Why has the price of Bitcoin risen today?

Bitcoin price is up today as available liquid supply hits an all-time low as institutional investors increase their allocations to BTC.

Market update

The price of Bitcoin (BTC) has risen today, recovering from the November 14 correction to $34,500 and hitting an intraday high of $37,650. The rally comes after Bitcoin price briefly hit one-week lows on November 15. The hype around a spot BTC exchange-traded fund (ETF) is driving significant capital inflows into Bitcoin as liquid supply is dwindling, driving up prices across the cryptocurrency market.

Let’s analyze the reasons why the price of Bitcoin has risen today.

Potential BTC Spot ETF Approval Boosts Market Sentiment

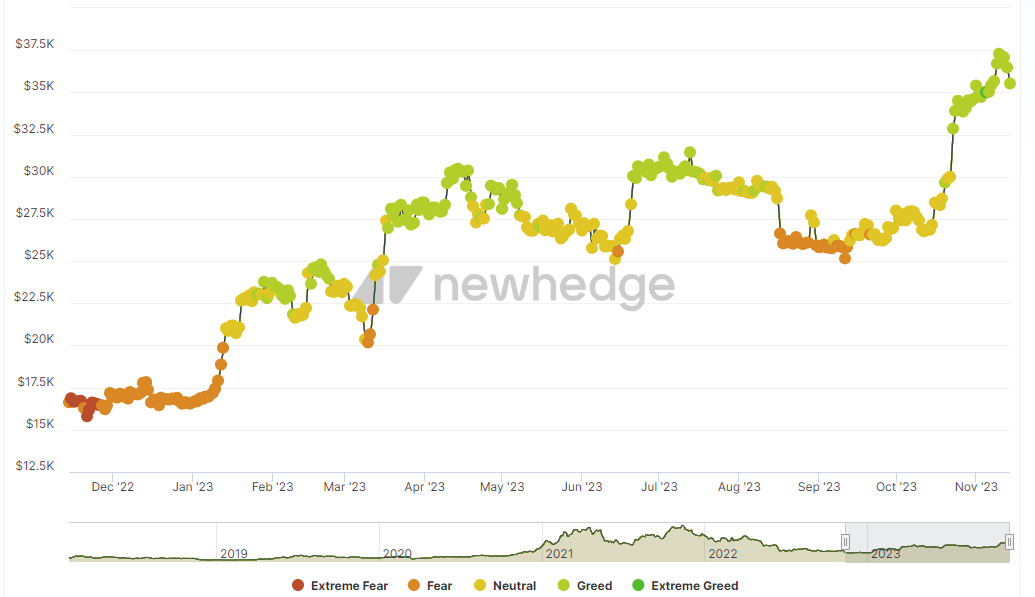

Despite a number of macroeconomic headwinds, Bitcoin price continues to rise, making a 126% gain year-to-date and options market data shows traders leaning towards the $40,000 level. The price movement of the past two weeks sent the Crypto Fear and Greed Index firmly into the “Greed” cohort, showing an improvement in market sentiment.

After a flurry of spot amendments to Bitcoin ETFs in mid-October, the first window for the Securities and Exchange Commission (SEC) to approve the 12 outstanding ETFs opened on November 9.

New research note from me today. We still believe there is a 90% chance by January 10th of getting a spot #Bitcoin ETF approvals. But if it comes sooner, we will enter a window where a wave of approval orders *MIGHT* occur for all current applicants. pic.twitter.com/u6dBva1ytD

-James Seyffart (@JSeyff) November 8, 2023

To date, the SEC has refused to approve a spot Bitcoin ETF despite numerous applicants, including BlackRock, Fidelity, ARK Invest, and 21Shares. The open period for approval lasts until November 17. If the SEC continues its pattern of delaying approval of a Bitcoin ETF, it will remain open until January 10.

