Price bitcoins and wider crypto -market grew after the victory of Donald Trump in November, and the rally gained a fresh impulse in the days preceding his inauguration on January 20.

Crypto-enthusiasts are largely sold according to the image of Trump as the Messiah of the industry, backed up by his self-proclaimed role as a champion of Pondo Politics. But are these hopes based on reality, or was the market as a result of imagination?

During his enthusiasm for Nashville in July last year, Trump made bold promises to turn the United States into a crypto -stage of the world. To support this vision, he confirmed his intention to create a strategic reserve of bitcoins (SBR).

“We will do something great with crypto, because we do not want China or someone else to move forward,” Trump CNBC said last month.

Now that the initial signs of growing inflation are afraid of the economic crisis, Trump is expected to release several executive orders related to Crypto after his return to the White House. The incoming administration has already announced plans to weaken normative acts, the creation of a crypto -presidential advisory council, including about 20 general directors and founders with close ties with Trump, to give the industry a vote in the government, to withdraw a restrictive policy such as SAB, and and Position the United States as a global Bitcoins production center.

Cryptocols

Trump appointed a venture capitalist and leading podcast David Sax as the first artificial intelligence of the country and crypto -king.

As part of the celebration of the inauguration of the weekend, Sacks organized a crypto-face in the audience of Andrew W. Mellon in Washington, the District of Colombia, January 17. The event was organized by BTC Inc., stand with Crypto, Exodus, Anchorage Digital, and Kraken. Sponsors included Microstrategy, Metamask, Coinbase, Solana, Galaxy Digital, Kraken and others.

It is delighted with being in Washington, the District of Colombia 🇺🇸 🇺🇸 for a crypto-smell-gala-concert dedicated to the inauguration of @realdonaldtrump, the celebration of American innovations and a bold, favorable vision of the new administration. It is arranged by David Sax, Crypto -Tsar and unites some of the brightest … Pic.twitter.com/en9L04BKK9

– Beniamin Mink | ACC 🔥🛠 (@beniaminmincu) January 17, 2025

According to the New York Post, the elected president reportedly considers the Kristo reserve strategy of the First America, which will include Bitcoin, as well as digital assets based on the United States, such as XRP and SOLANA.

Whether Trump’s own reserve will be in this reserve (Trump), now with a market capitalization of about 13 billion dollars.

According to Coingecko, is currently $ 21. The coin made her debut with 200 million tokens in circulation from the general offer of 1 billion, and the remaining sentences will be gradually released over the next three years.

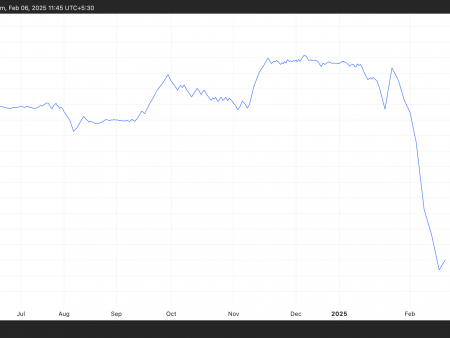

He reached $ 73.43 and currently ranges from $ 66 at the time of writing.

