Why is the price of Bitcoin down today?

Bitcoin price is down today as an exit from leveraged long traders took BTC below the $35,000 level.

Market news

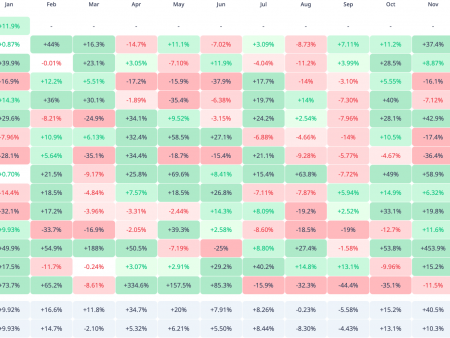

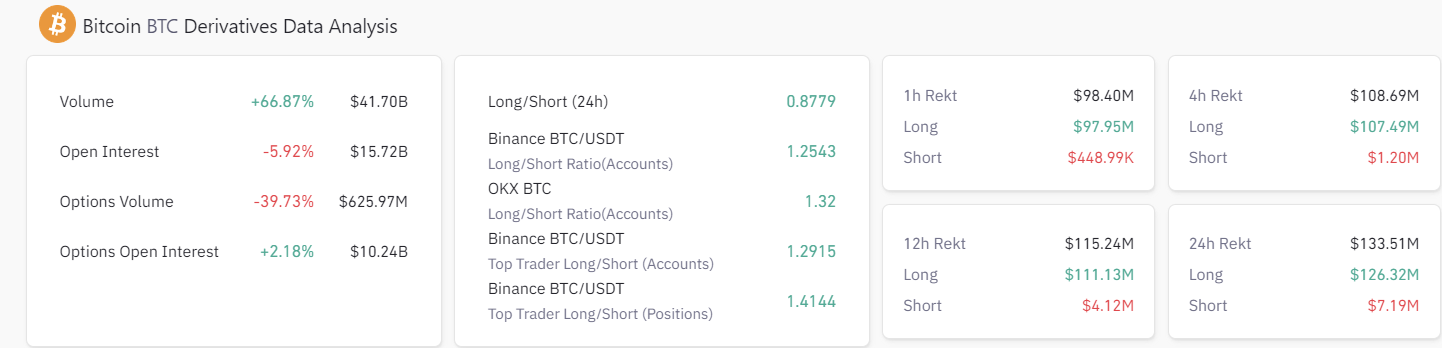

Even though US inflation data came in lower than expected and showed a 3.2% year-over-year increase, the bullish momentum that propelled Bitcoin (BTC) to 31.8% gains in 30 days was waning. November 14th. The price of Bitcoin seemed overheated, with close to $100 million. settled within an hour, even after traditional markets reacted positively to flat monthly inflation.

The contraction in the price of Bitcoin has not worried all analysts, and some believe that Bitcoin is beginning a path towards $48,000.

Let’s take a closer look at the factors affecting the price of Bitcoin today.

