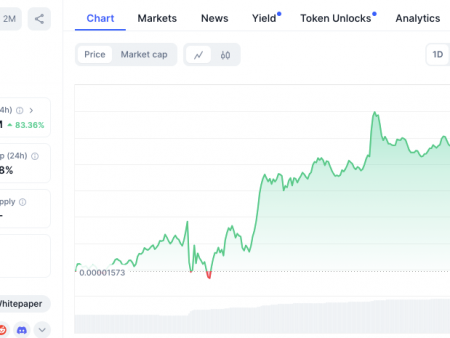

Trump’s official Token (Trump) jumped by 20% over the past 24 hours, increasing from $ 14.65 to a daily maximum of $ 17.52. The service follows the APBIT announcement for the transfer of Trump trading pairs (KRW, BTC and USDT) on February 13.

According to UPBIT, several trading restrictions will be applied to Trump listing. The purchase orders are faced with a 5-minute restriction after the start of trading, while orders for sale at a price are 10% lower than in the next place of the previous day for a 5-minute delay. All types of order, except for limited orders, are delayed for 1 hour.

Whale movements and impact on the market

In addition, whale activity also fed a rally. Data from Onchain Lens through X (earlier Twitter) show that Crypto -Kit spent $ 9,350 ($ 1.82 million) for the purchase of $ 105,923 for $ 16.50. This whale, which previously earned $ 2 million in Trump, returned to the market, probably expecting further growth after the Apbit list.

Over the past 30 minutes, the whale spent $ 9,350 in the amount of $ 1.82 million. The USA for the purchase of $ 105,923 at a price of $ 16.50.

The whale previously earned ~ $ 2 million in $ Trump and again drove into Trump due to the #UPBIT list.

Address: EIIANQSFCRUXHFKDABAMH4GZOVWWRQEFQGP11XW Pic.twitter.com/rmrloca8zh

– Onchain Lens (@onchainlens) February 13, 2025

Connected: HTX hints at Crypto Ties Justin Sun & Trump in a mysterious post

$ Trump price analysis

The 4-hour graph of Trump/USDT demonstrates a bull breakthrough above a 20-day exponential sliding medium (EMA) for $ 15.8. The breakthrough carries the weight, as Trump experienced a steep downward trend, falling 77.03% of his record high level $ 75.35 over the past 25 days.

Interestingly, the price broke past the upper strip of Bolinger, which indicates increased volatility. The upper strip serves as a strong level of resistance, and investors should expect brief consolidation until further achievement.

Meanwhile, the MACD indicator shows that the MACD line crossed the signal line (orange), confirming the bull divergence in the 4-hour diagram. The histogram became positive, increasing the pressure of the purchase.

Connected: Ripple and Galaxy borrowed MoonPay $ 160 million on weekends

Traiders must monitor profit at higher levels. If Trump holds above $ 15.8, he can check the resistance from 18 to $ 20 in the coming days, while the fall below $ 15.8 can cause short -term consolidation.

Refusal of responsibility: The information presented in this article is intended only for information and educational purposes. The article is not a financial advice or what -liba tips. Coin Edition is not responsible for any losses incurred as a result of the use of content, products or the services mentioned. Readers are recommended to be careful before taking any actions related to the company.