Avalanche (AVAX) will have another token unlock on August 20. This significant event – an increase in supply – could impact the price of AVAX, as it has in the past.

However, an analysis of the Avalanche network reveals an inequality between two key stakeholders.

Avalanche’s Key Figures Look in Different Directions

BeInCrypto previously reported that AVAX would unlock 9.54 million tokens, which were worth $251 million at the time. The distribution, which was supposed to go to the Avalanche team and strategic investors, could lead to volatility in the price of AVAX.

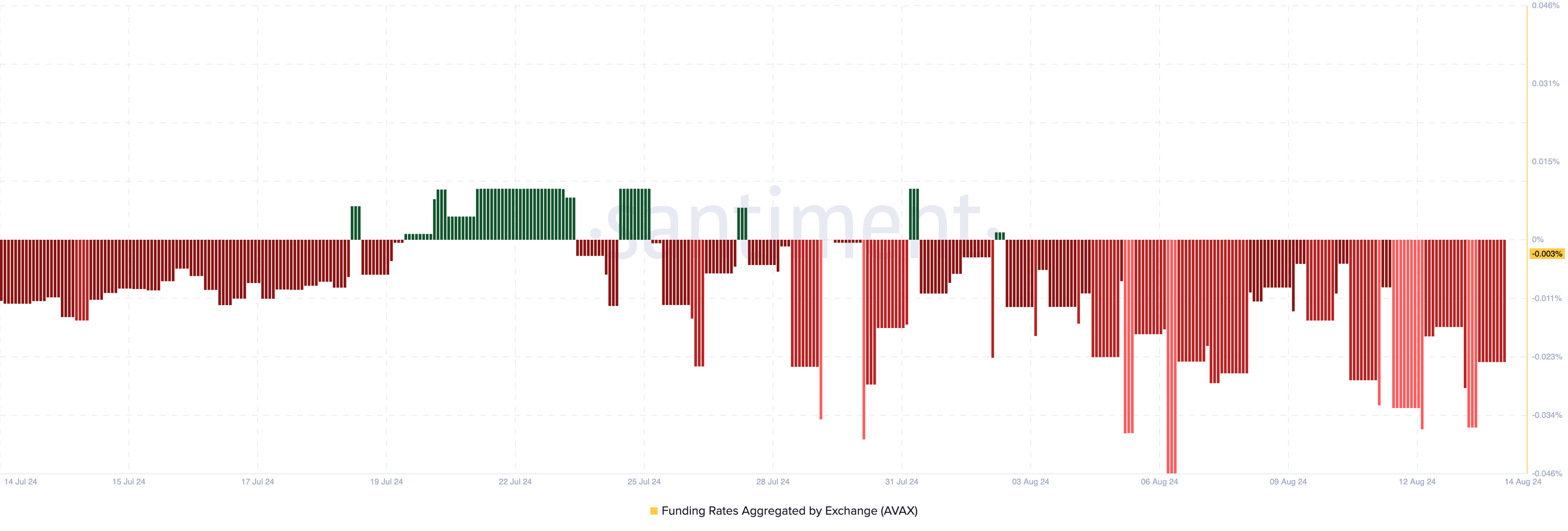

As the event approaches, on-chain data shows a marked difference in sentiment between whales and traders in the derivatives market. According to Santiment, the AVAX funding rate is negative.

In non-technical terms, the funding rate is the cost of holding an open position in the market. If funding is positive, the contract price trades at a premium to the spot price, suggesting that traders are willing to pay a higher fee to bet on rising prices.

Read more: What is Avalanche (AVAX)?

Negative funding, as in the case of AVAX, implies bearish sentiment, suggesting that traders expect the price to fall. However, whales seem to have a different opinion. According to IntoTheBlock, net flow from large holders on the Avalanche network has increased by 33.66% over the past seven days.

This flow is

represents the difference between the inflow and outflow of large holders. An increase in net flow indicates that whales are accumulating more than they are selling, while a decrease indicates greater distribution.

The positive difference for AVAX suggests accumulation. From a price perspective, if this trend continues, it could indicate increased confidence in a strong short-term outcome for AVAX.

AVAX Price Forecast: No Winner, No Loser

At press time, AVAX is trading at $21.27 and has been hovering around that area for the past few days. Between that consolidation, the token briefly dipped below $20 on August 8, as seen on the daily chart.

The Moving Average Convergence Divergence (MACD) shows bearish momentum for AVAX. MACD measures momentum by calculating the difference between two moving averages. When the MACD reading is above its signal line, it indicates bullish momentum; when below, it signals bearish momentum. For AVAX, the MACD is below its signal line, suggesting a breakout may be difficult.

Additionally, AVAX may continue to consolidate between the swing low of $20.43 and the swing high of $22.79. The Fibonacci retracement indicator provides additional insight into potential support and resistance levels.

Read More: 11 Best Avalanche (AVAX) Wallets to Consider in 2024

As shown above, an extreme bearish scenario could see AVAX decline to $17.10. However, if whale accumulation intensifies, the token could reach its first target at $23.07 before a possible retest of $26.64.