The cryptocurrency market can see that the price of Bitcoin (BTC) reaches an unprecedented line of $ 1 million per coin by 2030, which can compare the current Gold market capitalization in the amount of 19.3 trillion dollars, according to a bold forecast from the outstanding executive director.

Bitcoin can receive $ 1 million by 2030, the general director of Tech predicts

Daniel Roberts, founder and general director of the public registered Bitcoin Miner Wall Street Iren (Nasdaq: Iren), claims that the excellent characteristics of Bitcoin as a digital cost of value in combination with an increase in institutional adoption can lead to the cost of cryptocurrency to new heights.

“If you consider the historical trajectory of Bitcoin prices, I would be surprised if we were not $ 1 million by 2030, given the ETF power and institutional purchases now,” Roberts quoted, quoted by Roberts quoted Livewire Markets.

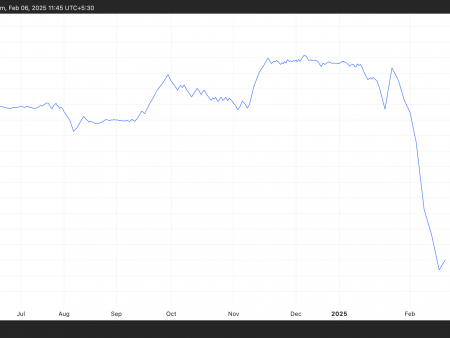

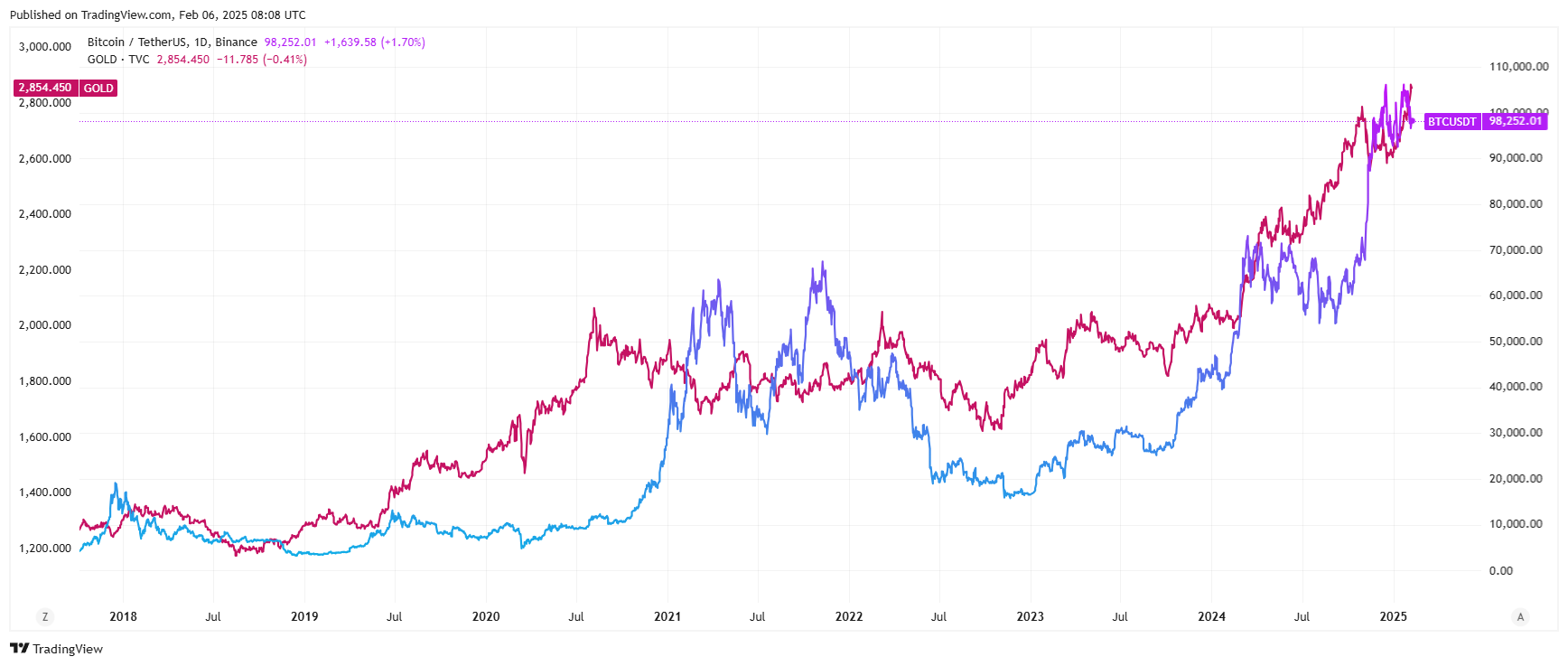

Cryptocurrency, currently trading about 100,000 US dollars, has already been published by 120% over the past year, ahead of traditional assets, since the giants of the Wall Schell are increasingly using digital currencies.

