Why has the price of Ether (ETH) risen today?

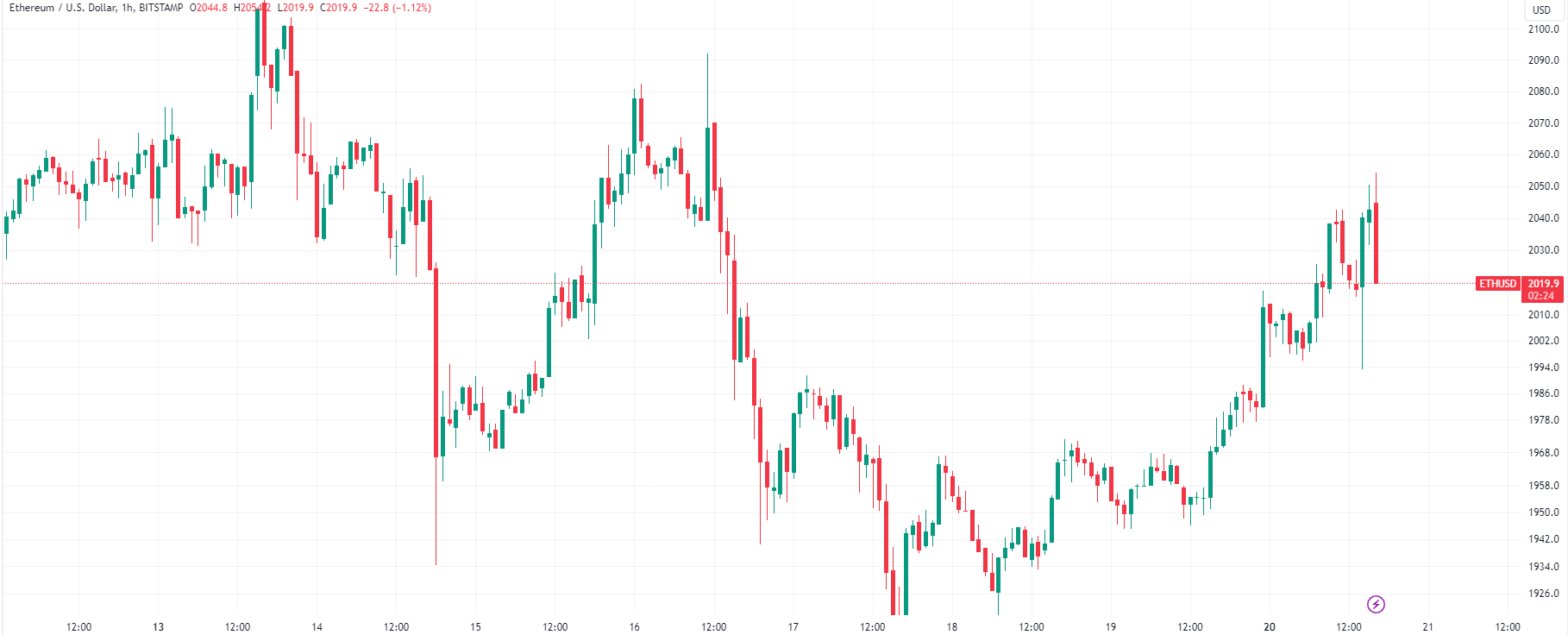

Ethereum price has risen today as enthusiasm for a potential ETH spot ETF and the price holding above the key $2,000 level motivates traders.

Market news

Ethereum (ETH) is witnessing a price breakout due to growing institutional interest in the second-largest cryptocurrency behind Bitcoin (BTC) by market cap. The increased bullish sentiment caused the price of Ether to rise by 26.2% in 30 days. The fact that ETH is trading above $2000 could indicate that more attention is being diverted towards Ether and this renewed bullish momentum has seen the price of ETH gain 69.5% so far this year.

Let’s review some of the reasons for Ether’s newfound strength.

Institutional interest soars as ETH spot hype spreads

The institutional investor uproar began on November 1 when the US Securities and Exchange Commission (SEC) recognized Grayscale Investment’s application to convert its Ethereum trust into an ETF.

The commission’s action responds to a direct court order requiring it to review Grayscale’s pending ETF applications. So far, it has not confirmed a spot crypto ETF.

However, the market showed more bullish signs when BlackRock, the world’s largest asset manager, filed for a spot Ether ETF on November 9. The confirmation sent Ether price above the $2,000 resistance, hitting a 6-month high on the same date. BlackRock filed Form S-1 with the SEC on November 16.

Many anticipate that the SEC will first approve a spot Bitcoin ETF in early 2024. Once that happens, many crypto analysts will see a spot Ether ETF approval soon after.

Related: Exclusive: 2 years after John McAfee’s death, widow Janice is broke and needs answers

The anticipation of approval is causing greater inflows of institutional capital. Institutional inflows into Bitcoin surpass $1 billion in 2023.

At the same time, CME options open interest, a favorite of institutions, surpassed Binance for the first time on November 10.

