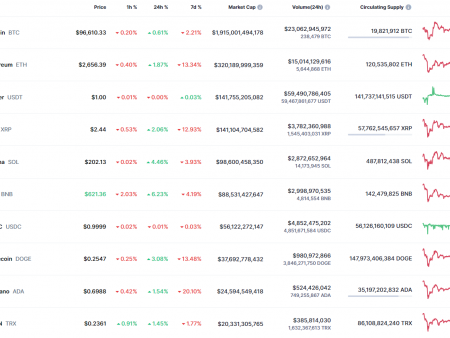

- XRP grew by 9.89% to $ 2.59, trading $ 2.52 with a market capitalization of $ 144.68 billion ..

- CMF indicates a strong influx, indicating a steady demand for XRP.

XRP grew by 9.89%, reaching $ 2.59, which caused recent adoption news. Cryptocurrency is currently trading at $ 2.52, which is 7.42% over the past 24 hours. Market activity emphasizes the growing interest in XRP, and there is an increase in trade volumes and new technical models.

The XRP market capitalization increased to $ 144.68 billion, which means an increase of 7.42%. The 24-hour bidding volume increased by 75.66% to 8.89 billion dollars. USA, which indicates increased purchase and sale activities. The fully diluted XRP (FDV) rating is $ 251.66 billion, and the market capitalization coefficient is 6.1%.

A large number of short positions open at the level of $ 2.60 have created a key liquidation zone. Market manufacturers can focus on these levels, which leads to potential volatility. Traiders closely monitor the price reactions around this threshold.

Key technical indicators for XRP

The XRP diagram offers mixed signals. The resistance is $ 2.60 with the immediate support of $ 2.45. A break above $ 2.60 can push the price of up to $ 2.75. If the support level breaks, XRP can check $ 2.30.

The relative force (RSI) index is 67.13, approaching the rejuvenation zone. The average RSI value is 56.33, signaling the bull impulse, but caution from excessive stretching. The average sliding on the graph also indicate an increase in pressure. The former crossover occurred recently, supporting the ongoing rally.

Cash flow CHAIKIN (CMF) is 0.22, which reflects a strong influx of capital in XRP. This implies constant demand and confidence from the traders. Medium slides show positive trends, but future prices will determine whether the rally supports.

Technical indicators imply that XRP may encounter short -term resistance, but maintain an ascending trajectory. If the bull impulse continues, the token can restore higher levels above $ 2.60. Nevertheless, RSI levels near the bought -up zone warn of potential corrections.