- Bitcoin price must stay above the critical support at $36,788 to keep hope alive for a continuation of the intermediate trend.

- The $1,935 support level continues to hold for Ethereum price, but the decline is likely to continue 5% lower.

- Ripple price extends south, invalidating the bullish thesis with the potential for a further 8% drop to $0.5392.

Bitcoin (BTC) price remains bearish, but there is hope, after the US Department of Justice cleared the way for the approval of spot BTC exchange-traded funds (ETFs). According to some analysts, one of the obstacles to approval was the dominance of the Binance exchange in the industry.

Lots of talk about this Blackrock #Bitcoin ETF. That’s right. Blackrock, more or less IS, is the United States government. They also received approval for 575/576 ETF applications.

One thing I will say: there is no chance, and I mean zero, of this ETF being approved with Binance in…

– Travis Kling (@Travis_Kling) June 16, 2023

Also Read: With Binance’s Market Dominance Threatened, Experts Say Path for Bitcoin Spot ETF Now Clear

Bitcoin price tests key support

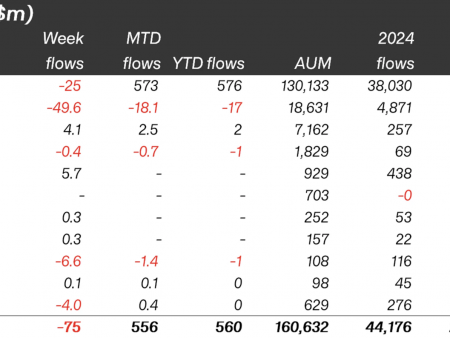

The price of Bitcoin (BTC) is showing weakness, recording a 3% drop on the day, and most of these losses were recorded following the news about the Binance exchange. Testing the critical support at $36,788 and with the Relative Strength Index (RSI) showing weakening momentum, BTC could fall.

Further selling pressure below the $36,788 mid-threshold of the supply zone extending from $36,276 to $37,301 could open the drains for a prolonged decline, with experts anticipating a drop to the psychological level of $30,000.

The Awesome Oscillator (AO) histogram bars are already drenched in red and inching closer to the midline each day. This points to the bears steadily taking control.

BTC/USDT 1-day chart

Conversely, further buying pressure from investors looking to capitalize on the retest of $36,788 could see Bitcoin price rise, first surpassing the local high at $37,972 before testing the range high at $37,980 and ultimately reclaiming the psychological level of $40,000, 10% above current levels.

Ethereum Price Struggles to Maintain $1,935 Support Base

Ethereum (ETH) price is at risk of losing the critical support at $1,935, which marks the midline of the supply zone turned bullish switch that extends between $1,864 and $2,004. If the $1,935 level fails to hold, it could spell doom for token holders, with ETH likely to fall to the psychological $1,800 level or, in the worst case, invalidate the bullish thesis below $1,753.

Both the RSI and AO support this outlook, moving lower as momentum continues to fade.

ETH/USDT 1-day chart

On the other hand, increased buying pressure, enough to justify Ethereum price out of the aforementioned supply barrier above $2,009, could spur optimism, putting ETH back above the ascending trend line. This could clear the sky for a while to $2,136, denoting a 10% rise from the current level.

Ethereum FAQ

What is Ethereum?

Ethereum is an open source decentralized blockchain with smart contract functionality. Serving as the core network for the cryptocurrency Ether (ETH), it is the second largest cryptocurrency and the largest altcoin by market capitalization. The Ethereum network is designed to offer scalability, programmability, security and decentralization, attributes that make it popular among developers.

What blockchain technology does Ethereum use?

Ethereum uses decentralized blockchain technology, where developers can create and deploy applications that are independent of the central authority. To facilitate this, the network has a programming language that helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows transactions between users.

What is betting?

Staking is a process in which investors grow their portfolios by locking up their assets for a specific period instead of selling them. It is used by most blockchains, especially those that employ the proof-of-stake (PoS) mechanism, and users earn rewards as an incentive for pledging their tokens. For most long-term cryptocurrency holders, staking is a strategy to generate passive income from their assets, putting them to work in exchange for generating rewards.

Why did Ethereum go from Proof of Work to Proof of Stake?

Ethereum moved from a proof-of-work (PoW) mechanism to a proof-of-stake (PoS) mechanism in an event dubbed “The Merge.” The transformation came about when the network wanted to achieve more security, reduce power consumption by 99.95%, and run new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are fewer barriers to entry for miners considering the reduction in energy demand.

Ripple Price Could Overturn Bullish Outlook With Bold Move

Ripple (XRP) price could invalidate the bullish outlook if it breaks decisively and closes below $0.5981 on the daily time frame. Further selling pressure below the current level could sink XRP into the consolidation phase between $0.4735 and $0.5392.

Momentum indicators also corroborate the bearish case, suggesting that Ripple price’s downtrend may not be over yet.

XRP/USDT 1-day chart

On the other hand, a resurgence of bulls could restore hope for XRP holders by bringing Ripple price back above the triangle’s lower trend line at $0.6603. In a highly bullish case, the payments token could rise further to test the fair value gap (FVG) at $0.7512, restoring balance to the XRP market.

Share: Cryptocurrency Feed