Why Bitcoin can leave gold in dust

Roberts, a former Macquarie banker, will also draw a sharp comparison between bitcoins and gold, comparing the connection with “digital and analogue” or “Netflix against the blockbuster”.

“Bitcoin is better in gold than gold,” Richardson said. “This is not enough, easier to transfer and easier to separate. Thus, all those characteristics that give the cost of gold are objectively better. ”

Meanwhile, Gold has recently reached a record maximum of $ 2840 per ounce, which is due to inflationary problems and increased physical demand, as evidenced by the record volumes of Comex futures for February 2025.

Iren is against Bitcoin

Richardson, Irene, which manages the data processing centers for the production of bitcoins and artificial intelligence services, attracted investments from large financial institutions, including Fidelity, InVesco and Citadel.

Although the shares of mining companies are considered an indirect influence of bitcoins for investors, the shares of the former Energy Energy have not grown as dynamically as the oldest cryptocurrency in the world. In 2024, they received 37%, but at present they have grown a little less than 13%.

Irene, like the entire cryptocurrency industry, is faced with problems. Record prices of BTC are delivered with rapidly growing complexity of production, which increases the cost of the production of one bitcoin. Companies can get less from a growing hash, while higher maintenance costs feed in their margin.

Irena’s struggle became obvious in mid -2023, when the company announced losses of $ 29 million. While this marked a six -fold reduction in debt compared to $ 172 million. The United States, which was reported a year earlier, it emphasizes difficulties with crypto -maining.

In response, the company decided to join the growing trend of AI, reprofiling its data processing centers to support high -performance calculations. Nevertheless, he faced a training claim, claiming that he distorted his opportunities and future prospects for investors.

Will Bitcoin go 1 million dollars? Experts forecasting 2025 and further

The prospect of bitcoins to get into the long -awaited mark of $ 1 million remains the topic of intense speculation. According to Jeff Park, the head of Alpha Strategies in Bitwise Asset Management, one of the key catalysts can lead Bitcoin to this milestone: creating a Bitcoin strategic reserve supported by the US government. Nevertheless, the probability of such an initiative materialized in 2025 is estimated as less than 10%.

“The idea of the federal strategic reserve of bitcoins taking place in 2025 is less than a 10% random event,” the park commented (previously Twitter). “This is the only mathematics in which Bitcoin can cost $ 1 million+ in 2025 when it happens.”

The idea of the Bitcoin federal strategic reserve occurring in 2025 is less than a 10% random event.

This is the only mathematics in which Bitcoin can reach $ 1 million. USA+ in 2025 when this will happen.

– Jeff Park (@dgt10011) December 26, 2024

The forecast of the park suggests that although Bitcoin, reaching seven digits, is theoretically possible, the probability remains weak without significant institutional or state intervention. He specifically connects this scenario with the creation of a federal reserve of bitcoins, implying that the strategic accumulation of bitcoins can sharply affect the dynamics of demand and demand dynamics.

Nevertheless, many experts have a more optimistic view of this issue. For example, Planb believes that Bitcoin can reach this price level this year.

Bitcoin price forecasting table

|

Date |

Predictor |

Target date |

Reasoning |

|

February 2025 |

Ark Invest (Katie Wood) |

2030 |

Institutional investments, adoption of corporate treasury, adoption of the national state |

|

January 2025 |

Arthur Hayes (founder of Bitmex) |

2030 |

Bitcoin 15-year-old record of survival, growing introduction as a valuable store |

|

December 2024 |

Plano |

2025 |

Lack of bitcoins, a reserve model to the flow, potential acceptance as an asset of a national reserve |

|

January 2025 |

Shelter investment |

After 2030 |

Market capitalization does this impossible until 2030 |

FAQ, price forecast for Bitcoin 2030

Will there be bitcoin up to 1 million?

According to Jeff Park, the head of Alpha Strategies in Bitwise Asset Management, a key factor that can advance bitcoin to $ 1 million. USA, is the creation of a strategic reserve supported by the US government. Nevertheless, he assigns less than 10% of the probability of this in 2025, which suggests that a seven -digit score for bitcoins in the near future is unlikely.

Can Bitcoin reach 1 million in 2030?

Daniel Roberts, General Director of Bitcoin Mining Company Iren, argues that excellent characteristics of bitcoin as a cost and a growing institutional interest can raise its price to this level.

ARK Invest Catie Wood also projects that Bitcoin can reach $ 1 million by 2030, referring to factors such as the adoption of the corporate treasury, institutional investments and even potential interest from national states seeking to diversify their reserves.