Related: Exclusive: 2 years after John McAfee’s death, widow Janice is broke and needs answers

An approval could reportedly generate $600 billion in new demand. CryptoQuant analysts believe that the approval of an ETF will lead to a $1 trillion increase in Bitcoin’s market capitalization.

Galaxy Digital predicts a 74% price increase in the first year after launching a BTC spot ETF.

Institutional inflows exceed $1 billion

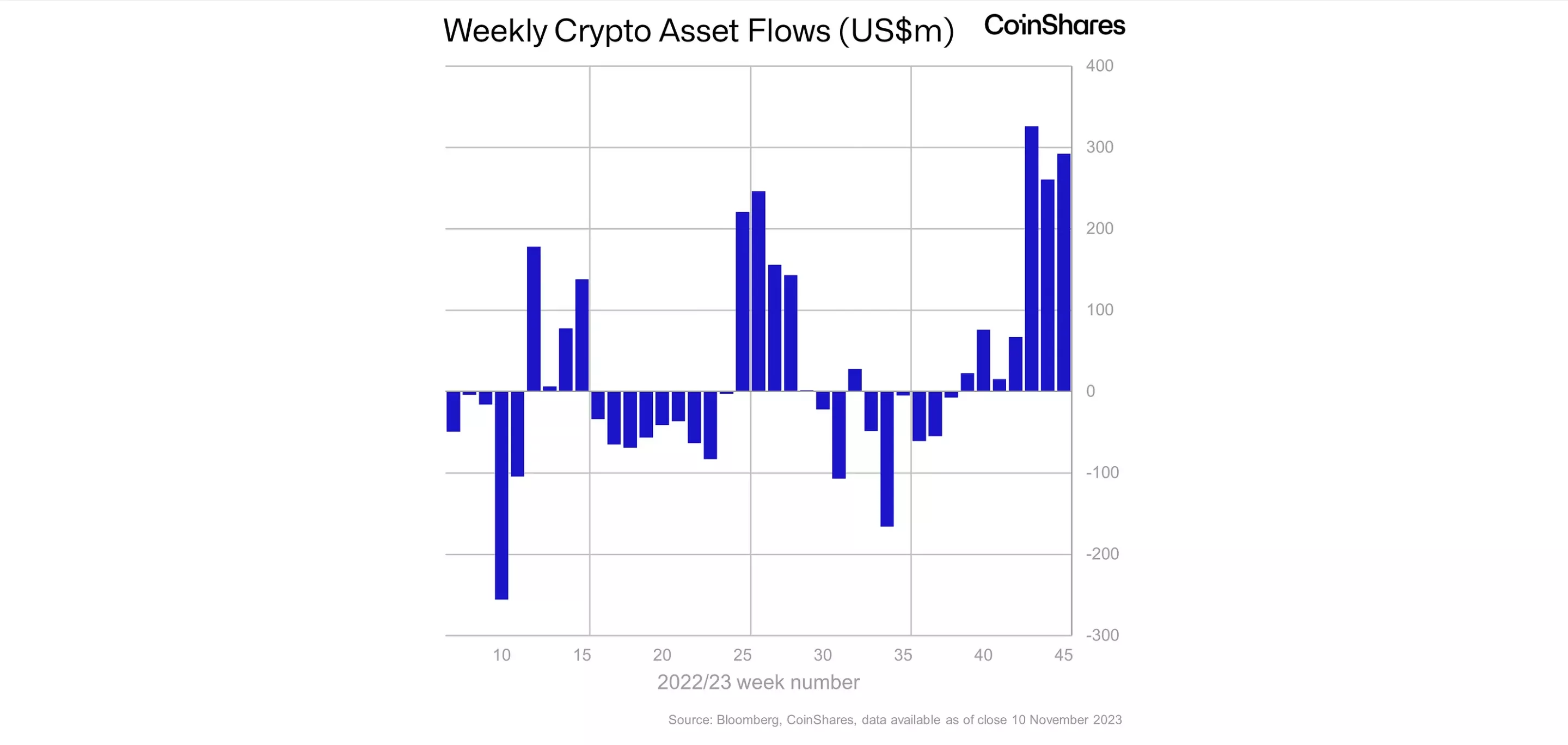

While some investors may be expecting greater liquidity from approved ETFs, institutional investors have already begun investing funds in Bitcoin and cryptocurrencies. According to CoinShares, institutional investors have invested more than $1 billion in cryptocurrencies over the past year.

