- The cryptocurrency market spent most of last week in a steady decline.

- Annual profit-taking is the main reason for the decline in prices as institutions unwind positions for the year, although the Fed’s hawkish stance at its Dec. 18 policy meeting also played a role.

- Open interest in major cryptocurrencies declined weekly.

Bitcoin

Bitcoin’s price fell from a one-week high of $108,372 on December 17 to a low of $92,555 before closing the week at $97,700. However, despite the decline of 9.7%, the price of Bitcoin did not change its downward trend.

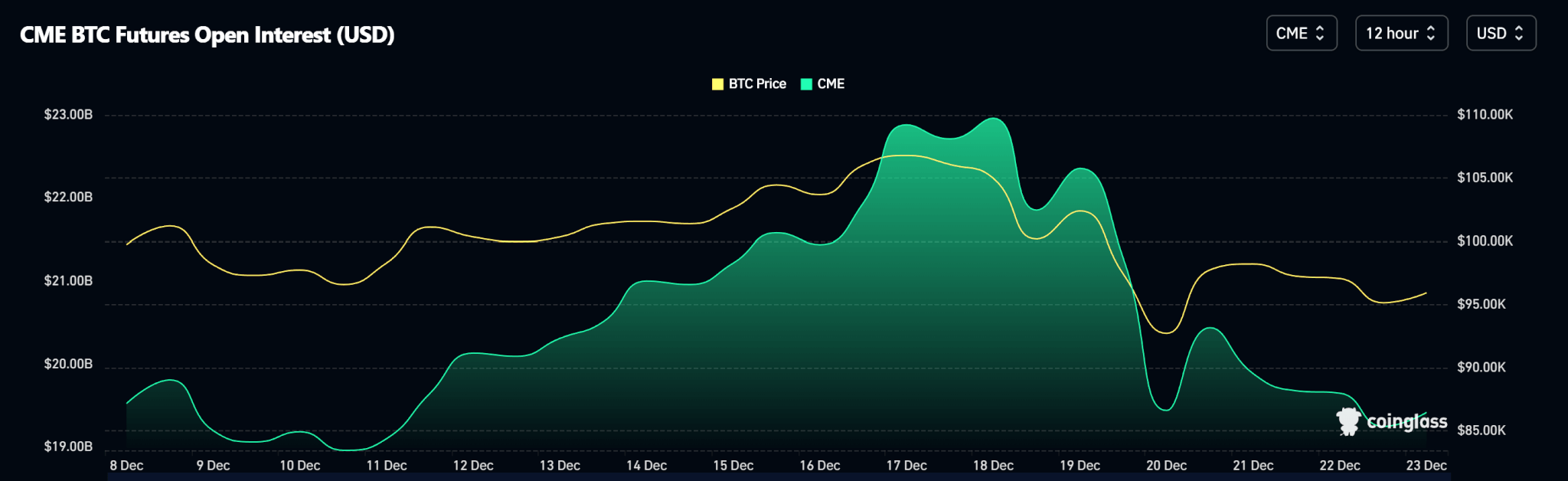

Open interest data shows a decline in the number of open contracts on the CME, which correlates with lower prices.

The Fed’s policy decision on December 18 called for a 25 bp rate cut. However, Fed Chairman Jerome Powell has expressed hawkish sentiments about cutting plans for next year, exacerbating the sell-off.

Meanwhile, Bitcoin spot ETF inflow data shows outflows on December 19 and 20 totaling $948.90 million. Net capital inflow from December 16 to 20 amounted to $447.00 million.

At the time of publication, Bitcoin is trading at $95,700.