$126 million in long Bitcoin positions liquidated

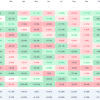

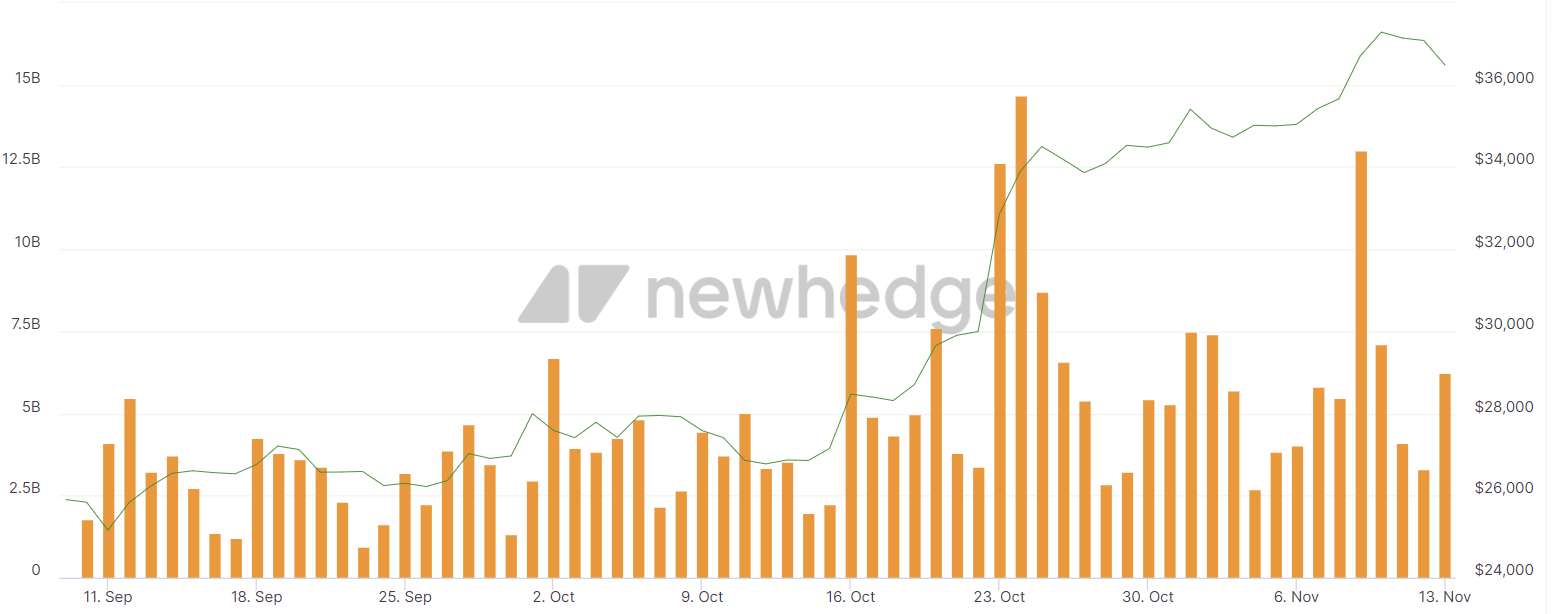

A strong move in the Bitcoin futures market appears to have been the main reason for the rapidity of today’s price drop. Bitcoin long liquidations quickly rose to more than $97.9 million in a one-hour span on Nov. 14, with more than $126.3 million liquidated in the previous 24 hours.

When BTC longs are liquidated without buying pressure from traders, the price of Bitcoin is negatively affected. Bitcoin trading volumes are down more than $7 billion from the November high set on November 9 of $13 billion.

Related: Exclusive: 2 years after John McAfee’s death, widow Janice is broke and needs answers

The lack of consistent liquidity and trading volume has led some analysts to debate whether Bitcoin’s current price rally has staying power. If there is an increase in liquidity, Bitcoin could recover quickly.

$BTC 1 HOUR

Pretty easy from here, I think.acceptance below $34.7k ~ look for lower liquidity

acceptance above $36.3K ~ look for higher liquidityOrder Book Levels

$34K ~ Offer Depth Increases

$38K ~ the depth of the question thickensHTF levels

$38K

$32K pic.twitter.com/9zN2bJV8gg— Skew Δ (@52kskew) November 14, 2023

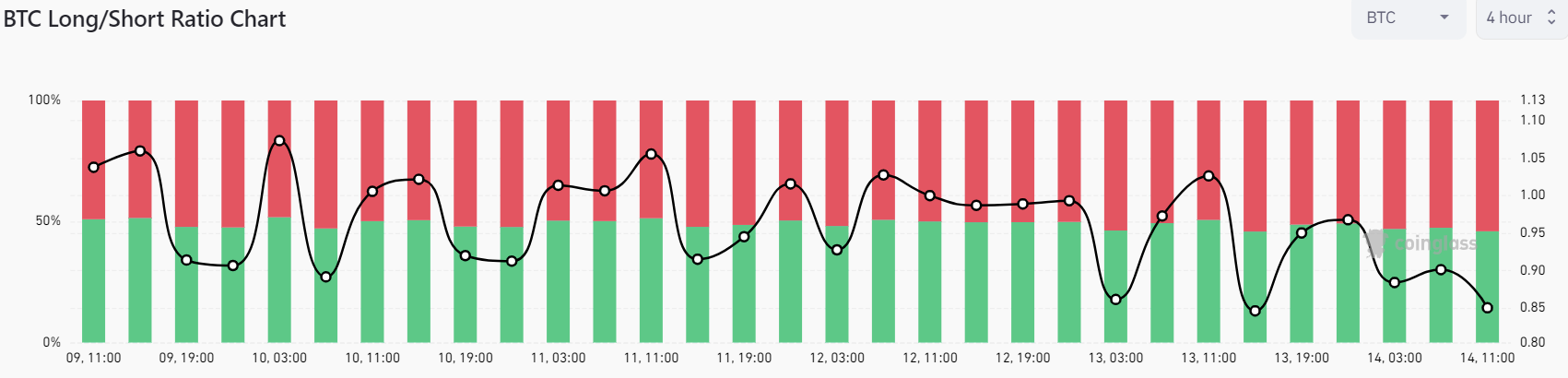

The futures market indicates that traders also believe a pullback is coming, with more than 54% remaining short Bitcoin.

