Bitcoin’s (BTC) potential move towards $100,000 could face further delays as the asset is likely to face volatility driven by macroeconomic signals later this week.

This expected volatility comes as Bitcoin’s chart shows the premier digital asset consolidating and this week’s labor report data may not bring attention to the asset, according to professional cryptocurrency trading expert Mikael van de Poppe in a Dec. 2 X-post.

Poppe suggested that volatility caused by labor market data could cause Bitcoin to fall below $90,000, potentially creating new entry opportunities.

“Bitcoin is consolidating well and this is labor data week. This is not the best period for Bitcoin when the optimal entry point (if there is a correction) comes back into play,” he said.

Let’s assume that Bitcoin fails to break through six-digit resistance and labor market dynamics cause prices to fall. He predicts the asset could find support at $85,000 to $88,000, levels he considers ideal for accumulation.

As for the impact of the upcoming report, strong data could signal economic strength but also raise concerns about inflation, increasing the likelihood of interest rate hikes and reducing the appeal of risk assets like Bitcoin.

Conversely, weaker data could ease inflation concerns and boost risk assets. After the October jobs report was disappointing, with just 12,000 jobs added (compared to a forecast of 100,000), expectations for November are optimistic.

Outside of the labor market, historical data shows that Bitcoin often falls at the beginning of each month, followed by a strong rebound.

Ideas shared by the Bitcoin comment platform Bitcoin Archive in X’s December 2nd post, the trend has continued for six months.

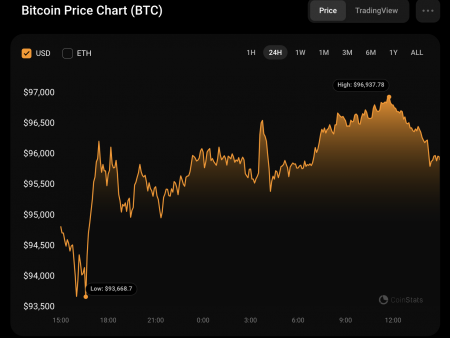

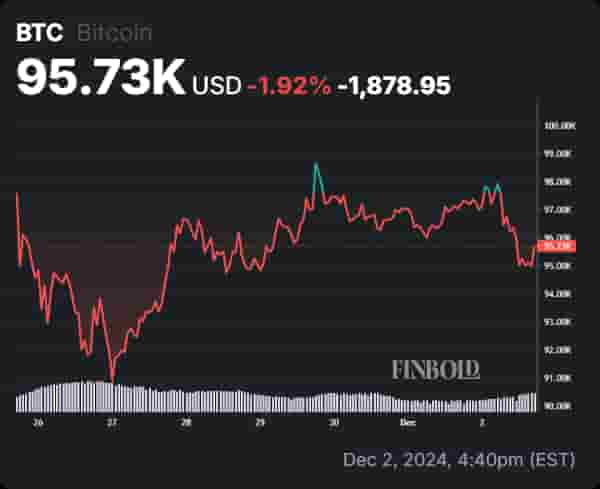

December appears to be following suit, with BTC pulling back to around $95,000 after approaching the $100,000 mark. Such short-term corrections could present investment opportunities.

Bitcoin will begin a parabolic run

Despite bearish sentiment in early December, historical price trends indicate that this month could also signal the start of a parabolic move for Bitcoin.

In this case, a decentralized finance (DeFi) researcher CryptoNobler suggested that Bitcoin’s biggest bull run could begin this December, with conditions resembling the 2016 and 2020 rallies.

Key factors in this optimism include expected pro-bitcoin policies in the United States, expected Federal Reserve rate cuts, a potential lifting of the cryptocurrency ban in China, and a $16 billion payout to FTX scheduled for early 2025.

Overall, Bitcoin’s move to a new all-time high appears to have stalled. The asset is looking to hold the $95,000 support level to keep the $100,000 target within reach.

The pullback has prompted figures such as author and investor Robert Kiyosaki to warn of a potential drop to $60,000, which he views as a savings opportunity.

Bitcoin Price Analysis

At press time, Bitcoin was trading at $95,730, posting daily and weekly losses of 1.5% and 1.9%, respectively.

On a technical level, Bitcoin remains well positioned to move higher, supported by its position above the 50-day and 200-day simple moving averages (SMA).

However, caution is warranted as a Relative Strength Index (RSI) of 67 and a Fear and Greed Index of 80 (extreme greed) suggest the market may be close to overbought.

Featured image via Shutterstock