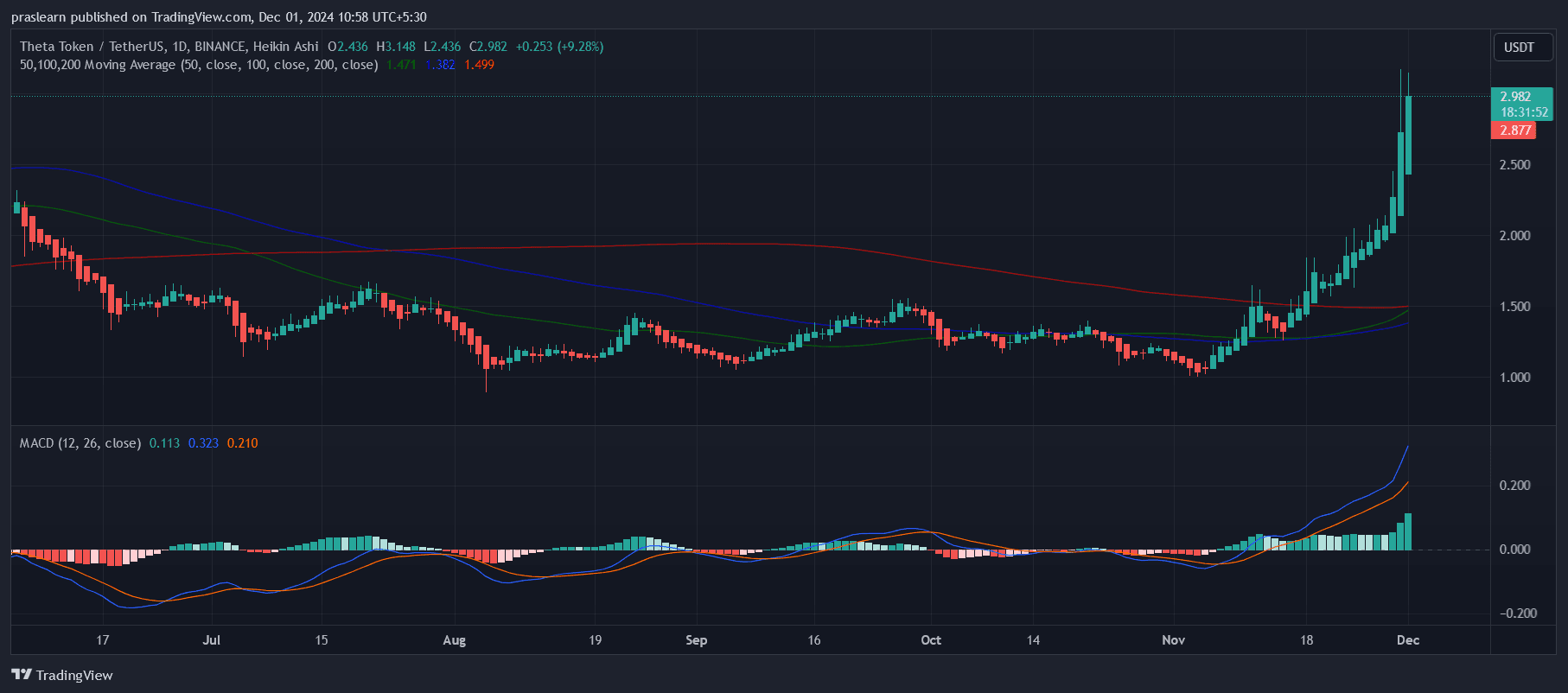

Theta Network (THETA) attracting attention with a big price jump, now trading at $2.88 after rising 25% in just one day! Everyone is wondering what’s behind this exciting surge. In this THETA Price Forecast In this article, we’ll look at what’s driving THETA’s growth and what it could mean for the future.

How has Theta Network (THETA) price changed recently?

The current Theta Token (THETA) price is $2.88, the 24-hour trading volume is $1.82 billion, the market capitalization is $2.49 billion, and the market dominance is 0.07%. Over the past 24 hours, THETA price has increased by 24.68%.

Theta price reached its all-time high of $16.07 on April 16, 2021, and its all-time low was recorded on March 13, 2020, at just $0.038956. Since its peak, the lowest price reached by THETA was $0.562497 during the market cycle with a subsequent cycle high of $3.80. Currently, price sentiment for Theta Token is bullish, as evidenced by a Fear and Greed Index of 81, signaling “extreme greed.” The circulating supply of Theta Token is 870.50 million THETA out of a maximum supply of 1 billion THETA. .

Why has Theta Network (THETA) price increased?

The price increase for Theta Network (THETA) can be attributed to several bullish factors that reflect both strong technical patterns and the growing adoption of its ecosystem. Analysts and market data highlight that THETA is breaking out of the textbook Bullish Bump & Run Reversal Pattern, signaling a potential reversal in bearish momentum and positioning it for a significant move higher.

This technical setup contributed to a change in market sentiment, causing the Theta price forecast to break through critical resistance levels at $2.40 and $2.50, reinforcing the strong uptrend.

The rapid scaling of the Theta ecosystem further fuels this rally. As a leading provider of decentralized cloud infrastructure for artificial intelligence, media and entertainment, Theta has attracted high-profile partnerships and use cases.

Institutions such as Seoul National University, University of Oregon, and KAIST are using Theta EdgeCloud’s hybrid GPU infrastructure for artificial intelligence research. Its decentralized approach to cloud computing positions it as a suitable solution for both academia and enterprises, increasing its credibility and adoption.

The ongoing bullish trajectory suggests the possibility of further price increases. Javon Marks, market analyst, notes that THETA’s breakout from its long-term trendline indicates a sustained reversal, with a steep upward trajectory and higher highs confirming bullish control.

This momentum could extend the rally to $8.00 in the near future. Additionally, Theta’s ability to scale its ecosystem and secure enterprise-level partnerships could push its price even higher, with forecasts indicating potential growth to $13,123 over time—a staggering 333% increase.

A 75.35% rise in open interest in THETA derivatives to $108.91 million signals growing confidence among traders. This increase in market activity is consistent with the lack of significant resistance in THETA’s current price range, leaving room for further gains.

If Theta’s adoption in the AI and media industry continues at the same pace, coupled with strong technical indicators, its price could experience further bullish momentum in both the short and long term.