This is an excerpt from the Forward Guidance newsletter. To read full editions, subscribe.

So yesterday the Fed cut rates by 25 basis points and markets went wild. Heck, we even ran a headline about Santa’s upcoming rally. Oops. This happens.

But what does it give? What really happened? Let’s figure it out.

Before an FOMC meeting, a combination of factors creates tension that leads to the price outcome of the event. This combination of market expectations is based on the forecasts of the FOMC (the name of this newsletter!) and the position of the market players who participated in the event regarding these expectations. Let’s look at these two concepts.

Expectations

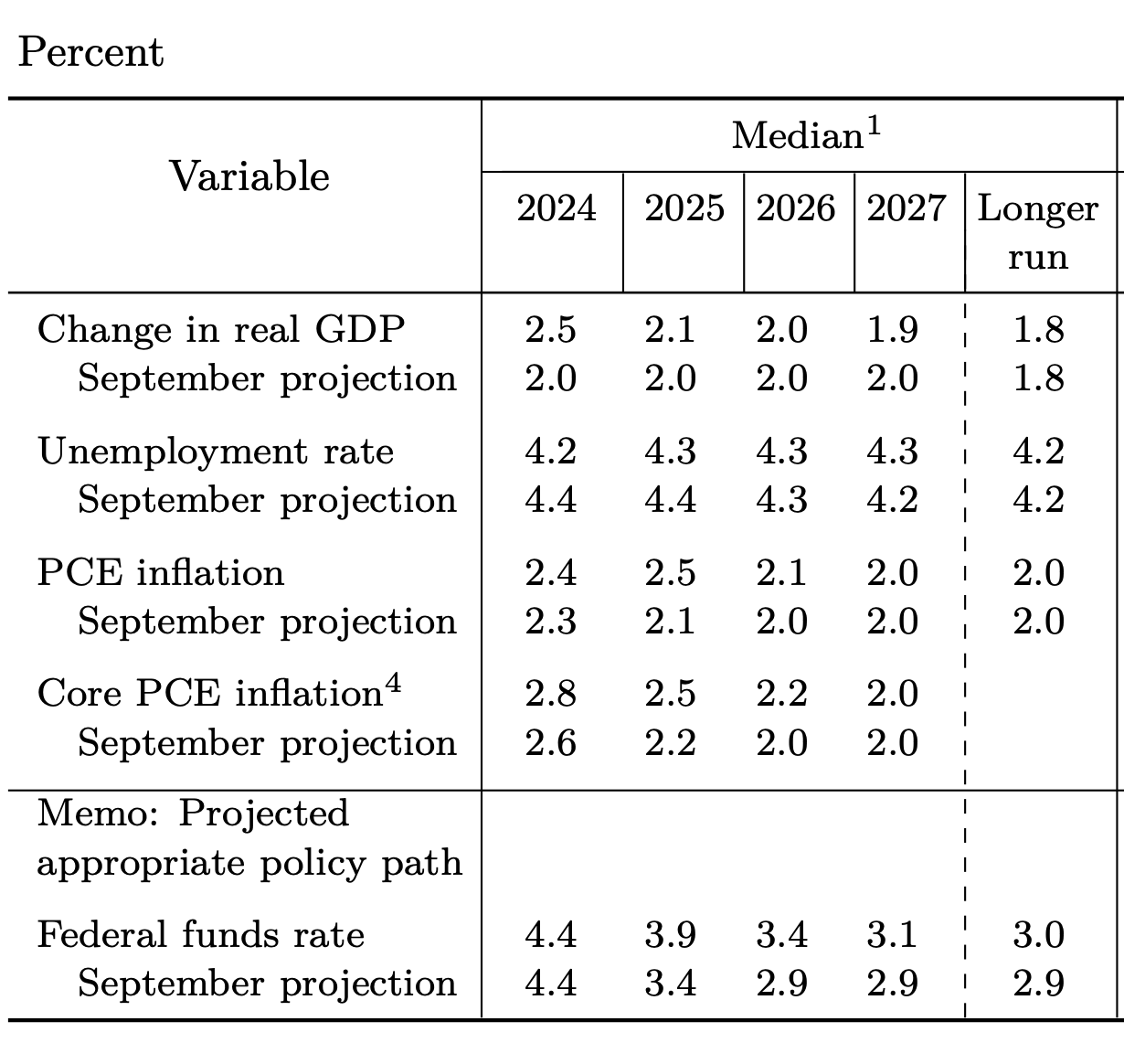

Ahead of the meeting, the SOFR curve, which can be viewed as the market’s implied forecast of the movement of the federal funds rate towards the final rate, deviated significantly from the previous consolidated forecast of the Fed’s economic forecasts from September.

This largely reflected a significant phase shift towards greater economic strength and labor market strength, necessitating smaller rate cuts than widely expected in September.

In 2025, the market expected only a threefold reduction in rates. Thus, to surprise the market with the hawkish side of events, the hurdles to achieving this goal were very high.

To my surprise, the FOMC managed to do this while simultaneously cutting rates yesterday. Hawk cut? What a time to be alive.

