Beginning 2025 XRP price Faced with significant bear pressure. Among the complex macroeconomic landscape, in which more powerful data about workplaces in the United States could be, pandemic fears and rising oil prices, investments are wondering if the price of an X -ray can crash or it remains stability.

In this analysis, we will plunge into the recent effectiveness of the XRP table, explore the macroeconomic factors affecting its price, and predict whether it can crash up to 0 dollars or recover after its current decline.

XRP price forecast: diagram analysis

1. The current price and movement

As of January 9, 2025, XRP is traded in $ 2.31970Reflecting an insignificant intraday increase 0.20%The chart demonstrates the consolidation phase with alternating bull -calves and bearish candles Heikin Ashi, indicating indecision among traders.

The price, by the same, checks the critical level of support for $ 2.30And any violation below this can accelerate the bear pulse.

2. Technical indicators

Bollinger Bands:

- Ballinger stripes display a compression pattern, which indicates low volatility. Historically, such surrender is often preceded by acute price movements, but the direction of the breakthrough remains uncertain.

- The XRP is traded next to the lower strip, a bear signal, which involves a continuation of the sale pressure, if only customers decide.

Relative power index (RSI):

- RSI stands at 44.86Below the neutral mark 50. This indicates that the XRP is in the bear area, with a weak pulse of the purchase.

- The lack of discrepancy between the price and RSI additionally signals that the descending trend can be preserved if external factors do not improve.

Key levels of support and resistance:

- Resistance: $ 2.35 (recent local maximum), $ 2.40 (secondary resistance).

- Support: $ 2.30 (psychological level) and $ 2.22 (critical level compared to previous minimums).

3. Bear and bull scenarios

- Bear: If the XRP violates support in the amount of $ 2.22, the next probable target is $ 2.00. This level can cause further sales caused by panic and wider market weakness.

- Bullish: On the other hand, holding the level of $ 2.30 and a gap of $ 2.35 can pave the way to restore up to $ 2.50.

Macroeconomic factors that reduce the price of XRP

The current macroeconomic environment is a significant oncoming wind for the XRP and a wider cryptocurrency market. Three key events exert descending pressure on prices:

1. Stronger data on US workplaces

The last report on workplaces in the United States showed 8.096 million vacanciessuperior to expected 7.605 millionThis field reflects the stable labor market, which reduces the likelihood of reducing the interest rates of the federal reserve system in the near future.

Influence on Crypto:

- A more stringent monetary policy limits liquidity, which is crucial for speculative assets, such as cryptocurrencies.

- XRP, as part of the altcoins market, is especially vulnerable to liquidity restrictions, since the reduction of investor capital often flows to safer assets.

2. New pandemic fears

Fear of a potential new virus, Human Metapneumovirus (HMPV)Alarming global markets. Reports on several cases on January 7, 2025 increase panic, causing memories of the initial flash of Covid-19.

The market reaction:

- Investors are running from unstable assets, such as cryptocurrencies looking for safe shelters, such as gold and US dollar.

- This uncertainty aggravated the inability of XRP to maintain an impulse, as reflected in its bear signals.

3. Oil prices rising

The decision of Russia and OPEC to compress oil supplies led to an increase in oil prices, which caused new inflation problems. An increase in inflation allows the federal reserve system to aggressively reduce interest rates, maintaining dense liquidity.

Crypto Connection:

- Higher inflation reduces the risk appetite among investors, which leads to an increase in cryptocurrency sales pressure.

- XRP is no exception, since he is struggling to attract buyers among a wider disgust in the market.

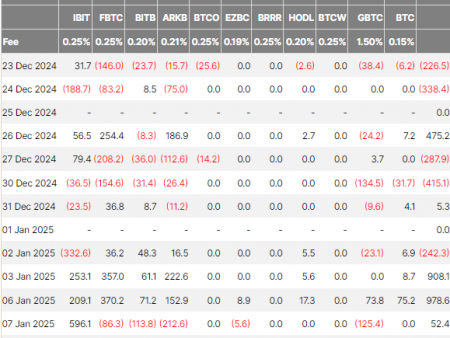

Additional factors in the decline of crypto -market

Investors’ profit:

- After significant success in 2024, many investors record profit, which contributes to a short -term sale. XRP is likely to face this oncoming wind when traders leave their position to ensure their profit.

Medical mood shifts:

- Waiting for changes in politics and macroeconomic uncertainty leads to rapid adjustment on crypto -markets. The price of the XRP reflects this shift in mood, when traders react to external factors more than the internal foundations.

Can XRP Price Crash up to $ 0?

The accident up to 0 dollars is very incredible for XRP, given its strong foundations, including:

- Institutional partnership: XRP is widely used in cross -border payments through RipPlenet, providing a real utility.

- Acceptance: The coin has a reliable presence in the market and support from the established community.

- Market capitalization: XRP remains one of the largest cryptocurrencies, which provides significant liquidity and prevents full accident.

XRP price forecast: Prospects for January 2025

Bear prospects

If XRP violates critical $ 2.22 supportThis can cause a sharp sale for the following purpose around $ 2.00This scenario can materialize this scenario if:

- Pandemic fears are aggravated, which leads to greater market volatility.

- Inflationary pressure and a more stringent monetary policy reduces investors’ appetite to assets at risk.

The potential of the restoration of bull

Despite the bear’s impulse, XRP has a potential for short -term recovery if:

- He holds above $ 2.30 support And erupts through $ 2.35 resistanceField

- Improved macroeconomic moods or crypto-specific news (for example, wave legal victory or adoption announcement) strengthens the confidence in the asset.

The return will probably be aimed at $ 2.50With the possibility of further profit, if external conditions are stabilized.

Conclusion

While XRP is faced with significant bear pressure, an accident up to 0 dollars is not a realistic result. The strong usefulness of cryptocurrency, institutional adoption and market capitalization provide it with a network of protection against complete collapse. Nevertheless, the macroeconomic environment dedicated to stronger data about workplaces in the United States, new pandemic fears and rising oil prices, maintain significant values in price.

Investors must carefully monitor the key levels, especially $ 2.22 down and $ 2.35 On the other hand, to evaluate the next large move. Since January is unfolding, patience and risk management will be crucial for traders focusing on this unstable period.