Recently, the price of the XRP fell sharply below 50 EMA, which often serves as a decisive support for a bull impulse. Many traders are wondering whether a return to the mark for $ 3 is still possible, given that the asset is currently difficult to hold more than $ 2.50. The obvious loss of the structure of the ascending trend in the current price action of the XRP is the most alarming aspect.

The level of $ 2.10 is the following critical support level to follow. XRP can be pulled to 200 EMA, which is located by about $ 1.80, if the price cannot remain above this zone. Recovery, however, cannot at all. XRP is trying to form a local bottom and discovered some temporary stability, despite a steep fall. To form a bull circulation, the price would have to move above $ 2.80 and return 50 EMA as support.

This would laid the way for re -testing the resistance zone for 3 dollars, which in the past served as an important obstacle. On the other hand, volumetric trends are reduced, which suggests that there are currently fewer purchases. XRP can be difficult to maintain any restoration efforts in the absence of a significant surge in demand. In addition, RSI is circulating on neutral territory, which indicates that there is no significant change yet.

The most likely scenario is currently that there will be further consolidation from $ 2.50 to $ 2.10. If XRP overcame the support of $ 2.10, the decline can quickly accelerate. Nevertheless, a return to 3 dollars can still be possible if buyers intervene and return the lost position, even if there is a strong opposition first.

Solan is going to turn around

Solana (SOL) is on the turning point when its price does not exceed $ 200. The upcoming crossover 50 and 100 EMA can lead to additional volatility of the decrease, and the recent price action indicates that SOL has difficulties with restoration of the pulse after its steep decrease.

SOLANA demonstrates signs of weakness, since it cannot restore the lost position, and at present it is trading for about $ 205. The immortal change in the impulse is often indicated by a decrease in the asset below 50 EMA and the fast convergence of 100 EMA. The completion of a bear crossover between two sliding mediums can increase pressure on sale and lead to the fact that Sol will fall below $ 200.

The most direct level of support is $ 191, where buyers intervened in the past to stop the decline. If this level is not held, the next significant support, which corresponds to the previous zone of demand, is about $ 175.

SOL will enter a more serious phase of correction if it breaks below, possibly testing 200 EMA about 160 dollars. On the other hand, 50 EMA is currently $ 222, followed by the first significant resistance of $ 215. To have any possibility of handling bull, SOL will have to flash above these levels to indicate that there is a new interest in buying. A decrease in activity in volumetric trends suggests that the bulls are not very confident at the current levels. Despite the fact that the RSI is slightly distorted in the neutral territory, it is slightly distorted down, which indicates that the bear is still strong.

Dangerous Dogecoin test

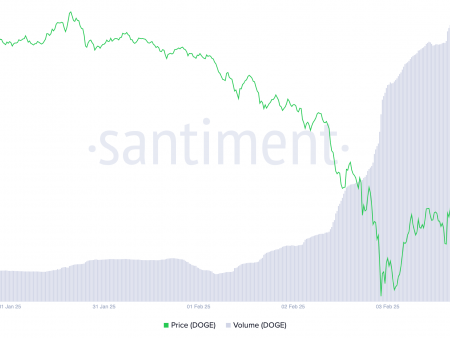

Dogecoin is approaching the rotary moment when it approaches 200 EMA, the level that can decide whether the memo coin continues on its ascending trajectory or begins to protracted down. After a sharp increase in more than 250%, DOGE made a significant recovery, destroying most of his profit and testing important support levels that will determine his next course of actions.

Currently, Dogecoin is traded at about 0.266 dollars, which is a steep fall compared to the last maximums of more than 0.44 dollars. The volume increased in tandem with a decrease, which indicates that a significant percentage of traders sells their positions. Strong downward pressure involves a sales wave, which can lead to the fact that dogs can even lower, even if an increase in volume can sometimes indicate a change. 200 EMA Asset is now the last line of protection. In the past, this level served as a solid buffer, stopping additional drops.

A short -term recovery can occur if DOGE can maintain above this sliding average, with a possible increase in an increase located about $ 0.30 and $ 0.317. Nevertheless, a complete transition to a downward trend can be confirmed if the price falls below 200 EMA, while $ 0.22 as the following significant support. EMA convergence, which indicates an increase in bear impulse, adds care.

These moving mediums can accelerate the decline and lead to a larger amount of investors surrender if they cross down. Since the RSI levels are currently 40, it seems that DOGE has not yet been resold and has a potential for further reduction. In order not to fall below 200 EMA at the moment, Dogecoin needs strong purchases.