Ethereum

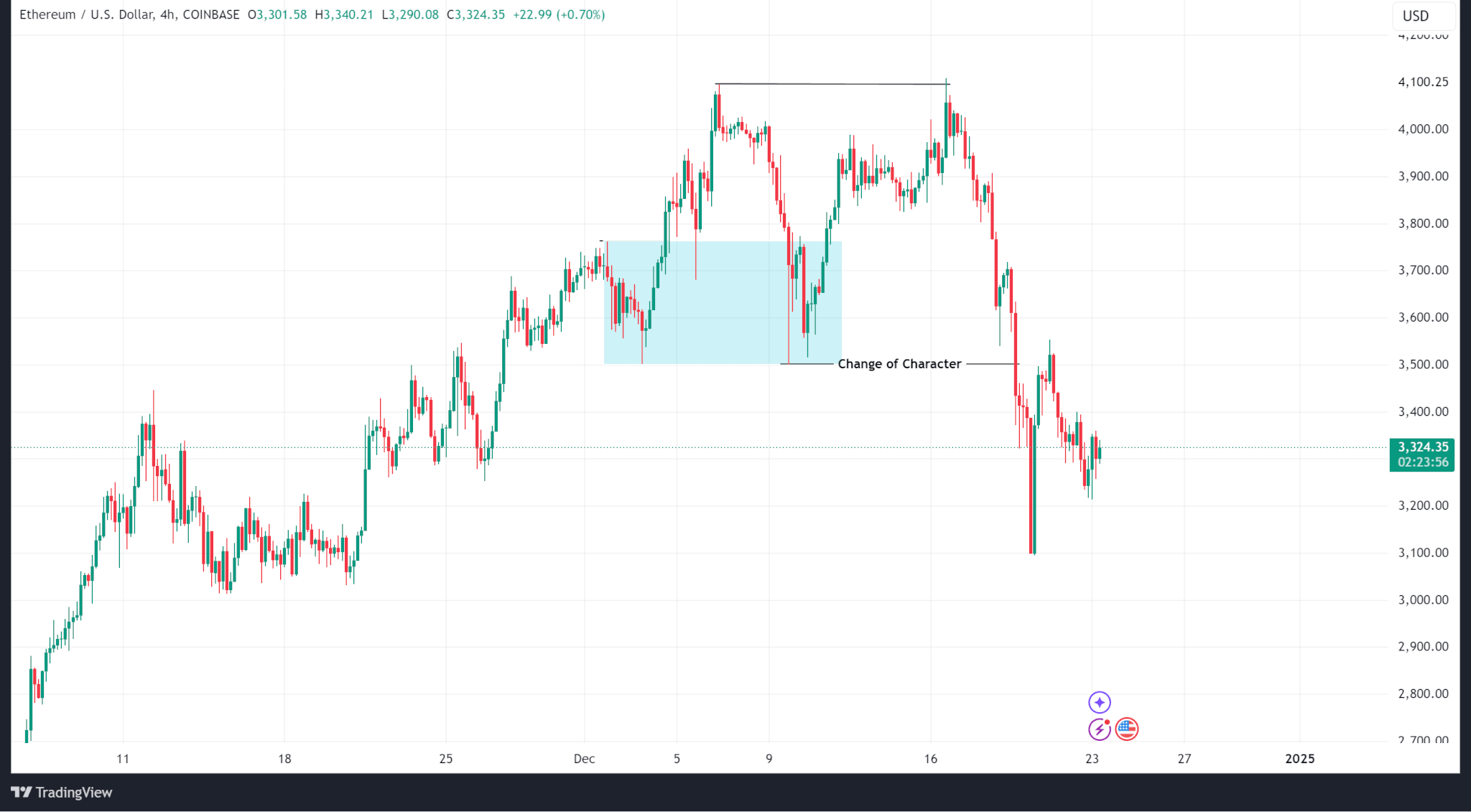

Unlike Bitcoin, which maintained a bullish structure, the price of Ethereum on the H4 timeframe changed its character and began to decline after testing (but failing to break through) the local high of $4096.50.

Ethereum fell from a weekly high of $4,108.82 to a weekly low of $3,098.40 before closing the week at $3,470.44 (a 15.51% drop).

