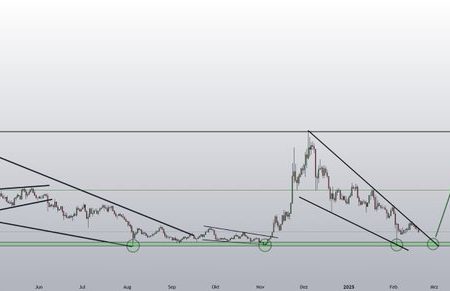

The price of the XRP is at the critical stage: traders observe $ 2.4 to determine the next step of token. The recent pricing action shows a combination of signals to restore bull and bear risks, as a result of which the market participants decided – to get acquainted with weakness or output near the resistance.

XRP Slack levels of prices for viewing

The cryptocurrency retreated from the last maximums, with a price action showing mixed signals on a four -hour graph. The level of $ 2.4 has become key support, and its strength will determine the short -term direction of token.

A break below $ 2.4 can put up a liquidity market on the sale side of about $ 2.326, which increases the chances of further decline. Nevertheless, cryptocurrency can bounce to zones of higher resistance if buyers protect this level. The market has already demonstrated a shift in the structure, assuming that price movement can be unstable at the upcoming sessions.

In addition, the diagram shows critical levels that traders control. Direct resistance is $ 2.581, which corresponds to the recovery level of 50% Fibonacci. A breakthrough above this zone can allow customers to push the price to the liquidity level of $ 2.83.

Further growth goals include $ 3.15 and $ 3.55, which corresponds to Fibonacci expansion levels. On the other hand, the inability to keep above $ 2.4 can lead to re -testing of $ 2.326. The breakdown below this support indicates an increase in sales pressure, which sets $ 2.10 as a possible purpose.

Displacement of the diagram and market prospects

The structure of the market involves indecision, with the trade in the XRP token inside the growing wedge. This formation often signals the weakening of the impulse, which makes the following breakthrough critically important for sending prices. Moreover, the relative force index (RSI), currently about 41, is reduced, hinting that the cryptocurrency market prefers the bears a little.

Nevertheless, if the RSI is restored above 45, this may indicate a pulse shift, preferring the Buy-The Dip strategies. Conversely, the continuation of the decline below 40 will confirm the control of bear, increasing the likelihood of destruction. A Data in the chain Further supports uncertainty in the XRP price movement.

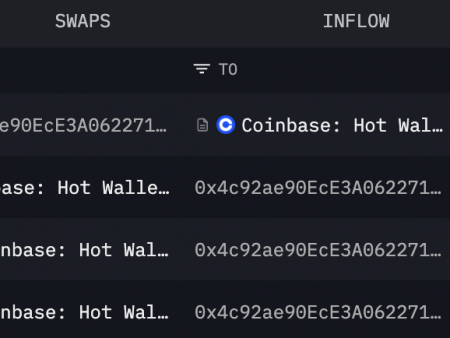

Since February 18, 2025 with a clean outflow of 75.26 million dollars. The United States, investors, by the same, move to exchanges, are often a sign of accumulation. Nevertheless, the price of the XRP of token is $ 2.5628. If the outfills continue without price restoration, support in the amount of $ 2.4 can weaken, which will increase the risk of falling to $ 2.326.

Again, liquidation data show a long liquidation of $ 8.7 million. USA, ahead of shorts in the amount of 2.21 million dollars. USA, which indicates more forced exits. If a short liquidation will rise, this can signal the appeal from $ 2.83. Otherwise, XRP can remain under pressure, which makes the next movement critical.