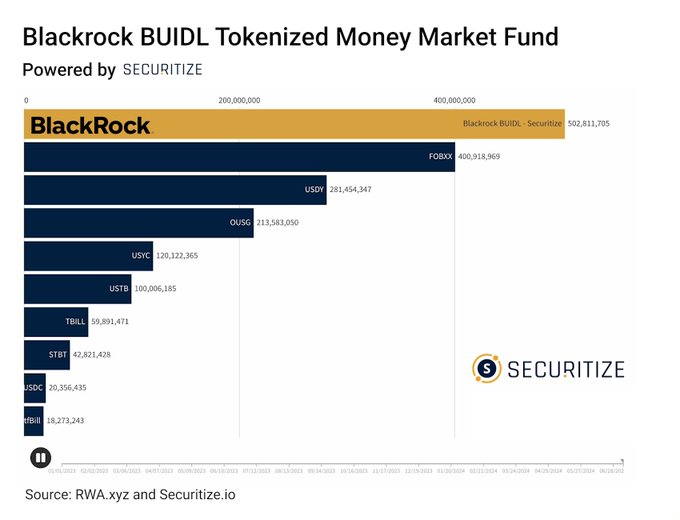

Earlier this week, BlackRock’s BUIDL surpassed $500 million, a milestone no tokenized money market fund has ever reached.

Tokenized funds have really taken off in the last few years, Securitize CEO Carlos Domingo told Blockworks. BlackRock and Securitize launched BUIDL earlier this year.

However, only certain investors can access the fund. Qualified investors with assets of more than $5 million can subscribe through Securitize.

What led to this growth?

The rise of stablecoins is certainly a factor, Domingo said, as it has gotten people thinking about what else could be tokenized.

Read more: Circle Introduces Way to Trade Tokenized BlackRock Stocks for USDC

The total value of the tokenized Treasury bond market, including BUIDL, is currently $1.8 billion. Domingo wouldn’t be surprised if the market cap soon exceeds $2 billion.

While the market is obviously much smaller than the $160 billion stablecoin market, “it’s definitely growing much faster than stablecoins.”

“Keep in mind that stablecoins are easier to buy and use because they are permissionless, whereas tokenized treasuries are securities. So they have some restrictions on who can buy them, how you can transfer them, etc. So they will never be — in my opinion — as big as stablecoins… but I think they could easily be 10-20% of the stablecoin market,” he said.

While the rest of the industry was undoubtedly excited by the launch of a Bitcoin ETF earlier this year, Domingo believes the two trends have been operating on “parallel tracks.”

“The way I see it is you take the Web3 asset, which is Bitcoin, and you put it on [traditional finance] world through ETFs. Rather, I think tokenization is the opposite. You take [traditional finance] asset and you put it into crypto — into the Web3 space — through tokenization. So it’s like two different things that are very valuable but have nothing to do with each other,” he said.

Domingo spoke about his conversations with others in the space, noting that they have become more intense since BUIDL launched.

“Every asset manager is thinking about how they can get involved,” he told me. Perhaps unsurprisingly, given the interest in BUIDL.

But this success is not unique to BlackRock.

Franklin Templeton’s FOBXX fund, launched last April, has surpassed $400 million, up 16% in the last 30 days, according to rwa.xyz. BUIDL, by comparison, has jumped nearly 9% in the same time period.

But Domingo thinks BUIDL’s next $500 million could come even faster—the fund launched just four months ago. Part of that could be due to some “new features,” he teased. Some will be unveiled in just a few weeks.

It should also be noted that due to the nature of the fund, there may be a slight delay when trying to subscribe to it.

He added: “In terms of attracting entities, because these are institutions, it takes time… for them to be able to invest in BUIDL. But we have a very large pipeline of entities that are joining [so] that once they join, they will invest, right?

BUIDL’s success has led to discussions between BlackRock and Securitize about future projects. Domingo said both firms are well aware that they are only four months into BUIDL, so nothing else is expected at this point.

Read more: How TradFi’s Latest Blockchain Test Could Mark the ‘Five Yards’ for Mass Adoption

“So everything takes longer than [it would] “Take for example working with a startup, which is fine because you also get the trust of BlackRock… I think in the next few months we will focus more on developing BUIDL in terms of the utility of the token, the functionality and integration with all parts of the ecosystem, rather than launching a new project,” he said.

But despite wanting to grow while operating a “small company” (Domingo says Securitize currently employs 150 people), he said his firm has no plans to raise additional funds anytime soon. In May, ICYMI, BlackRock led a nearly $50 million round for the firm.

“We need to implement what we have. We have a lot of money. We weren’t raising money when BlackRock came in. We already had money in the bank. So it’s not that we needed money… I think raising money [has] “It was a huge distraction for me, especially because I have to deal with a lot of people and at this point I don’t want to raise more money,” Domingo said.

A short version of this article first appeared in Empire Thursday Newsletter. Register Here so you never miss a single issue.