Trump family fund, World Liberty Financial, is on the way to sell the latter from WLFI tokens. The second stage of pre -sale should raise only $ 2 million to close, opening the next stage of the project.

World Liberty Financial almost completed the last stage of its pre -sale WLFI tokens. A little more than 40 million tokens remains with a price of $ 0.05, waiting for an influx of only $ 2 million. USA. The fundraising remained relatively slow, as most of the purchases were for retail sums. The fund closes its second pre -sale, after previously placed 25B tokens at 0.015 US dollars.

For now, WLFI I did not attract other large -scale buyers, and most purchases are similar to small donations. WLFI continues to sell Ethereum (ETH) or USDC most often. WLFI purchases vary from 10 to 10 US dollars to 3.1ET for one of the recent additions. The last stage increased the owners of WLFI to 85 569 Wallets.

The next stage of the fund is to launch your own version of the AAVE storage, providing passive income based on crypto -lending. In the future, the exact use of WLFI token will become more clear, although the asset will remain locked and not transmitted for at least a year after the pre -sale ends.

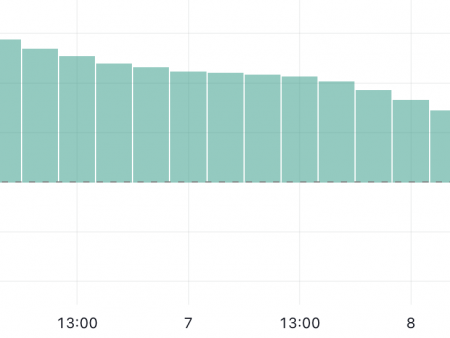

World Liberty Fi portfolio loses $ 3 million a day

World Liberty Fi is more than the fund was used as an indicator for a reliable choice of token. Despite this, the estimated losses from the peak value can be before 110 million dollarsThe field is difficult to evaluate the exact losses, as the fund traded and reorganized its portfolio in order to maintain the cost.

The purpose of the portfolio would be to provide side by AAVE storage facilities, which will bring passive income. For this reason, the World Liberty Fi turned some of its assets into the most widely used capital radiation on AAVE.

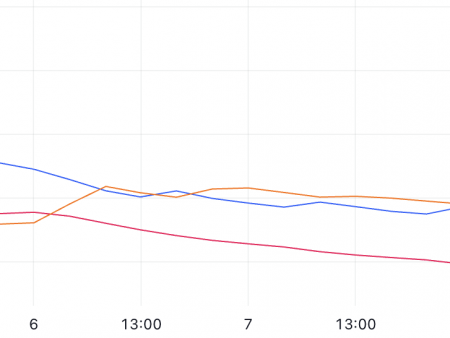

As of March 10, the fund portfolio based on the main public wallet Fell up to 75 million dollars. USA, which is 3 million dollars. USA in a few hours. A rough assessment shows that Ethereum (ETH) is the largest source of losses, which is up to 65% for paper losses. The fund relies on the Ethereum ecosystem, with ETH and its wrapped versions as the greatest possession.

Currently, the fund saves 7.53 thousand ET, estimated at more than $ 14 million. This is the largest ownership of the fund accrued in recent weeks as a result of shopping and trade WLFI. It is known that the fund is actively trading and buys the fall of ETH.

Despite this, the World Liberty FI lost 9% of the ETH cost last day, since the asset fell less than $ 2,000. ETH is more than 65% of the fund’s possessions, which practically makes the Trump family to the maximalists. Even Eric Trump, one of the closest to the fund, was involved in the task recommendation To buy ETH, just before another significant price cutting.

Some of the World Liberty FI assets were moved to other wallets, although one of the public addresses remains the most active, receiving an influx from buyers.

World Liberty Fi retains its Tron (TRX) assets, which also published the smallest losses. The fund also expanded its own movement (move). In general, the World Liberty Fi reduced its selection of tokens, removing some of its main wallet tokens.

After recent movements and shifts, the fund portfolio is more limited. World Liberty Fi has moved its assets ONDO (ONDO) and ChainLink (Link) during the adaptation of Whitebit (White). Some of the funds were transferred to WBTC, serving both a scarce asset and the BTC market price tracker.