sliding medium (MACD) remained above the signal line, confirming the bull impulse, while the 50-year-old simple sliding medium (SMA) acted as support of about $ 2.8. Nevertheless, a small decrease in the volume of trading in shorter temporary frames hinted at potential consolidation before the next breakthrough.

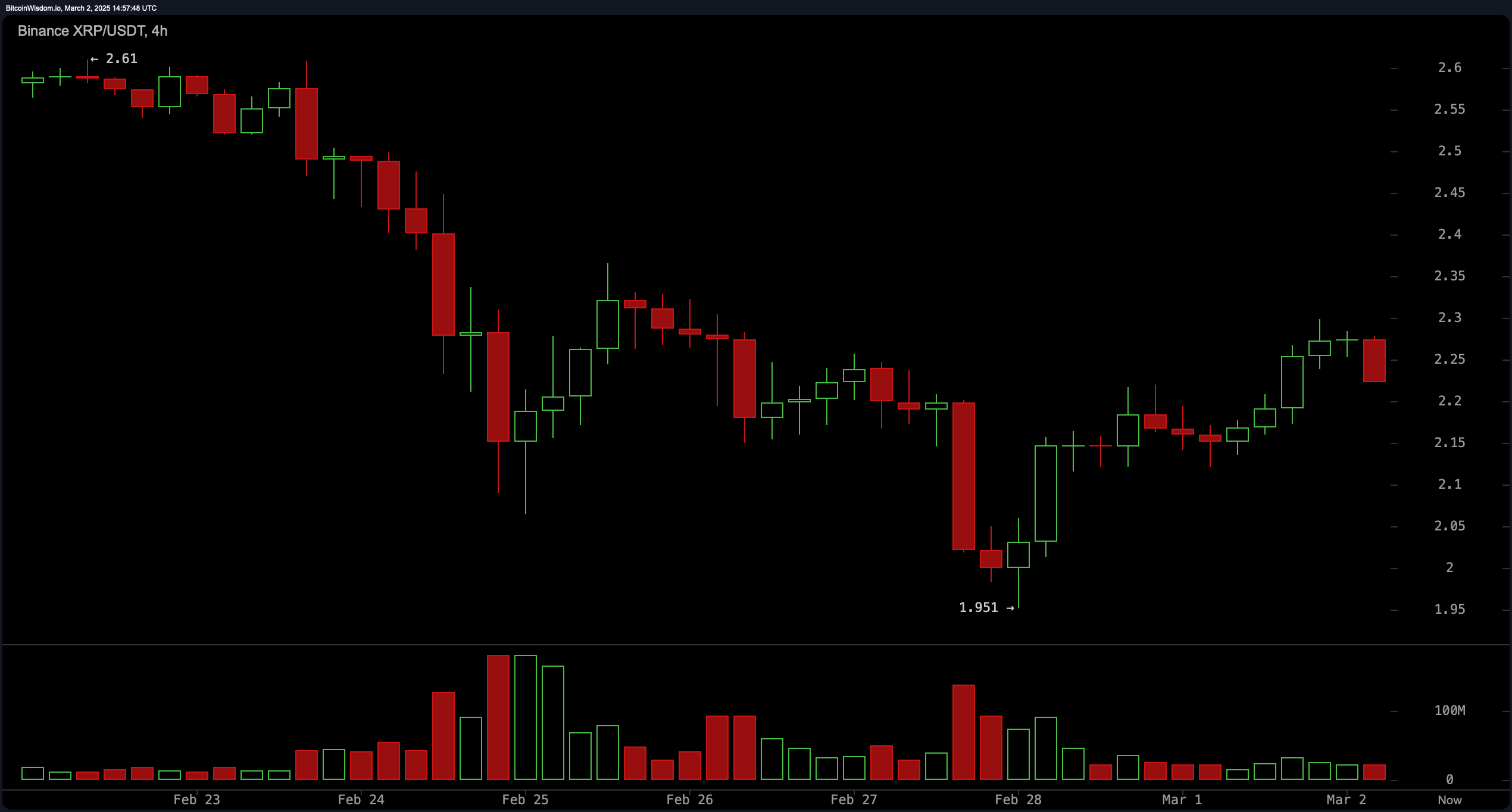

The 4-hour diagram ensured a wider pricing prospect of the XRP, demonstrating a stable upward movement due to strong support levels. RSI remained neutral in 58, which allowed to continue moving up without an immediate risk of excessive stretching. The MACD histogram showed an expanding bull impulse, enhancing a positive trend. The 100-periodic exponential sliding medium (EMA) provided a strong foundation of $ 2.12, which is consistent with previous resistance support. The volume trends supported a gradual accumulation, assuming that the XRP could re -check the upper end of its intraday range before turning to a resistance of about $ 2.30.

