Solana (SOL) is undergoing a price correction after rising almost 300% in recent months.

Why has the price of Solana dropped today?

As of November 21, SOL’s price was trading at $55, down 20% from its local high of $60.50 set just five days earlier. The drop reflects similar moves elsewhere in the cryptocurrency market, with top coins Bitcoin (BTC) and Ether (ETH) also falling 2.2% and 5.5% from their local highs.

Let’s analyze the main reasons behind Solana’s downfall.

SEC labels SOL a “value”

Solana’s price drop coincides with the latest lawsuit by the US Securities and Exchange Commission (SEC) against crypto exchange Kraken. In its filings on Nov. 20, the watchdog accused Kraken of violating securities laws.

In doing so, the SEC labeled a bunch of cryptocurrencies as securities, including Solana. SOL price has decreased by 10.25% since then.

Other tokens mentioned in the SEC lawsuit fell similarly, including ADA, whose price fell 5.5% after the Kraken news.

The SEC’s potential designation of SOL as a security may impact its availability on US cryptocurrency exchanges, similar to the impact seen with XRP.

Overbought Correction

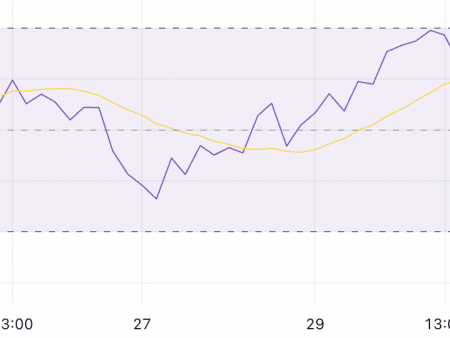

SOL’s price drop today is part of an overbought correction that began after its daily Relative Strength Index (RSI) rose above 70.

Furthermore, Solana’s correction came after a period of increasing divergence between its rising prices and falling RSI, indicating bullish exhaustion.

More than $6.5 million in long positions were liquidated

Solana’s decline also coincides with long liquidations worth $6.5 million in its derivatives markets since November 20. In comparison, nearly $2 million worth of short positions were liquidated.

When a long position is liquidated, the trader is forced to sell, which increases selling pressure.

Is the Solana bull market over?

Price chart technical data suggests that Solana’s price correction has begun near a key Fibonacci retracement level, limiting its bullish bias in the coming months.

The 0.236 Fib line is near $67.40, which has acted as resistance since summer 2022.

The combination of these bearish factors increases SOL’s potential to extend its correction in the coming days or weeks. That starts with a drop towards $47.50, an inverted support level, followed by an extended sell-off towards $30, if the previous level is broken.

The $30 level, down 50% from current prices, coincides with Solana’s 50-week exponential moving average (50-week EMA; the red wave) and the upper trendline of its previous ascending channel pattern.

Related: Crypto Community Responds to Kraken Lawsuit, Deaton Slams ‘Disgraceful’ Gensler

On the contrary, SOL price could recover before or after testing $47.50 to its year-to-date high near $68.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.