The Telegram-based Toncoin (TON) project has become one of the breakthrough blockchains of this cycle. This success is due not only to the token’s price performance, but also to the significant level of adoption it has achieved.

However, despite Toncoin’s many achievements, the blockchain faces challenges that could impact its price.

Toncoin has a double-edged sword

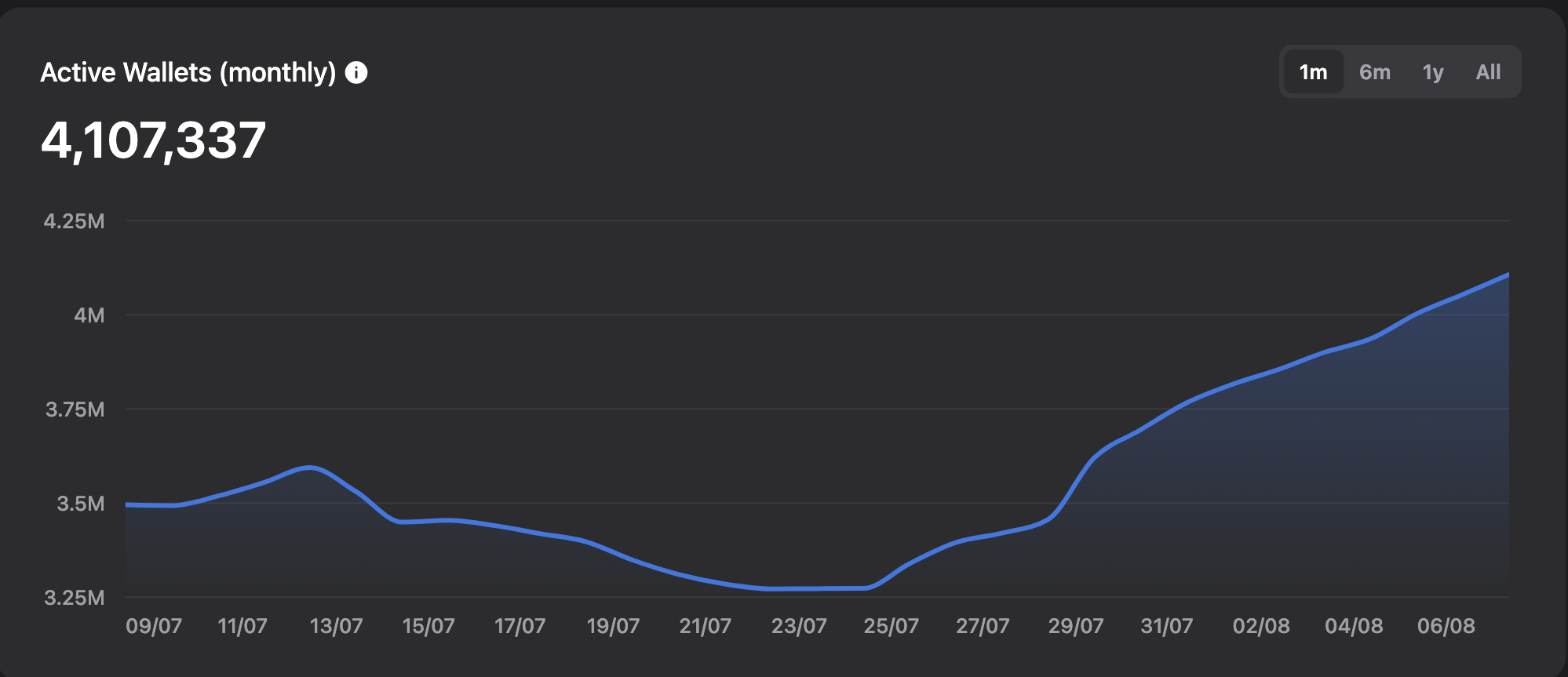

One area where the project has excelled is in active wallets. According to TON Stat, the number of monthly active wallets has exceeded four million, driven by more than 500,000 new accounts joining the network since early August.

The 30-day active wallets metric tracks the number of wallets involved in at least one successful transaction. For Toncoin, this growth is largely due to active participation in on-chain Tap-to-Earn platforms.