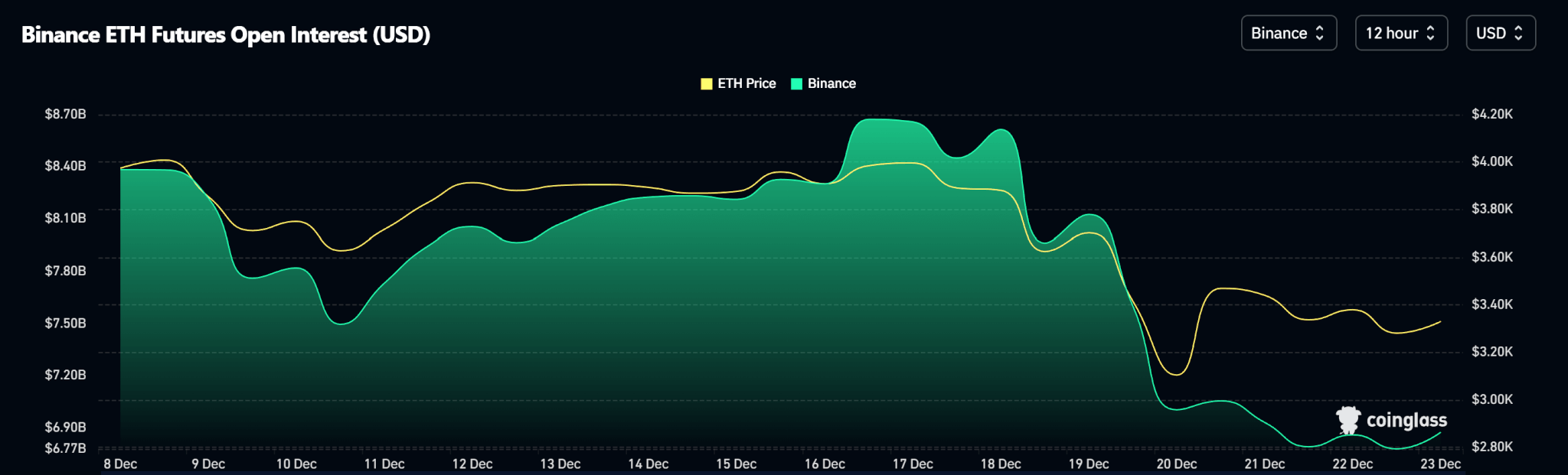

Ethereum spot ETF inflows show a similar pattern to Bitcoin outflows in the last two days of the week.

Meanwhile, open interest in Ethereum is showing a sharp decline, correlating with the price.

At the time of publication, Ethereum is trading at $3,330.78.

