Ripple (XRP) survived a decrease by 4% after the expected lost rally pulse. Assets broke above a significant trend line, causing the optimism of traders. Nevertheless, he could not maintain a profit higher than the resistance level of $ 2.50, retreating to $ 2.40.

At the weekend, XRP grew by 10% after it escaped from a symmetrical triangle formed in early December and early January. This breakthrough initially signaling a potential bull tendency.

Nevertheless, the rally quickly lost the impulse, which indicates insufficient pressure on the purchase to maintain upward movement. The inability to close above the resistance of $ 2.50 weakened bull sentiments, which makes x -rays more susceptible to the pressure of sales.

The key support levels are at the mark of $ 2.30, which corresponds to a 50-day exponential sliding medium (EMA). The fall below this support can lead to a further decrease in the US dollars or even $ 1.20 dollars. The relative force (RSI) index costs about 57 neutrally, since bears and bulls are fighting for positions to reduce liquidation.

Data and results of the IPC, which can move the crypto -market this week

This week in the United States, several key reports on inflation are planned, which may affect the monetary -political policy of the Central Bank. The December price index (PPI), which reflects the prices of input prices for manufacturers and manufacturers, is set on Tuesday.

The data measure the costs of the production of consumer goods that directly affect retail prices and serve as an indicator of inflationary pressure. In addition, the December index of the consumer price (CPI) in December, which measures average changes over time at prices paid consumers for goods and services, should be on Wednesday.

According to the global financial markets Tracker the Kobeissi Piret, these reports are the final set of inflation data to the collection of the Federal Reserve system on January 29. If the CPI data exceeds the expectations, the Fed may be proposed to revise their position of monetary policy, which may affect a high influence -score assets, such as cryptocurrencies.

Last week, the cryptocurrency market collided with a significant decline, and more than $ 300 billion left the digital asset sector. Like the previous week, the crypto -market has not yet tracked the steps until the exit in November 2024. According to Coingecko, global crypto -market capitalization is 3.33 trillion dollars, and on the last day – ~ 4.18%.

Bitcoin’s recent performance shows a descending trend. The price of the asset is currently 92,912 US dollars, which was 0.95% decreased compared to the previous closure.

Ethereum reflected the movement of the descending one, increasing above $ 3300, and then returned to the level of $ 3,200, which is 14% reduced weekly. The main altcoins of BNB, Solana, Dogecoin, Cardano, Tron, Avalanche and Sui also traded in red.

Gold, Bitcoin Break S&P500 Pattern, insurance shares are falling

According to the letter of Kobissy, the correlation coefficient between gold and S&P 500 reached a record of 0.91 in 2024, which indicates that these assets moved in tandem 91% of cases. Market analysts indicate that this has never happened before, as historically, gold and S&P 500 were often negatively correlated.

This has never been before:

The correlation coefficient between gold and S&P 500 reached a record 0.91 in 2024.

This means that gold and S&P 500 moved in tandem 91% of cases.

Why is “security trade” in the world in the world increasing with shares?

(stream)