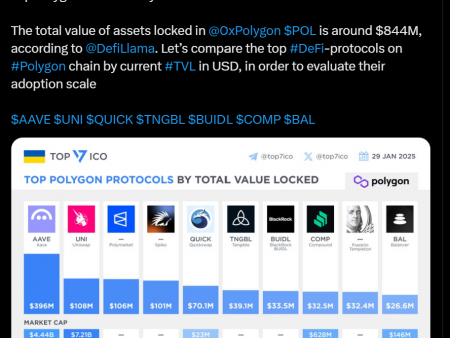

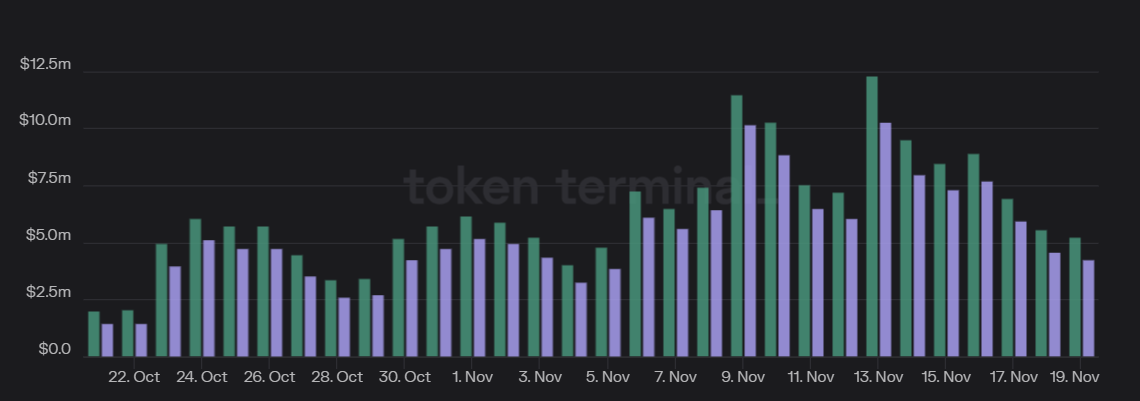

Ethereum network revenue and fees increase

The Ethereum decentralized finance (DeFi) ecosystem witnessed a surge in daily fees, growing by 180% in 30 days on November 20, along with the growth in Ether prices. With the increase in Ether fees, Ethereum network revenue increased by 218.6% in the last 30 days, equal to $1.94 billion annualized.

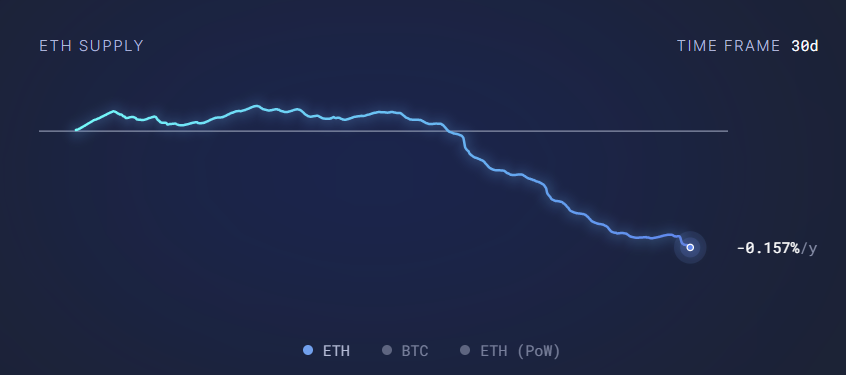

The growth of the Ethereum network has increased gas fees and made the network deflationary again. On November 8, Ethereum network issuances had been inflationary, but after rising fees and revenues, Ether became deflationary and its coin supply growth contracted by -0.31% over a period of 7 days.

Related: 70% BTC idle for a year: 5 things you should know about Bitcoin this week

Bitcoin Price Action Lifts Ethereum Price and Sentiment

Ether broke the key $2,000 level just as Bitcoin surpassed $37,000. Despite profit-taking for both tokens, the increase in trading volume has helped maintain these levels.

The largest transactions, with purchases of $40,000 and $50,000 in December and January, offset by the massive sale of $37,000 on December 1 for a premium received of $2.8 million.⁰

Also worth noting is the diagonal spread on the December/January call of -$37,000/+$39,000.

– GravitySucks (@Gravity5ucks) November 19, 2023

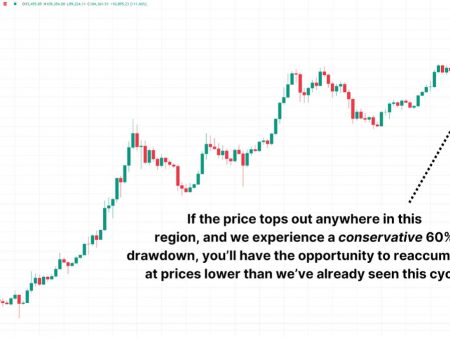

As Ether price demonstrates its ability to sustain $2,000, some analysts believe the altcoin is positioned for further gain amid higher and positive volatility.

He $ETH overwriter has bought back over 1 million Vega!

And now there is less likely to be an overwrite offer weighing on the curve. #The panorama pic.twitter.com/TkZBZPvKOL

– Paradigm (@tradeparadigm) November 20, 2023

While Ether price sentiment and volatility are increasing, whales are steadily accumulating more. Whale accumulation occurs after 2 months of net selling of Ether by whales.

#Ethereum | A subtle but intriguing change is occurring: $ETH The whales appear to be on a slow accumulation path for the first time in two months! pic.twitter.com/LfvOG0sM3T

—Ali (@ali_charts) November 20, 2023

While the current market appears healthy, macro factors such as further rate hikes and a possible crackdown on US industry may slightly impact the price of Ether. Factors such as the approval of a Bitcoin or Ether ETF, positive regulatory clarity, and easing of interest rate hikes may prove to be catalysts for price growth. Ether price volatility is likely to continue.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

Add reaction