After a recent flash car, less than 99,000 Bitcoin dollars (BTC) caused an even deeper subsidence for other assets. Earlier, hot narratives, such as AI and Defai agents, were the most affected by correction.

The narrative of the AI agent and especially Defai were the most difficult during the recent market correction. Since Bitcoin (BTC) briefly fell less than $ 99,000, recently hot narratives erased even greater value.

Two narratives lost their impulse in January, despite the expectations that in 2025 they became a leading source of profit. These two narratives surpassed all assets with a rally at the end of the year in 2024, but the impulse was not stable.

The space of the tokens of AI as a whole had a correction, affecting even the legacy of the AI and tokens coins. The market of artificial intelligence in infrastructure and more old general computing projects lost more than 13% of the market capitalization of $ 36 billion.

Defai refused after losses of agent’s personalities in artificial AI

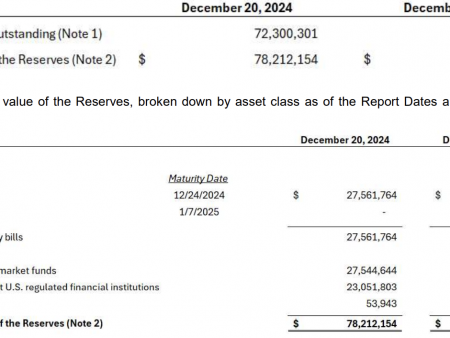

Defai is one of the latest categories of tokens that currently create market capitalization. The upper Defai tokens lead Aixbt and Griffain, which dragged the entire sector. Defai lost more than 21% of its market capitalization in 24 hours, up to $ 2.1 billion.

Based on other indicators, the sector lost more than 29% Its cost, with accelerated sales. Defai is still a small sector of tokens, similar to Desci, which offers both big achievements and more sharp corrections.

The loss of enthusiasm for Defai follows the general weakness in the sector of AI agents. After he became redirected, the market of artificial intelligence agents could not hold the initial influx. Most of the value was accumulated in several tokens of the AI agent, while fewer liquid assets crashed even faster.

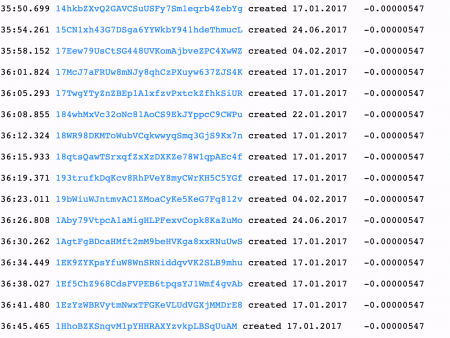

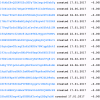

The space of the AI agent, adjusted from peak assessments above $ 17 billion. USA, up to $ 9.59b By the end of January. Agents on Ethereum, Solana and Base were mainly in red, despite the fact that they sought to be cult tokens with minimal sales.

AIXBT, leading token in space, lost almost 50% of its cost for several days, up to $ 0.50 from a peak close to $ 1. Griffain published a similar loss of 0.60 to 0.30 dollars in the United States. Most other tokens lost from 20% to 40% in 24 hours.

Even a cult token, Fartcoin, continued to slide, up to $ 0.94. Fartcoin accelerated his slide after the news that the terminal of truth, the owner of the AI, began to deprive his assets through OTC transactionThe Fartcoin field decreased by 25.9% in 24 hours, as the asset continues to see frequent trade from whales.

Deepseek violates the space of agent AI

All current AI agents were created with the old LLM, while the main attention was paid to success on social networks and speculative trade. The appearance of a recently trained Deepseek also violates the AI agent. Projects are trying to add a new model or completely replace their previous tools for launch.

Crypto Projects is trying to direct this trend by adding a new batch of agents based on DeepSeek’s trend. The earliest risky agent of AI tokens Based on DeepSeek’s training has already appeared on Solan. Swarmnode is also AdaptedAllowing all agents to switch to DeepSeek, trying to reconsider the agent’s story. As usual, the builders of Solana answered almost immediately informal Deepseekai token on Solana, also a risky bet.

The creators of the agent on the Internet computer also published an example of a new personality of AI, built on ICP, located directly in Deepseek GITHUB repositoryField

Smart money switch to other assets

Pure purchase pressure for AIXBT and AI16Z decreased, as smart money and whales accumulate other assets.

After increasing AI agents, funds are now returning to infrastructure tokens. Virtuals (Virtual) protocol was the most widely purchased asset, with the advantage of buyers for 200 thousand dollars compared to sellers.

Instead of tokens, traders also moved to CBBTC, a wrapped version of BTC Coinbase. Since the market consolidates and traders switch to safer assets, the AI space should now show that its projects can survive outside the initial excitement.

Traiders also return to memes tokens, since AI agents are considered a similar type of asset. Trading accelerated for basic tokens Meme Toshi, Miggles and Mochi. Some of the funds returned to the tokens of Defi, such as the airfield (Aero).

Cryptopolitical Academy: how to write a resume Web3, which is landing