Last week, a massive influx is observed in the accumulation of bitcoins using retail sales for thoroughly folding innovative cryptocurrency.

Despite the bitcoins Recent struggleWhales are still interested in the main asset. Large holders saw price fluctuations as an opportunity to buy fears prevailing in the market.

A noticeable reporter of September September recently shared a positive trend of accumulation among Bitcoin Kits. IN tweet Today he noted that tributaries in whale wallets are observed at a distance of market uncertainty.

Accumulated wallets see a tributary

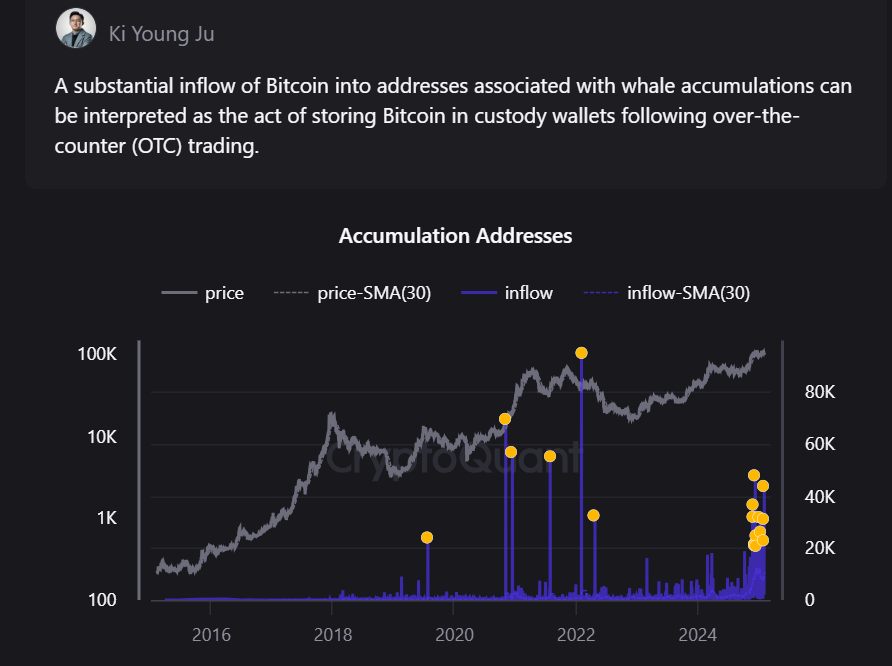

The data quoted the analytical understanding from the data supplier on the Cryptoquant chain. Further analysis shows that the influx was supposed to be addresses of the accumulation of bitcoins.

Cryptoquant said that on February 4, these wallets for the accumulation of whales scored 31,226 BTC worth $ 3 billion at the current market price. This huge influx follows the trend of huge acquisitions at these addresses last week.

Ki Young Ju, general director and founder of an analytical company, Stated The fact that a huge accrual in these wallets can be interpreted as an act of laying bitcoins in wallets in custody after anti -receptive (OTC) trade.

Whales buy retail fears

Santiment’s market reconnaissance company confirmed the growing Bitcoin Accumulation from the addresses of the whale. He emphasized the typical feelings of these large holders, who, as a rule, buy more innovative cryptocurrency during a medium -sized landfill and market volatility.

Moving Today’s postAddles with at least 100 BTC increased only by 135 only in February. The whales borrowed Baron Rothschild “Buying Time is when blood on the streets” to get more and more effects on the main asset.

Meanwhile, whales bought bitcoins at the expense of retail merchants. Santiment data show that large holders have folded landfills from small retail merchants who panicked during market fluctuations.

In particular, the addresses of the BTC Sub-100 have still reduced by 138,680 wallets in February after intense market fluctuations. The analysis showed that most of these sales came from freshmen, especially those who bought over the past six months.

Nevertheless, the commentary of the sanity emphasized that most often the market is restored in such conditions. The company claimed that a bull drive has been on the maps, noting that it may take several weeks or even months to implement.

At the same time, Bitcoin continues to boil less than $ 100,000Presenting more opportunities for the purchase. Assets are traded at 98,266 US dollars, which has decreased by 6% over the past seven days.