Of the $1 billion allocated to crypto assets in the last year, more than $240 million has flowed specifically into Bitcoin. Institutional investors also account for 19.8% of all Bitcoin trading volume.

Digital asset investment products saw inflows totaling $293 million last week.

Year-to-date receipts: $1.14 billion (third-highest annual receipts ever recorded)– #Bitcoin –

$BTC: Admissions of $240 million (admissions so far this year: $1.08 billion)

Short Bitcoin: $7 million outflowsBitcoin ETP… pic.twitter.com/6UK1aDtF96

—CoinShares (@CoinSharesCo) November 13, 2023

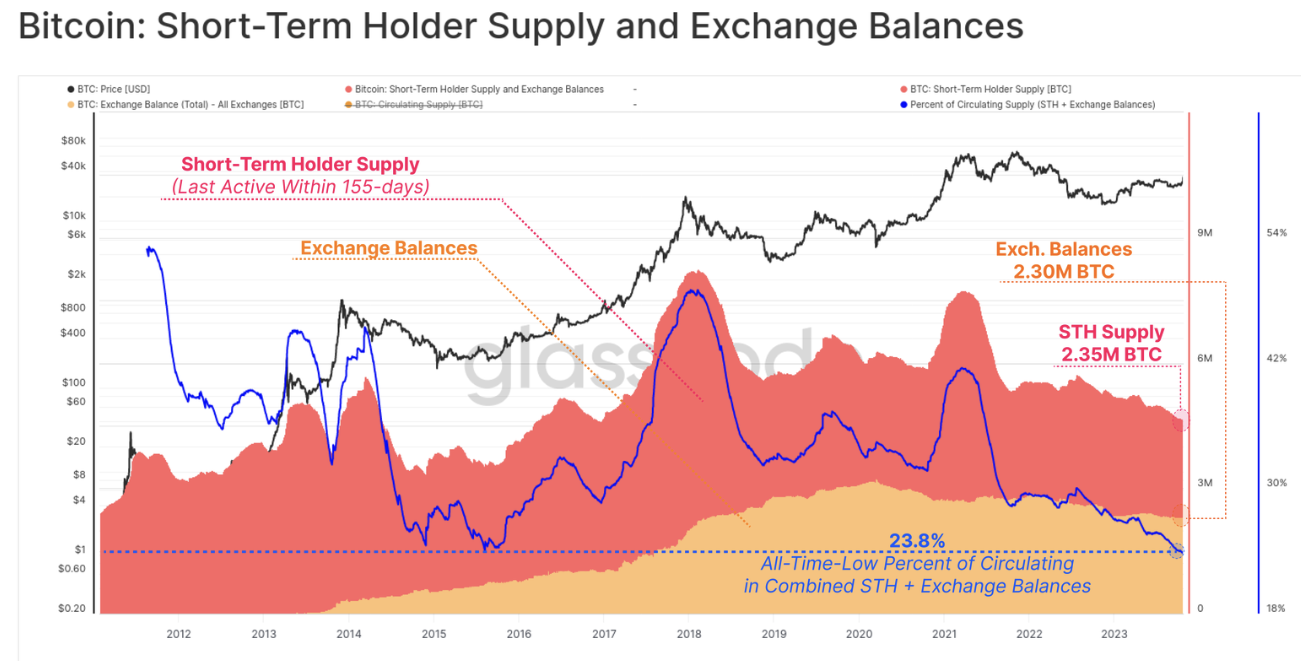

Bitcoin supply shrinks

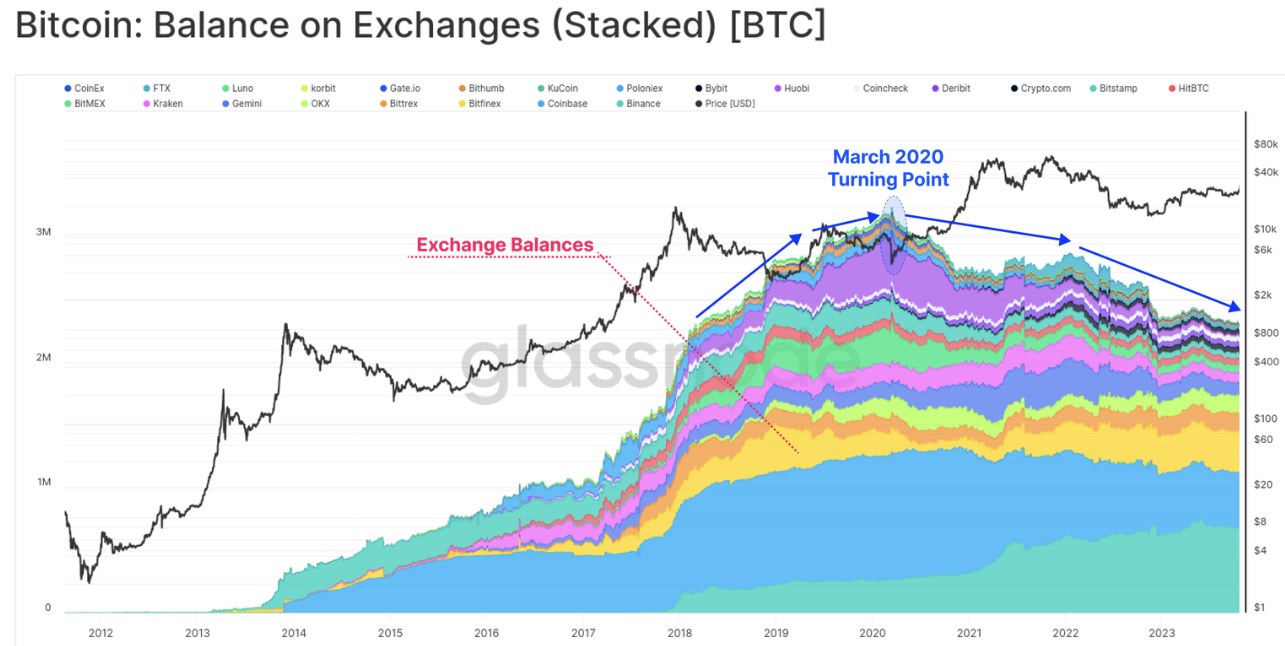

As institutional investors continue to pour money into Bitcoin, the available liquid supply of BTC is shrinking. Coinciding with Bitcoin’s price gains, BTC supply on exchanges remains below the May 3, 2023 peak. Exchanges have lost more than 200,000 Bitcoin since that yearly peak, continuing a downward trend of several years in BTC balances.

Coins leaving crypto exchanges are perceived by the market as a bullish sign, given that traders often withdraw their BTC when they want to keep it in custody for the long term. On November 7, long-term Bitcoin holders hit an all-time high by purchasing 92% of all newly minted BTC.

Related: Chainlink (LINK) Pumps 26% in 6 Days – Is There Room for More?

Glassnode analysts believe that the exchange supply combined with the supply from short-term holders could mean that the available supply of Bitcoin is at an all-time low in relative terms.

The analysis continues,

“If we compare the supply of short-term holders and exchange balances, we can see that they are of a similar magnitude of around 2.3 million BTC. Combined, these two measures of ‘available supply’ equal 23.8% of circulating supply, which is now at an all-time low.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

Collect this item as NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Add reaction