For example, projects like Tapswap and Hamster Kombat continue to show high levels of user adoption. Alternatives including Catizen and Blum have also played a major role in Toncoin reaching this milestone.

Read more: What are Telegram Bot Coins?

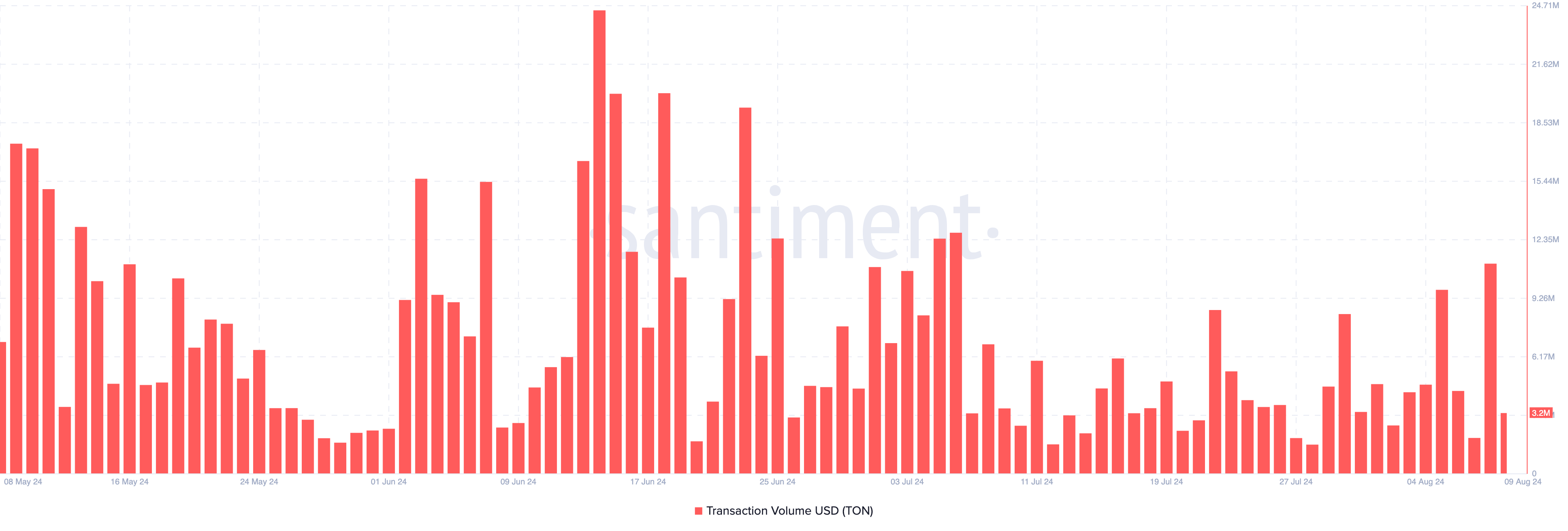

Despite the surge in traction, TON is struggling to handle a large number of daily transactions. Typically, an increase in transaction costs increases the share of fees and network revenue.

Moreover, higher transaction volumes could support the token’s recovery, especially if a significant portion includes the purchase of its own token. On August 8, the total volume of TON transactions reached $11 million. However, at the time of publication, this figure has fallen almost threefold to $3.2 million.

This drop indicates that interest in the cryptocurrency is waning. If this trend continues or worsens, the price of TON may suffer similarly.

TON Price Prediction: $6 is the Key

Toncoin is trading at $6.44, a level it reached after listing the cryptocurrency on Binance. According to the daily chart, TON is on the verge of recouping the losses it suffered between August 1 and August 5.

However, the Aroon indicator suggests that this rally may soon stop. The Aroon indicator, which measures the strength of a trend, consists of two lines: Aroon Up (orange) and Aroon Down (blue).

At press time, the Aroon Down line was higher than the Aroon Up line, indicating that TON’s rally could soon be neutralized. Additionally, the moving average convergence divergence (MACD), which measures momentum, is currently negative.

The MACD position suggests that the momentum around the token is mostly bearish. If this trend continues, it could lead to a decline in the price.

Read more: 6 Best Toncoin (TON) Wallets in 2024

If so, the TON price could fall to $6.04. However, sustained buying pressure from bulls could push the price higher, potentially reaching $6.91.