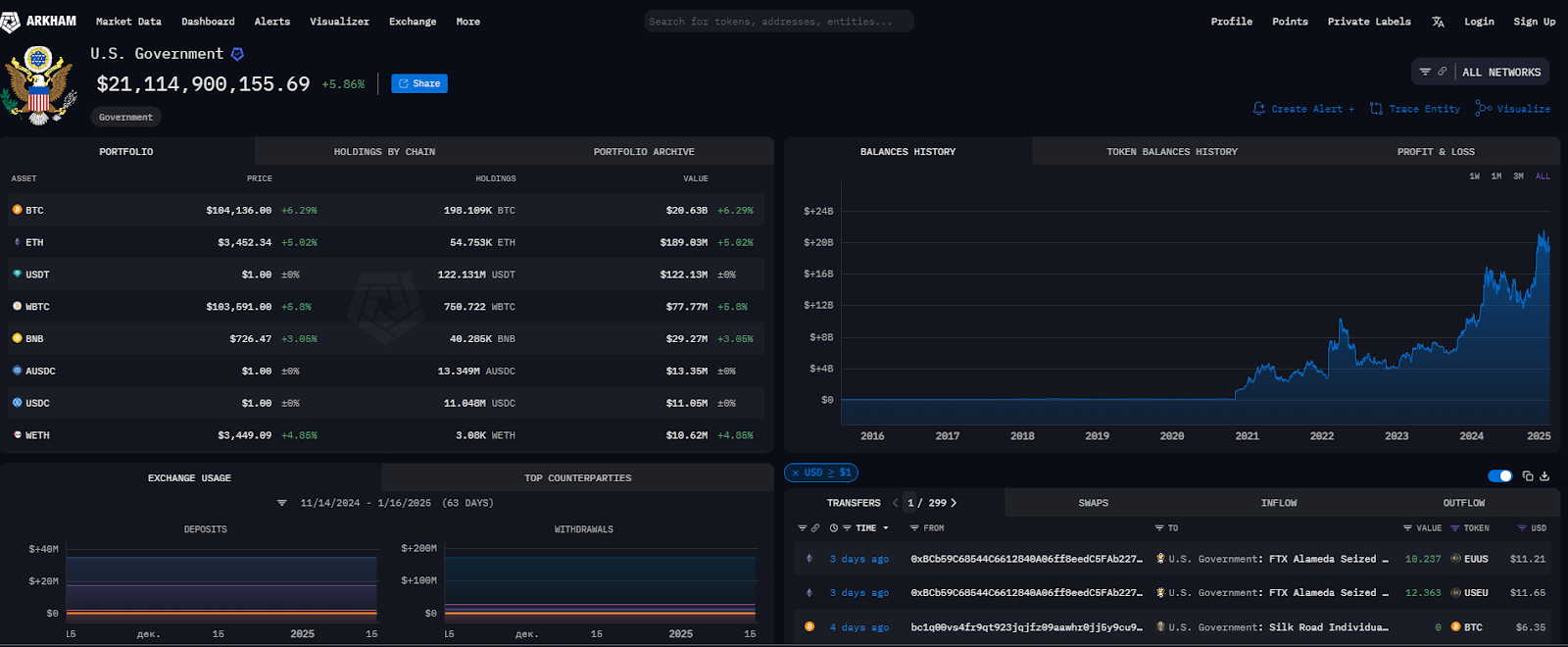

Based on the data of the ARKHAM analytical company, the US government currently has Bitcoin in the amount of almost $ 20 billion, captured in various law enforcement actions. This portfolio includes 198 109 BTC, estimated at about $ 20.63 billion. USA, as well as other digital assets, such as 54,753 ETH (189.03 million US dollars), $ 122.13 million. USA ($ 122.13 million) and 750.722 WBTC ($ 77.77 million).

The current shares of the government also represent the Binance (BNB), AAVE (AAVE) coin, US dollars (USDC) and others.

Analyzing the potential influence of these events on the cryptocurrency market, it is reasonable to expect that the market will continue to grow.

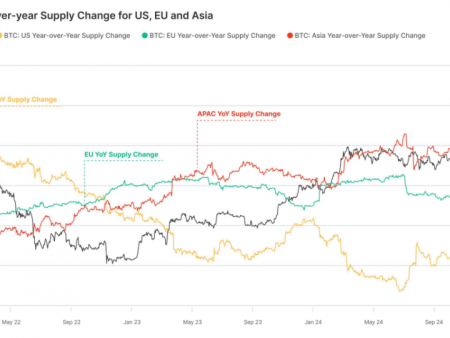

The creation of a crypto -reserve signals the strong state support of bitcoins as a value and a strategic asset. Like previous institutional adoption measures, such a step can increase the demand for bitcoins and reduce the market supply. As a result, it can begin the global domino effect, and more governments accepts similar strategies and sending the requirements.

Speaking about accurate targeted prices, the price of Bitcoin may experience a rally similar to previous measures to adopt institutional adoption, with the possibility of reaching $ 120,000–150,000 for six -12 months, depending on the mood of the market and macroeconomic factors.

The priority based on the United States, such as XRP and SOLANA, can improve the adoption of these crypto projects on a global scale. XRP and SOLANA may rally 30-50% in the short term, depending on the specifics of the strategy. As for the decision to launch the Trump Meme coin just a few days before the inauguration, this, apparently, is a strategic step aimed at strengthening Trump’s shuttle position and cause a sense of excitement among his supporters.

The consequence of view may be a government that goes to areas, traditionally outside its sphere. Despite the fact that the crypto politician downwardly regulates deregulation, which contradicts the main values of the decentralization of the crypto community.

In addition, if deregulation is really the goal, how will consumer protection be ensured? Shock balance – Hercules taskField From my experience, leading PR, I personally saw how even well -intentioned politicians can create friction between innovations and supervision. Moreover, political promises often stop or encounter obstacles before becoming a reality. If these initiatives are not effective, the market reaction can be warm.

Final thoughts

The crypto -market enthusiasts have reason to be excited – the proposed policy can significantly increase adoption and assessment.

The largest stumbling of crypto -abroad has long been a government, but if you can achieve leveling between politicians and the industry, growth potential is very promising.

However, as always in the cryptography market, execution and external factors will ultimately determine the scale and sustainability of this growth.