The price of Brachain (braa) grew to $ 15 in the first hours after the launch of Mainnet, but quickly began to decline. Airdrop Brachain was one of the most anticipated distributions in 2025 after a positive year of development during 2024.

Nevertheless, the technical indicators now involve the weakening of the impulse, and the RSI falls from the level of bite and CMF, becoming negative. With other recent air flows, such as Hype and Pengu, fighting after launch, Bra is faced with a difficult way to restore, unless market sentiments are moved.

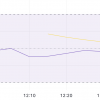

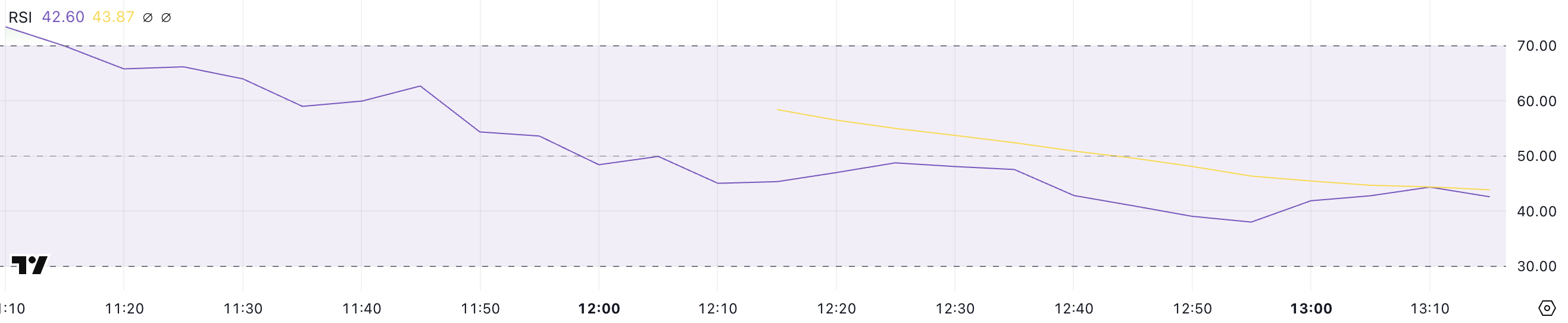

Braa rsi falls quickly

Braa is the native token Brachain, one of the most inflated blockchains Layer-1 over the past few years. After launching earlier today, it currently has RSI 42.6, falling from almost 70 only a few hours ago.

The relative force index (RSI) is an indicator of the impulse, which measures the speed and value of price changes in order to evaluate whether the asset or resold is exceeded.

Indications above 70 indicate the conditions of bite and potential for the rollback, while levels below 30 suggest ove -axed conditions, which can lead to restoration. Since the RSI Braa is now much lower than 70, the recent sales pressure weakened his impulse, signaling the trend.

In 42.6 RSI BERA, it suggests that its price is located on a neutral territory, but is inclined to a bear impulse. The fall from the levels of overwhelming indicates that the previous upward trend has lost strength, and the further movement of the deficiency may follow if the sales pressure has been preserved.

However, if the RSI stabilizes or changes near this level, this can offer consolidation until the next movement. The continuation of the decline to the side of 30 will signal the increase in weakness, while the rebound from this zone may indicate that buyers intervene in support of potential recovery.

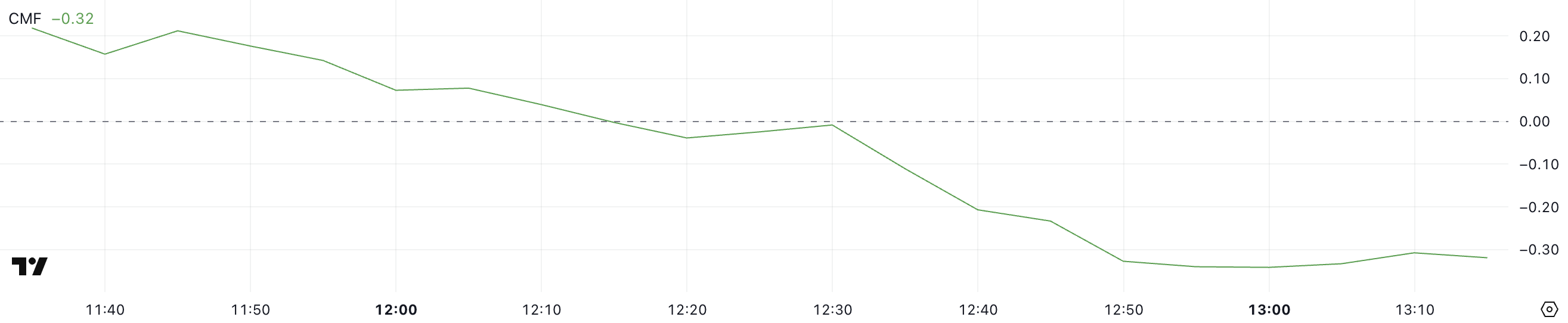

Braa CMF is very negative after touch 0.2

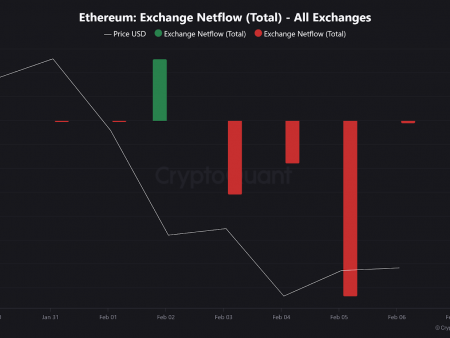

Currently, BERA has a CHAIKIN (CMF) -0.32 cash, after it sat about 0.20 just a few hours ago before starting to fall. CMF is an indicator that measures the pressure on the purchase and sale by analyzing the volume and price movements for a certain period.

The positive value of CMF implies the accumulation, which indicates a strong percentage of purchase, while a negative value signals the distribution and pressure of sales. With CMF from BERA, now deep in the negative territory, the pressure of the sale has intensified, which involves a change in the mood of the market.

This CMF decrease occurred after Bragachain launched his Airdrop Bera after a year of construction within 2024. However, the broader trend of Airdrop tokens was weak, and previous long -awaited launches, such as Houpe and Pengu, are fighting in terms of profitability.

CMF braa on -0.32 suggests that liquidity follows, which means that sellers dominate the market. If this trend continues, braa may encounter further pressure, unless buyers enter into force in order to absorb sales and stabilize the price.

BERA price forecast: will Bra recover in the near future?

Bera Price raised to $ 15 a.m. after its air flow, but quickly began to decline. With the RSI now 42.6, compared with almost 70, and CMF has fallen to -0.32, the indicators suggest that the purchase of the impulse has disappeared, while the sale pressure increases.

The falling RSI indicates a weakening of bull force, while the negative CMF signals the outflow of capital, increasing the idea that sellers are under control. Given this setting, Berahain may continue to fight if the demand does not rise to counteract sales.

Recent air flows, such as HYPE and PENGU, also performed poorly after their initial noise, emphasizing the wider tendency of weak profitable income after the athlete. If Braa follows a similar scheme, it may experience further shortcomings, since the early recipients sell their tokens.

However, if the sale of pressure is stabilized, and the indicators will begin to contact, Braa may enter the consolidation phase before finding it in the next direction. At the moment, the technical installation remains a bear, and a strong catalyst will be required to shift the mood in its favor.