Among the accident in the cryptography market, is Bitcoin falling below $ 90,000 below, since the liquidation will exceed $ 2 billion?

With a recent crash, the total market capitalization of crypto -market capitalization fell to 3.01 trillion dollars. Among the best losers Bitcoin and Ethereum are faced with significant losses at important levels. Bitcoin reached a 24-hour minimum of $ 91,530, but since then he bounced up to 94,254 dollars.

Bear feelings remain extremely strong, as sellers dominate. The 24-hour liquidation in the cryptography market increased to $ 2.24 billion, and the bulls received a blow to 1,1,8 billion dollars.

Bitcoin saw the liquidation for a total of 410.43 million dollars. The USA, while Ethereum headed $ 609.89 million. USA in the form of liquidation.

As the leading traders are eliminated, market volatility has reached its peak. Given these conditions, will Bitcoin burst below the support level of $ 90,000? Let’s analyze.

Analysis of bitcoins indicates a risk of decrease to 86 thousand dollars. USA

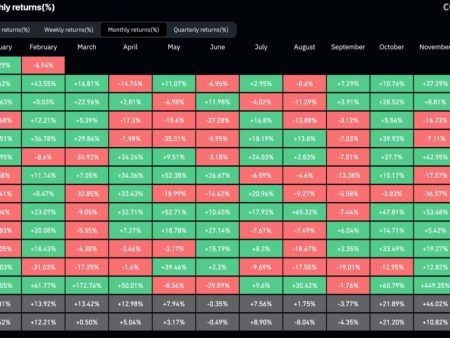

In the daily diagram, the price actions of BTC record four consecutive bear candles. This is a fall by almost 12% from the previous day.

Despite this rollback, the BTC remains above the local line of the support trend. In addition, bulls maintain dominance over the lower strip of the Supertrend indicator, which indicates minor support at lower levels. Nevertheless, the intraday rollback of 3.62% broke below the lower band of the Bolinger.

This involves a serious shift in the price trend of BTC, signaling the bear continuation. According to the analysis of price actions, the breakdown of the local support line will probably push Bitcoin to the next support level of $ 86,707.