Solana

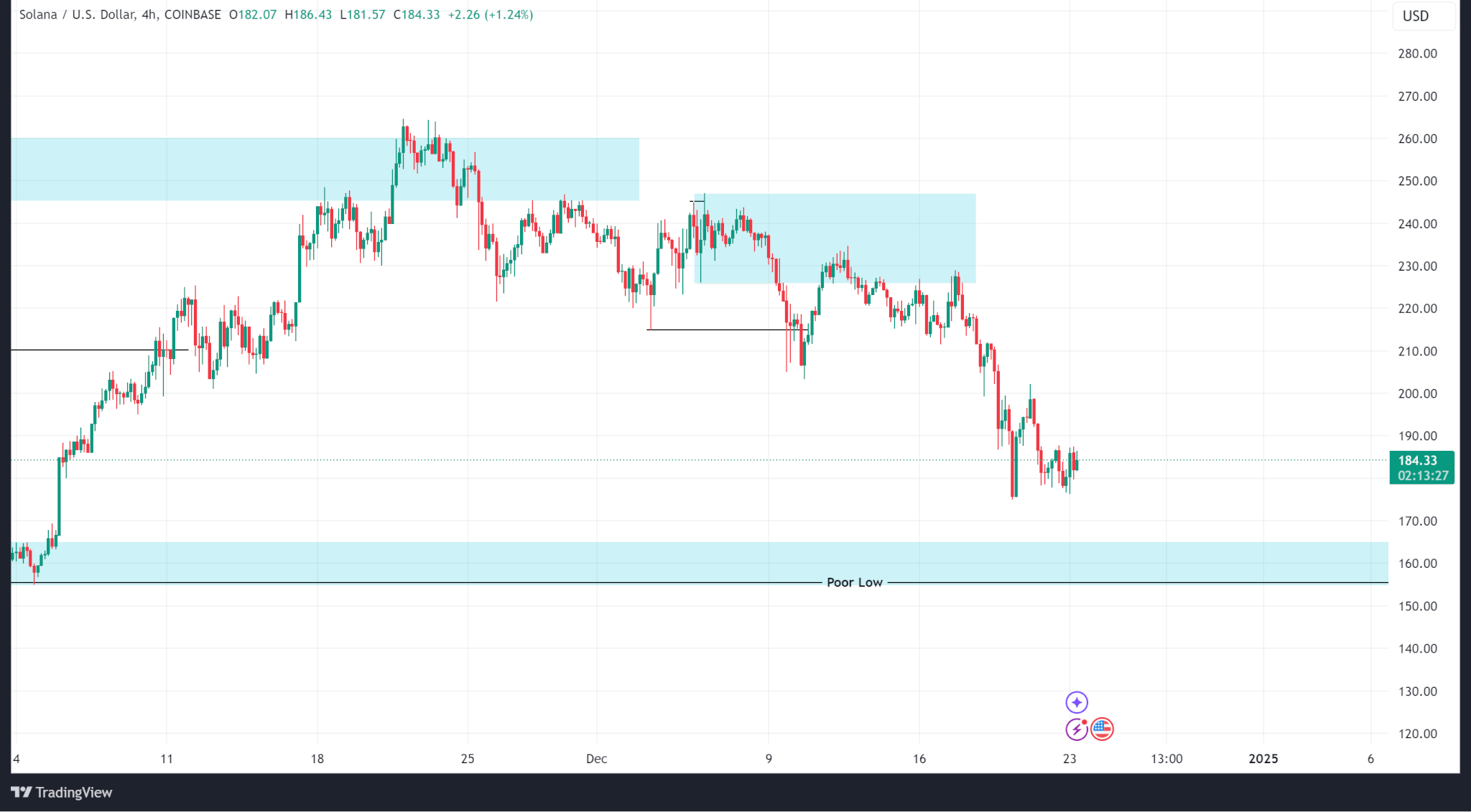

Solana’s price action continued the decline that began two weeks ago after it failed to break through its all-time high of $260.02.

Last week, price action traded in the inside supply zone around $227.71, continued selling to a one-week low of $175.12, and ultimately closed at $194.44 (down 15.07%).

The demand zone around $160 (mentioned last week) remains the first logical support zone as open interest continues to fall.

At the time of publication, Solana is trading at $184.82.

Ripple

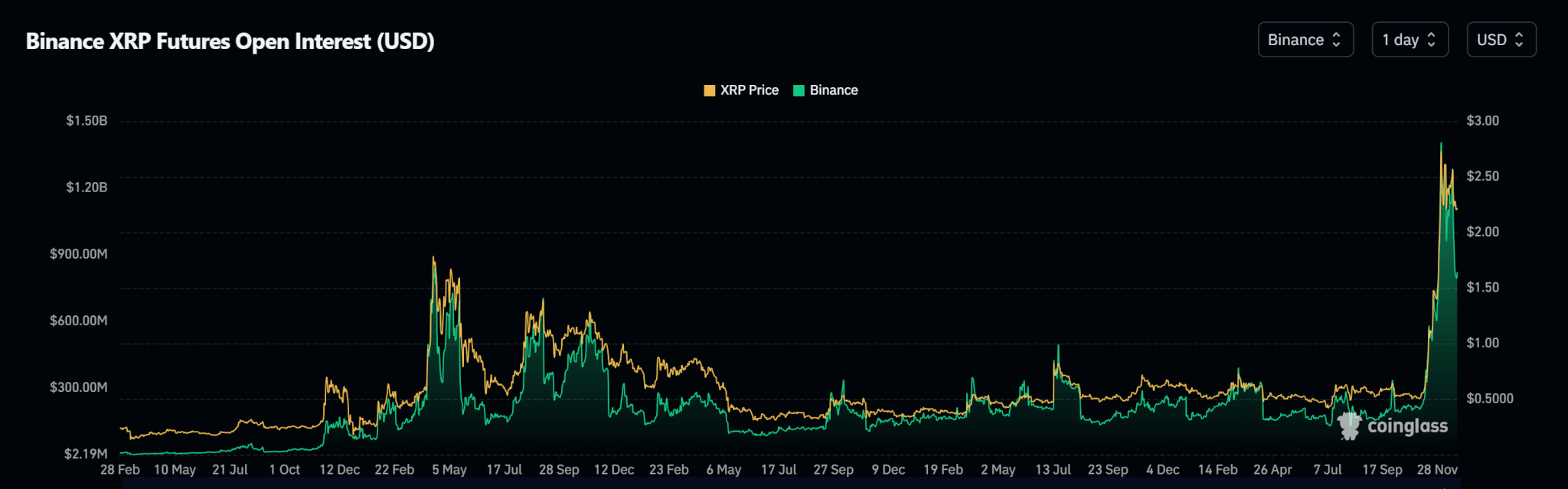

Since hitting previous all-time highs two weeks ago, Ripple’s price has mostly fluctuated between $1.89 and $2.90. However, the price made lower lows in this range.

Ripple price traded in the inside supply zone and broke above it on December 17, but fell to a one-week low of $1.95 before eventually closing at $2.27 (a 16.42% drop).

Ripple’s open interest data shows a decline in the number of open contracts since December 3rd.

At the time of publication, Ripple is trading at $2.21.