Virtuals Protocol (VIRTUAL), the cryptocurrency leading the history of artificial intelligence agents in the market, briefly surpassed a $5 billion market cap on January 2nd. Like the market cap, VIRTUAL’s price also hit a new all-time high, surpassing $5 around the same time. period.

However, the recent rally was short-lived, with the token price falling 15.20% in the last 24 hours. Here’s a closer look at the factors behind the rapid recovery and what may lie ahead for VIRTUAL.

Pressure from sales of virtual technology protocols stalls rise

As of January 1, Virtuals Protocols had a market capitalization of $3.87 billion. Yesterday it rose to $5.05 billion. However, as of this writing, everything has changed and VIRTUAL’s market capitalization has fallen to $4.28 billion.

Market capitalization is the product of circulating supply and price. Thus, when any of these indicators increase or decrease, it affects the market capitalization of the cryptocurrency. As for VIRTUAL, a total supply of 1 billion tokens is already in circulation.

Thus, the drop in the indicator as shown below can be attributed to the price, which fell from $5.05 to $4.28 in the last 24 hours. Moreover, if the value of the altcoin continues to fall, the protocol’s market capitalization risks going in the same direction.

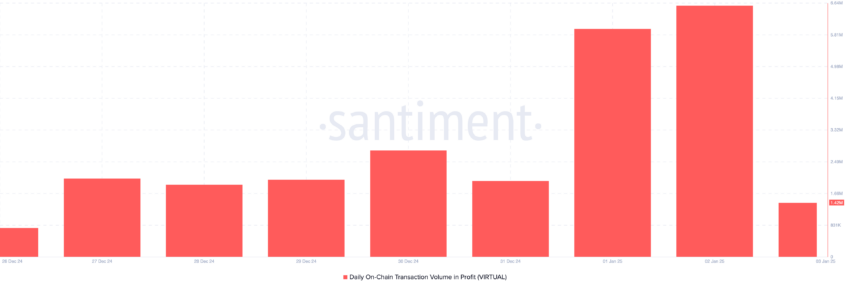

According to BeInCrypto’s findings, this double-digit decline may be due to significant profit taking from holders. According to Santiment, the volume of on-chain profit as of January 1 was 5.95 million. This indicator measures the level of realized profit for a certain period. But on January 2, at the same time, VIRTUAL rose to a new all-time high, and the profit volume rose to 6.56 million.

At the current price, this meant that VIRTUAL holders had booked over $28 million in profits. Although profit booking has not reached this level today, further increases could result in a prolonged decline in market capitalization and price.

VIRTUAL PRICE FORECAST: Long decline before rebound

According to the Relative Strength Index (RSI), there was a VIRTUAL correction on the 4-hour chart due to the token being overbought. RSI is a technical indicator that measures momentum and also checks whether an asset is overbought or oversold.

Readings above 70.00 indicate the currency is overbought, while readings below 30.00 indicate it is oversold. On January 2, the RSI on the VIRTUAL/USD chart showed that the rating reached 79.87, which forced the price to roll back.

But in addition, the Supertrend indicator, which plays a key role in identifying buy and sell zones, showed upper resistance at $5.15. If the red Supertrend segment remains above the VIRTUAL price, the altcoin could fall to $3.85.

On the other hand, if the bulls successfully break through the $5.15 resistance, this trend could reverse. In this scenario, the virtual market capitalization could exceed $6 billion and the price could approach $7.