The funding rates of the accident, when bear speculation surfaces

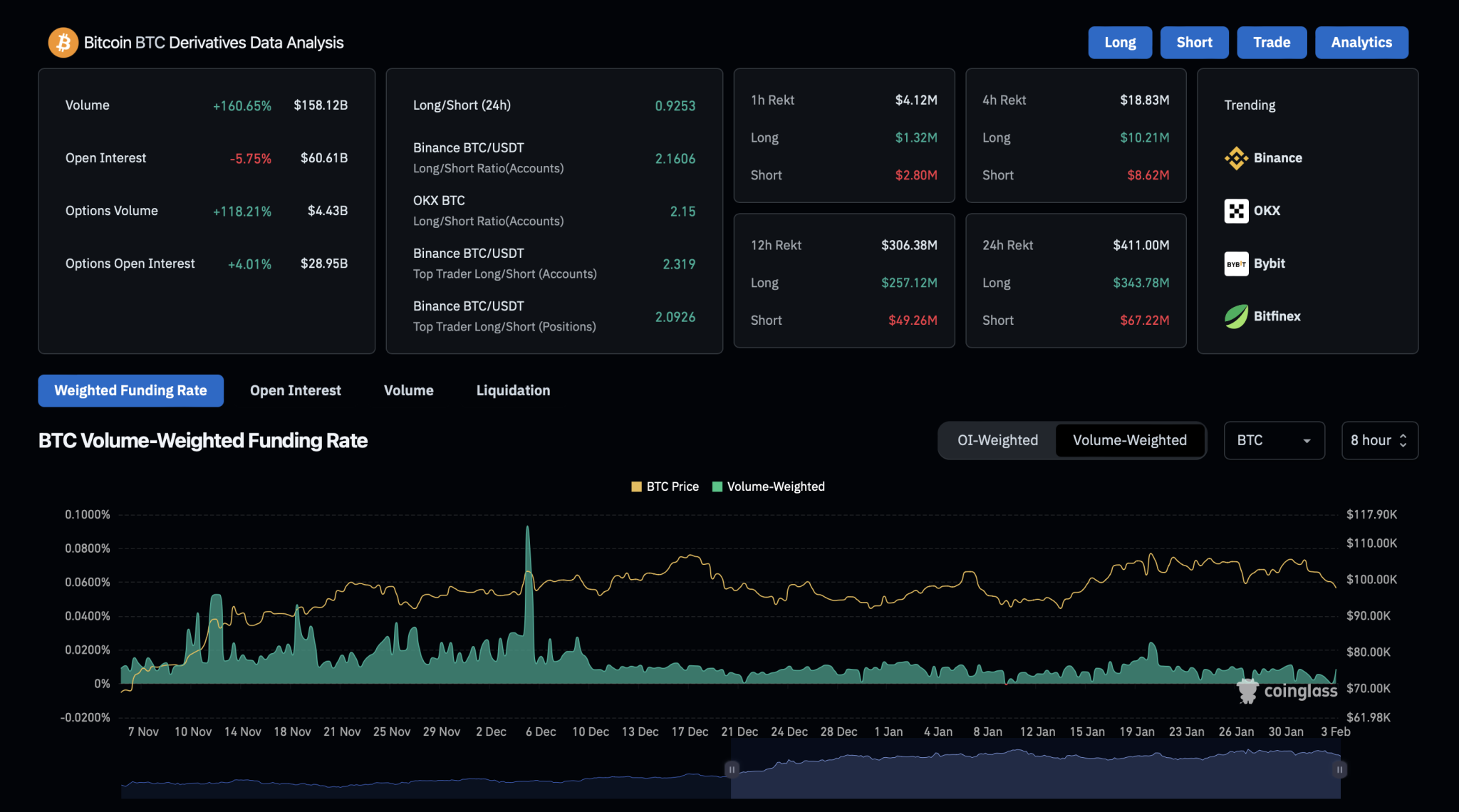

With significant correction in the price of Bitcoin, an open percentage fell to 60.61 billion dollars. USA, which is 5.75%.

With a fall in open interest, a long and short ratio over the past 24 hours has fallen to 0.9253. After falling, the financing level has recently fallen to almost 0%, which reflects low confidence among bull merchants. Among A lower price deviation, the financing rate remains at 0.0006%.

Consequently, the speculation foresee further amendments to Bitcoins with general volatility.

Hinting at an expanded accident

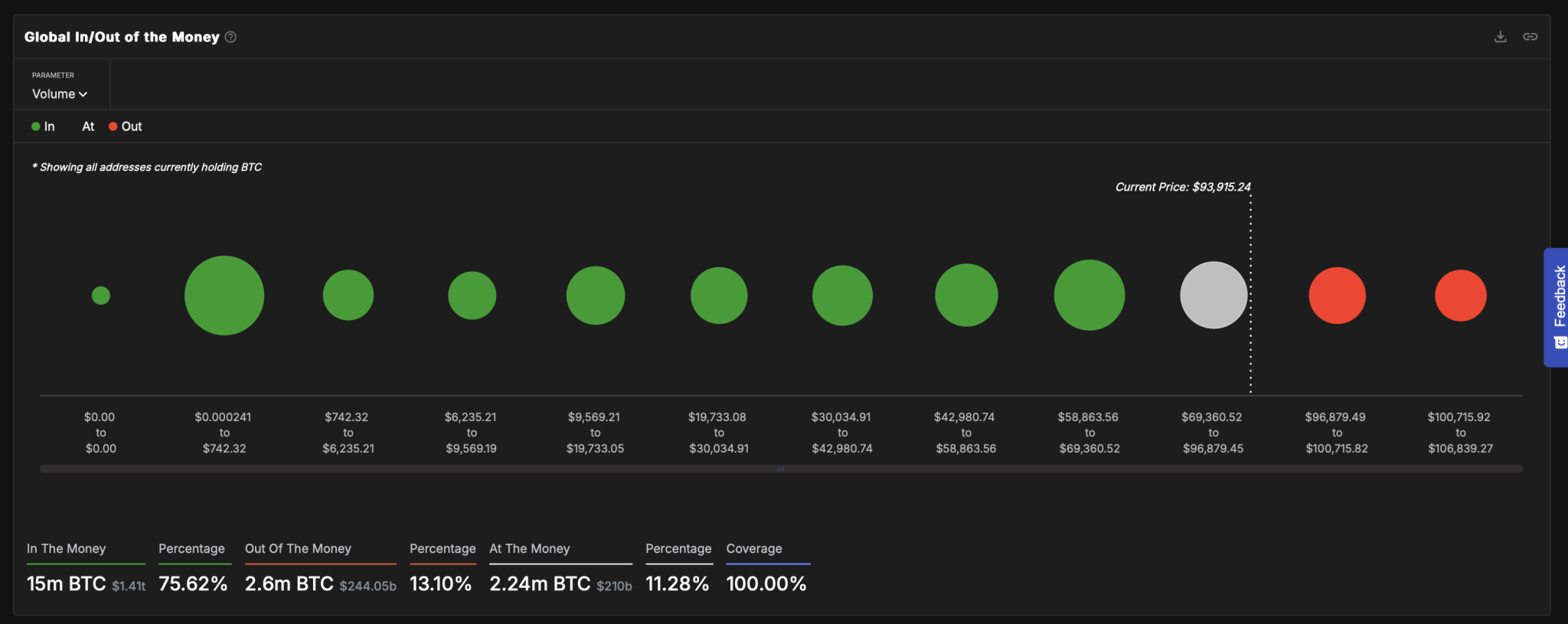

Since the rollback continues, global data and because of money show that 13.10% of Bitcoin’s offer entered the “outside of money” zone. This is 2.6 million BTC in the amount of 244.05 billion dollars.

Currently, the zone outside the money extends from 69,360 to $ 95,879, which contains 2.24 million BTC.

If a wider market continues to remain unstable, the lower limit of the current zone hints at the rollback of almost $ 70,000.

In short, Bitcoin’s current price action signals an increased bear pressure with a risk of violation below the support level of $ 90,000. If sellers retain dominance, and the local support line fails, BTC can check the following critical level of $ 86,707.