– letter Kobeissi (@kobeissiletter) January 12, 2025

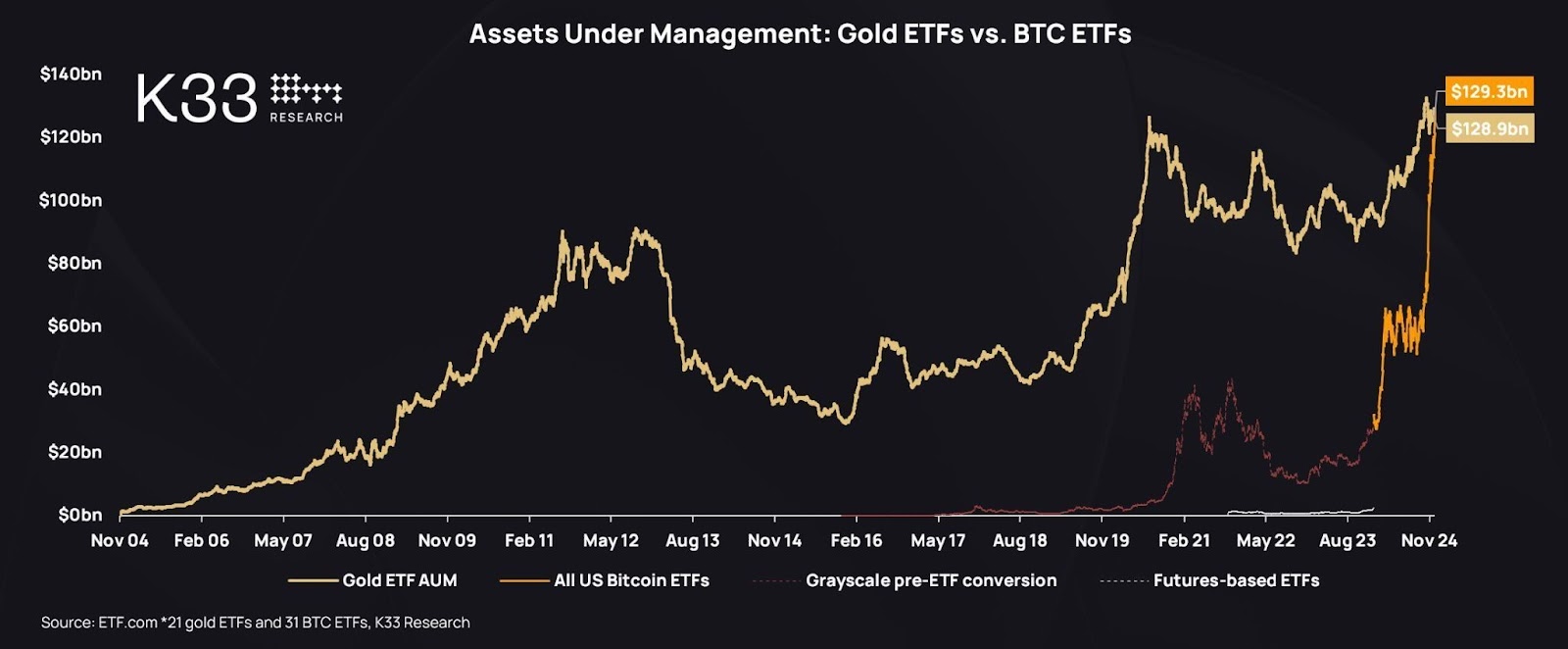

Bitcoin and gold, traditionally regarded as competing “safe” assets, both broke their feedback with S&P 500. Empressing their growing attractiveness among investors.

Over the past year, Bitcoin has significantly surpassed gold, and the profitability exceeded 110% compared with 30% Gold revenue for the same period. However, since the beginning of 2025, Gold investors have collected more income than BTC enthusiasts, thanks to a wider wider cryptographic struggle.

Meanwhile, the ongoing forest fires in Los -Angeles, California, led to significant economic losses, and insurance claims are estimated from 10 to $ 20 billion. This led to a sharp decrease in insurance shares, as companies are faced with significant payments.

Insurance shares are tuned to the roll:

Lee Lee Retreating Officers officially distributed more than 40,000 acres, and insurance losses crossed $ 20 billion.

Since the market closed on Friday, the alleged damage tripled to $ 150 billion.

Can this cause the effect of an economic wave?

(branch) pic.twitter.com/08YMNJYPUQ

– letter Kobeissi (@kobeissiletter) January 12, 2025

Promotions of companies such as Mercury General fell by almost 20% amid concern about the influence of claims related to forest fire. The financial burden on insurers can force investors to refer to alternative investments, including cryptocurrencies that are decentralized and not directly from such localized events.

From Zero to Web3 Pro: your 90-day career plan