In raising its expected federal funds rate to 3.9% (from 3.4%), the FOMC projected only two cuts in 2025, compared with an already aggressively positioned market that expected three.

This reduction in the amount of cuts was largely due to increased uncertainty about the path of inflation over the next 12 months, as shown here:

All this information has been boiled down to this simple step – the second point will exceed market expectations in 2025:

What made this move yesterday so cruel? Second part: positioning.

Positioning

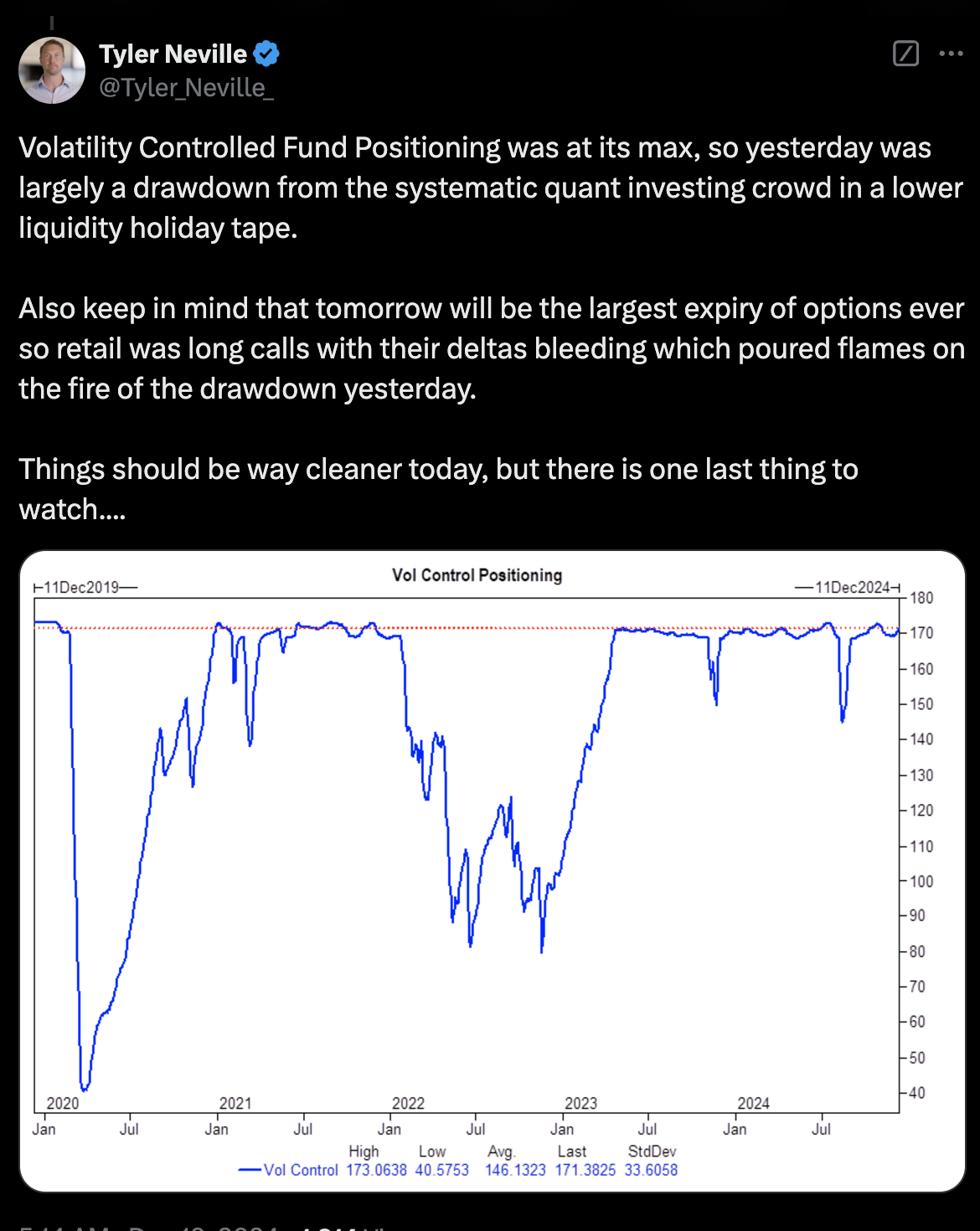

There are triple positioning dynamics that come together to lead to the perfect ignition, fueling the fire that was yesterday. As Tyler Neville (co-host of the review) discusses here, because the VIX was so low early in the event, the systematic crowd was aggressively long:

Additionally, there is widespread anticipation of seasonal dynamics in the markets (i.e. the Santa rally we mentioned yesterday) that will take us to the promised land. This led to everyone starting to make the same trade, wanting assets with high beta risk, assuming that Powell would continue to be peaceful.

Finally, this week marks the largest options expiration in history. With so much open interest, dealers who have to hedge delta risk end up reflexively chasing gamma, which amplifies moves in the markets. This further led to yesterday’s acceleration.

As always, there is no single reason for the market to move on any given day. Moreover, it is a combination of many factors that together lead to a result. And some days these actions end up in very aggressive steps, as we saw yesterday.