Currently, the XRP at the price of $ 3.13, which leads to market capitalization of 180 billion dollars and a 24-hour trade volume of $ 2.53 billion. USA. Its intraudic movement of price motion heavily fluctuated within the boundaries of $ 3.11 borders and $ 3.14, reflecting the measured activity.

XRP

In a single -hour diagram, XRP demonstrates the consolidation period, and prices range within the limited range from $ 3.11 to $ 3.15. The recent formations of the candlestick are deprived of a decisive impulse, suggesting a lull in trade dynamics. Sporadic increase in volume was leveled with additional prices, signaling a cautious position among market participants.

A four -hour diagram determines a wider range limited by $ 3.00 and $ 3.28, with a model of a decrease in maximums indicating either weakening bull impulse or the appearance of bear moods. The trading volume, although moderate, does not give clear indications about the directed breakthrough. Conservative traders can strive to initiate orders for the purchase of about $ 3.10 with a narrowly placed stop at $ 3.00 or, as an alternative, expect an impetus to the impulse above $ 3.28, before entering the long positions.

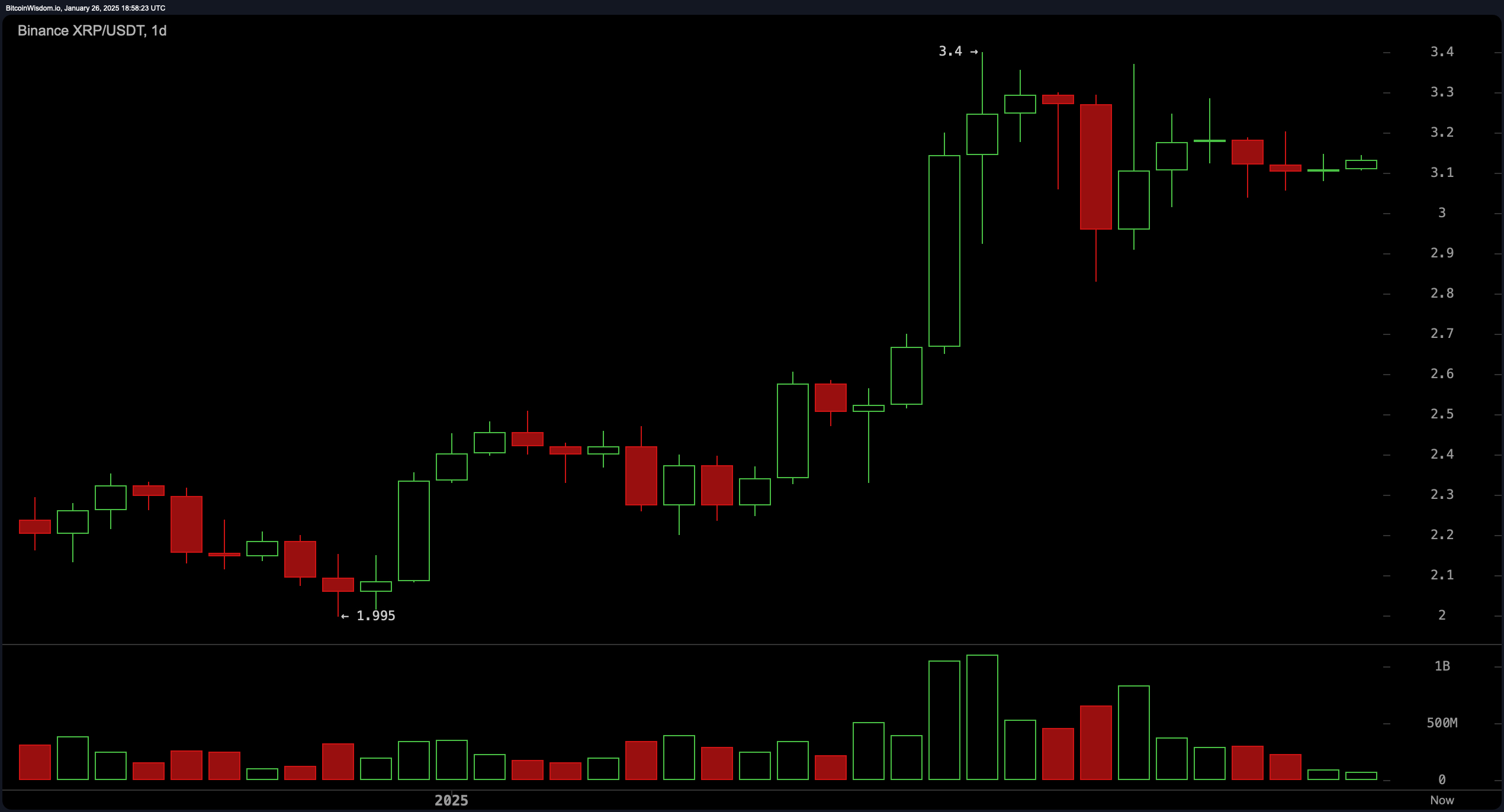

On the daily diagram, XRP supports its common bull trajectory, and prices are consolidated from $ 3.10 to $ 3.20. Over the past weeks, its rise from 2.00 to $ 3.40, the USPU was emphasized upward. However, at the stage of current consolidation, volumetric trends reveal a tapering scheme, which indicates a decrease in trade activity. If the price exceeds $ 3.40, this may mean a continuation of the prevailing upward trend. Conversely, a decrease below $ 3.00 may mean a potential shift in the mood to change.

Technical generators offer an additional context. The relative force index (RSI) at 63.91 and stochastic (14, 3, 3) in 73.20 both are described in neutral zones, which indicates the absence of the final displacement of the direction. Similarly, the product channels (CCI) index, the average direction (ADX) index and an amazing generator reflect neutrality, confirming a wider topic of consolidation. Nevertheless, the signal of the sale of the pulse indicator of at -0.11, in combination with the indication of the divergence of convergence on average (MACD) 0.21, hints with a slight tilt to the bear.

Average movements represent a more nuanced perspective. The exponential sliding medium (EMA) for 10, 20 and 30 periods select the purchase signals, which indicates the main bull moods. A simple sliding average (SMA) for 10 periods, on the contrary, signals the sale, while SMAS for 20, 30, 50, 100 and 200 periods implies favorable long -term prospects. Together, these indicators suggest that although the short-term consolidation is preserved, the long-term trajectory is still distorted in the direction of optimism.

Bull’s sentence:

The long -term XRP trajectory retains the optimistic bias, supported by its stable subspress trend and buy signals in most moving average. A breakthrough above $ 3.40. On a daily diagram, it enhances the impulse up, signaling the potential for further profit. Traiders aligned with bull moods can look for opportunities for purchase at key levels of support, especially about $ 3.10, at the same time anticipating the continuation of a wider rally.

Bear Verdict:

Despite the longer -term ascending trend, short -term consolidation and the lack of a decisive impulse, as reflected in neutral generators and narrowing, suggest caution. Violation below $ 3.00 can cause a change, and bear mood is gaining momentum. Traders with bear prospects should control the weakness of the price below $ 3.10 as an early warning about potential risks of reduction.