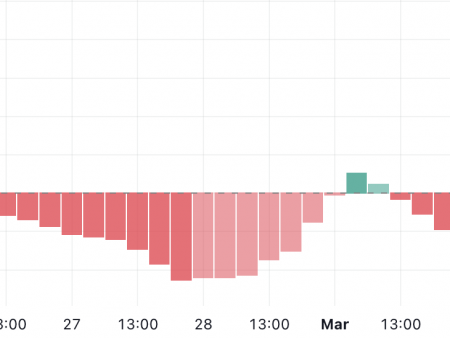

The price of the XRP was somewhat stuck from 50 and 100-day sliding medium, which creates a rigid range in which both bulls and bears are trying to establish dominance. At the moment, the impulse, of course, is not decisive. The breakthrough above or below one of these levels will be a key factor in determining the future direction of the asset.

Strong resistance is located close to 50 EMA, which is currently $ 2.71, and the XRP is currently trading about $ 2.50. The break above this mark would indicate a bull force and can cause movement to $ 3.00 and above. Although XRP experienced difficulties in overcoming this barrier in the past, a change in the trend may be checked, if this happens.

100 EMA serves as a decisive support in a lack and is located about $ 2.30. If the XRP cannot maintain this level, the sale pressure can increase and increase the price to an important psychological level of $ 2.00 or even $ 1.82. XRP needs a significant surge of the purchase volume to move above $ 2.71 and turn 50 EMA in support in order to get out of its current range.

Daily closure is higher than this mark will probably attract more buyers and paves the way to a long -term tendency to increase. Nevertheless, a bearish impulse can take the top and cause a deeper correction if the XRP explodes below $ 2.30 after loss of 100 EMA. In this situation, traders should be careful, because the asset can return to lower support levels before showing any signs of recovery.

At this critical moment, two EMAs serve as important obstacles to XRP. Although a decrease below $ 2.30 can lead to an additional lack, a step above $ 2.71 would have paved the way for a bull breakthrough. In the coming weeks, the XRP direction will probably be determined by the following significant price action, so traders should closely monitor these levels.