If the historical prices of prices are something, then this week can be key for bitcoins (BTC), as this can cause a parabolic rally among the current consolidation below the level of 95,000 US dollars, according to the forecasts of the trade expert.

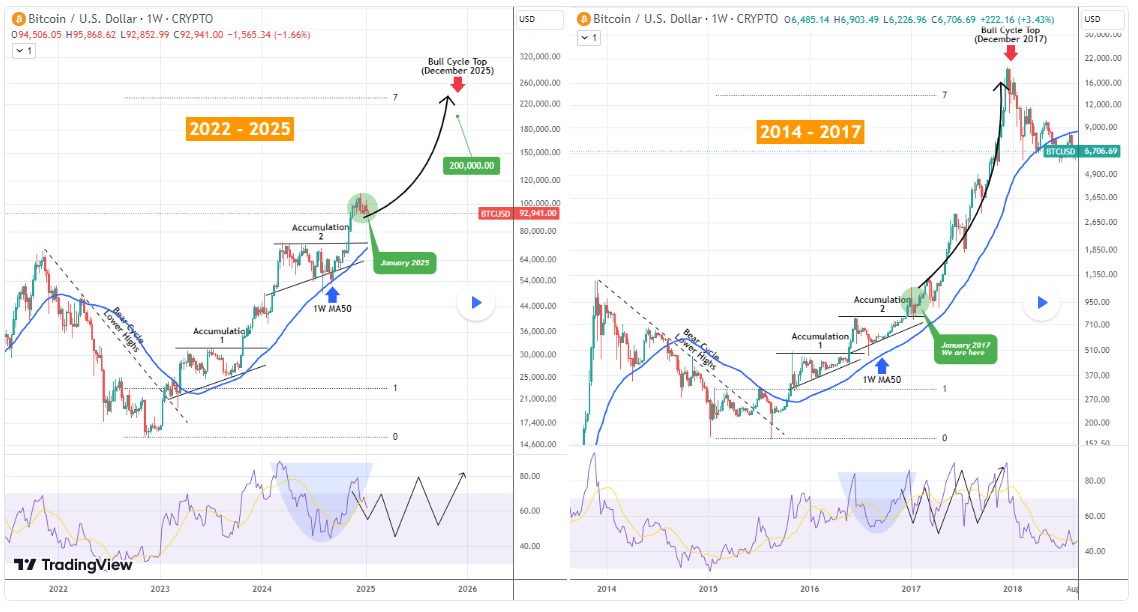

Trading slingshotsThe famous online cryptocurrency analyst, notes that the current bitcoin cycle repeats the market structure of 2014–2017. TradingView Message January 13.

The analysis revealed two different phases of accumulation above the continuous sliding average, which occurred, signaling the key possibilities of long -term purchases.

A similar scheme preceded Bitcoin’s explosive rally in 2017, when BTC reached a record maximum of $ 20,000.

In addition, the relative force index (RSI), the impulse indicator, demonstrates a rollback similar to the movement of the price observed in January 2017.

Historically, such corrections noted the transition from accumulation to the rapid acceleration of prices.

The expert also said that if Bitcoin continues to follow the 2017 template, the top of the cycle may correspond to the expansion of 7.0 fibonacci from the bottom of the cycle. This forecast involves the target price of at least 200,000 US dollars to the peak of the current bull at the end of 2025.

Consequently, this week is important in the analysis, since Bitcoin, apparently, is at the last stages of the preliminary paraversion.

This can set a new local bottom at the level of $ 90,000, offering the basis for mass price growth.

Already part of the market players shares a target of $ 200,000. For example, as Finbold, Jeff Kendrick, an analyst from the Standard Chartered banking giant, believes that Bitcoin is intended for a target of $ 200,000 in 2025, perhaps stems out of institutional interest, inspired by optimism around Donald Trump’s elections, which is considered as friendly in Cryptocurrency space.

Brief price bitcoin

Indeed, in the short term, Bitcoin’s potential to establish a parabolic rally depends on how the asset interacts with the key prices.

In particular, the impaired resistance in the amount of $ 95,000 is central to achieve further growth, while the decisive step below the level of $ 90,000 can open the door for further losses.

To this end, the analysis of Ahmed’s cryptocurrency analyst in post X January 13 showed that the leading digital asset was rejected at 95,500 dollars, as expected.

He noted that the price action follows the established scheme, with the range formed on the 12-hour (H12) circuit of the candlestick on January 8. This range was originally tested for liquidity below due to the report on the non-farmer payment statement (NFP). Before finding liquidity above the level of 95,500 dollars.

Since then, the market has formed a new assortment, which is focused on the search for liquidity below the first, since attention to the data of the consumer price index on January 14 (CPI) on January 14.

At the same time, the possibility of correction of the price of bitcoins was emphasized by the expert in trading Peter Brandt, who expects the BTC to potentially fall below $ 90,000 before surviving up to $ 150,000.

Bitcoin prices analysis

By the time of the press, Bitcoin is trading at 91,170 US dollars, plunged almost 3% over the past 24 hours. In weekly, BTC decreased by more than 8%.

Bitcoin, Meddeni, by the same, are in full control after the bulls were overcome at $ 95,000. Therefore, the current fall can be perfect, as this will allow cryptocurrency to confirm the bottom before trying to break through the critical levels of resistance.

Shown image through Shutterstock