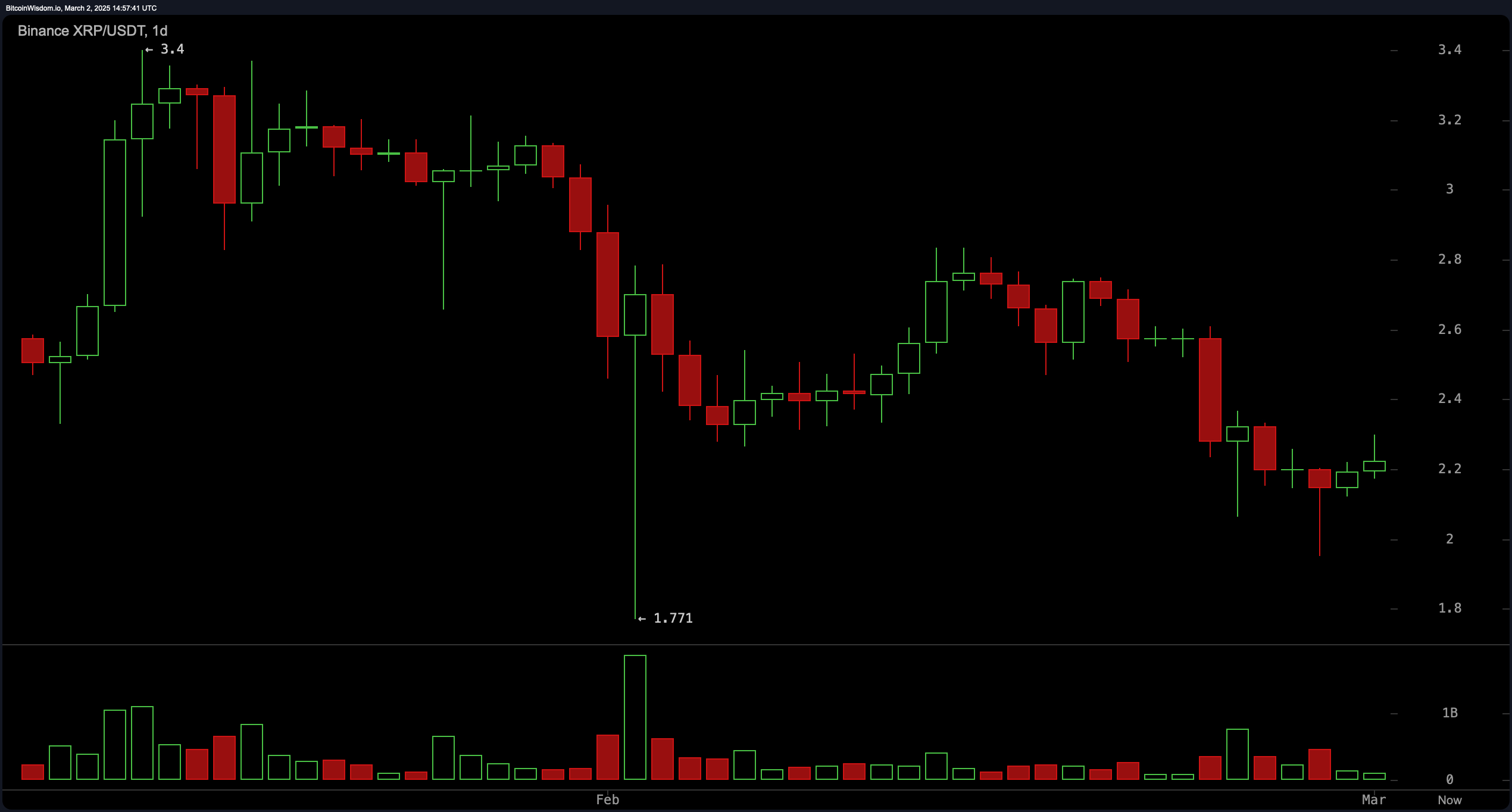

The daily diagram strengthened the bull trajectory XRP, and the assets support higher low shows and tested the resistance levels of the key. RSI in 65 indicated a bull impulse, without reaching the extreme bite conditions. Macd remained in a positive crossover, confirming an upward impulse. The 200-periodic SMA provided strong support for about $ 1.98, while the price action contributed to the continuation of the next psychological barrier of $ 2.35. The volume of trading remained stable, which indicates a steady interest among buyers.

Oscillators in several temporary framework supported bull moods, and most of the indicators leveled off with a continuation of the upward movement. RSI in all observed diagrams remained on the territory of neutral to galleys, which confirms a strong impulse. The Stochastic generator pointed out possible short -term repetitions, but a broader trend remained untouched. The positioning of the MACD above the signal line on all basic time frames was increased by the constant pressure of the purchase.

The average sliding (MAS) additionally confirmed the upward XRP trend, with key support levels, leaving long -term indicators. The 50-periodic SMA and 100-periodic EMA were held during shorter temporary frames, while the 200-periodic SMA on the daily diagram provided a long-term support base. The merger of these levels indicated strong bull moods, with a potential continuation to the next serious resistance of $ 2.35, if buyers support control.

Bull’s verdict:

The price action of the XRP, supported by a bull impulse in several temporary framework, indicates a strong tendency to increase the potential for checking higher levels of resistance. The alignment of the average key sliding average, a positive diverging average distribution (MACD) and the indications of stable relative strength (RSI) suggest sustainable purchase pressure. If the volume continues to maintain a trend, XRP can advance to $ 2.35 and above, strengthening its bull forecast.

Bear Verdict:

Despite the recent achievements of the XRP, caution is justified, since the conditions of bite arise, and volumetric trends hint at possible consolidation. The stochastic generator signals the potential short-term kickbacks and the inability to hold the key support levels that are as a 50-period, a simple sliding medium (SMA) on a 1-hour diagram or 200-periodic SMA on a daily diagram, can cause a decline. With an increase in sales pressure, XRP can view $ 2.10 or lower, signaling the weakening bull tendency.