The XRP market is set to witness a new rush of liquidity amid multiple XRP ETPs, with one of these products hitting the European market next month.

XRP Community member and prominent YouTuber Zach Rector highlighted these products in a recent video and emphasized that their combined presence could reinforce XRP Liquidity. This could materialize as institutional adoption witnesses an observable uptick.

Let us remember that The Basic Crypto reported yesterday that DeFi Technologies, a prominent technology company, was looking to launch an XRP-based exchange-traded product (ETP). DeFi Technologies announced that it would launch the product in early December through its subsidiary Valor.

A large number of XRP ETPs

The report generated anticipation within the XRP community, as the introduction of this investment vehicle signaled greater institutional adoption. Amid the bullish reception, Zach Rector took to his YouTube channel to highlight the possible implications of the measure, drawing even more attention to similar products.

Citing revelations from community influencer Chad Steingraber, Rector noted that 21Shares, a Swiss financial technology company, has the 21Shares Ripple XRP ETP with the symbol AXRP. Despite drawing public attention to the product, the 21Shares XRP ETP was launched four years ago.

Introduced in April 2019, AXRP is available to investors in the form of regular shares on a traditional exchange. The product tracks investment in XRP and currently has $49,017,104 in assets under management (AUM). The 21Shares XRP ETP is posting a year-to-date performance of +69%.

Additionally, Zach Rector noted that Germany-based crypto ETP issuer ETC Group also has its XRP investment product, the ETC Group Physical XRP (GXRP). According to ETC Group, the product is 100% physically backed by XRP and is marketed as a regular ETF. ETC Group listed GXRP for trading on European exchanges last April.

Possible implications for the XRP market

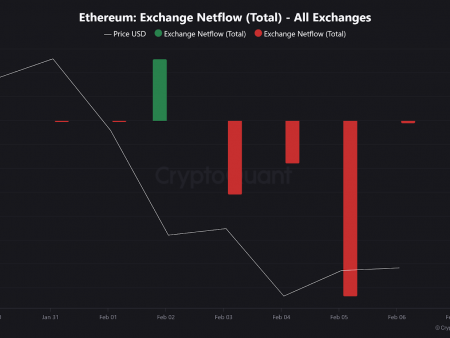

Multiple XRP ETPS can impact the XRP market by improving the liquidity of the asset by providing easier access to institutional and retail investors. These investment products allow investors to trade XRP on traditional exchanges, potentially increasing trading volume.

Additionally, ETPs can offer a regulated and safe investment avenue, attracting a wider range of investors and contributing to price discovery. This increased market share can also improve the overall efficiency of the XRP market.

For this reason, several members of the XRP community have clamored for the launch of a spot XRP ETF in the United States as the asset has achieved legal clarity. These calls intensified after the discovery of a fake BlackRock Introducing the XRP ETF in delaware.