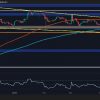

In the end, XRP violated the decisive barrier on the graph in a possible change in his market narrative. The technical milestone, which often signals the return to the bull impulse, the assets successfully closed above the 200-day exponential sliding medium (EMA) after a long period of downward pressure. The XRP was impressively restored from its recent minimums about $ 1.84 and is currently trading a little less than $ 2 of $ 1.99.

This increase returns it during the distance from the threshold over 2 dollars, which is psychologically significant. More importantly, it is closely higher than 200 EMA, often used by the dynamic indicator of the trend direction, increases the likelihood that the XRP is now ready for a long recovery period.

Over the past few weeks, 200 EMA served as a powerful level of resistance, forcing the price below every time they tried to restore control. Investors have a new hope after this last closure above the level of turns of this resistance into possible support. The crossover of this type is often interpreted as an indicator of bull intent, which can now stimulate additional movement in the price price. In order to confirm a change in the trend, XRP must successfully break out of the channel with a descending price price that began to form at the beginning of this year.

The upper limit of the channel and the next critical resistance zone 2.20-2.25 dollars should be crossed for XRP to completely restore the bull impulse. The argument about the possible rally is additionally supported by the levels of the RSI, which shows that there is still an opportunity for growth before approaching the territory of overhabitation.

The volume is gradually growing, which offers the main evidence that the percentage of purchase is renewed. Since the XRP closed above 200 EMA, optimism was thinned. Soon, assets can soon set themselves above $ 2 and, possibly, continue its rally to $ 2.30 or more if the impulse continues, and significant resistance levels will be violated.