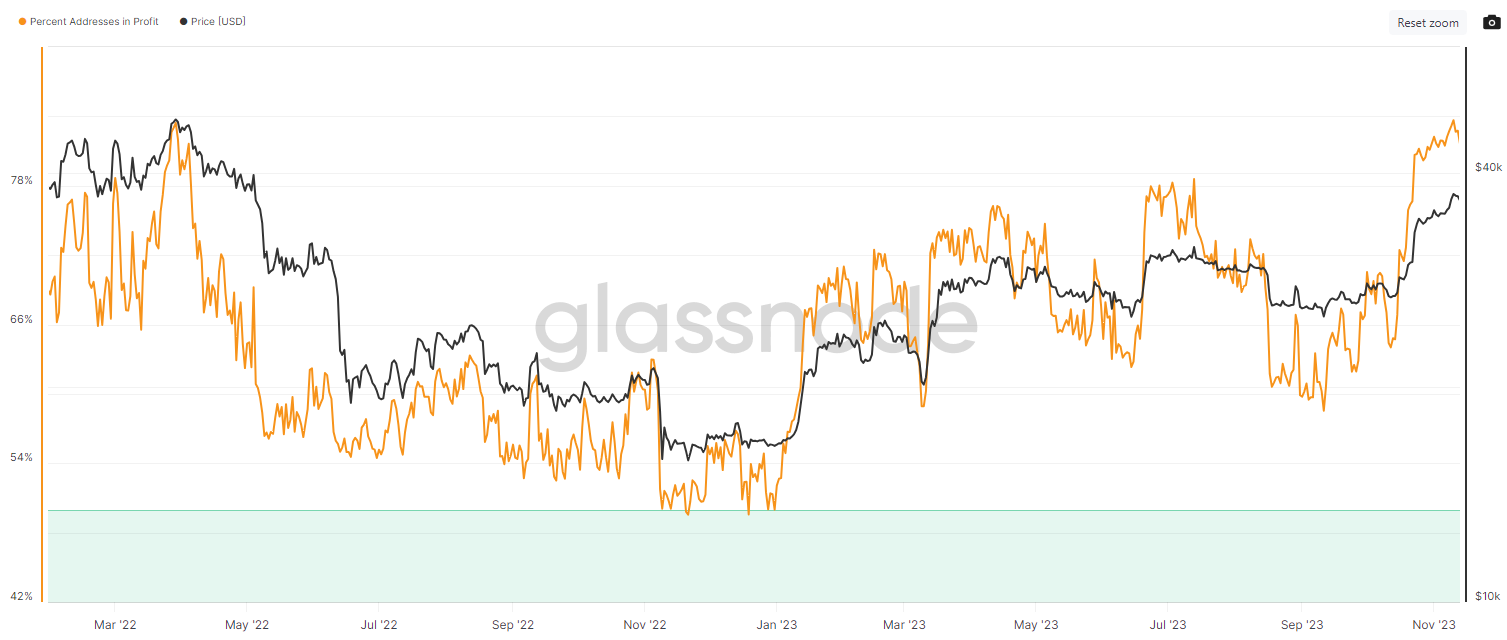

Record number of BTC wallets make profits

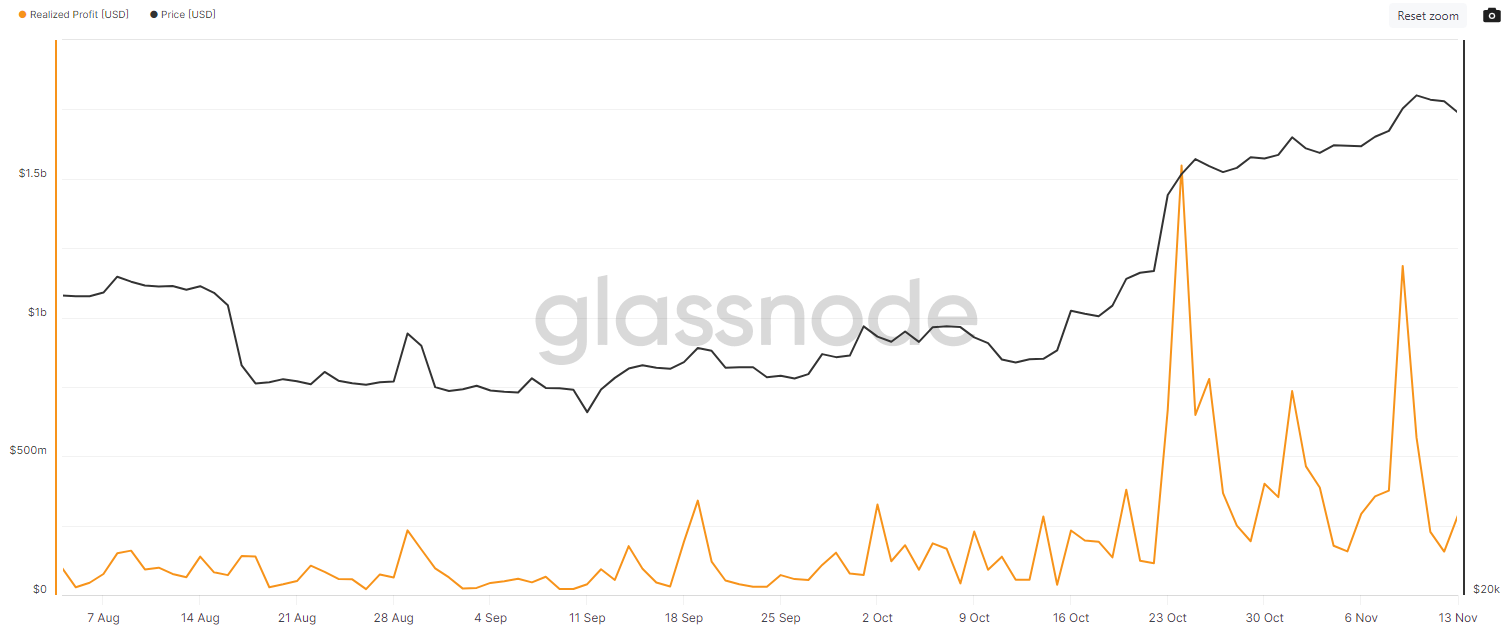

Despite the drop in the price of Bitcoin on November 14, a high percentage of wallets with profits so far this year were reached on November 11. More than 83% of short and long holders are currently making profits.

With a record number of wallets in profit, traders are still below the level of profits made on October 24, but the rally coincides with the price drop. Profit-taking in October was supported by higher trading volume, which may have helped boost the price of Bitcoin. Declining trading volume combined with the large number of investors making profits may cause the price of Bitcoin to continue to fall if more traders begin to make profits.

All eyes are on Bitcoin ETF applications

The short-term uncertainty in the cryptocurrency market does not appear to have changed the long-term outlook for institutional investors. Despite the hostile regulatory environment in the United States, two large institutions, BlackRock and Invesco Galaxy, have exchange-traded fund (ETF) tickers listed on the Depository Trust and Clearing Corporation website.

Despite urgency from major financial firms, the Securities and Exchange Commission appears set to continue delaying decisions on approving Bitcoin ETFs until 2024. BlackRock recently cited USD Coin (USDC) and Tether (USDT) before the SEC as a potential risk to the price of Bitcoin. .

Related: Bitcoin Rebounds to Lows of $36.2K as CPI Inflation Slows Beyond Forecasts

The price of Bitcoin continues to be directly affected by macroeconomic developments, and new regulatory actions, ETF news, and interest rate hikes are also likely to continue to have some effect on the price of BTC.

Even though Federal Reserve Chairman Jerome Powell paused interest rate increases, the price of Bitcoin did not immediately react positively. The pause in interest rates and funding ratios has led some analysts to believe that the price of Bitcoin will reach $69,000 before long.

In the long term, market participants still expect the price of Bitcoin to recover, especially as more financial institutions are apparently adopting BTC.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk; You should do your own research when making a decision.

Add reaction