Litecoin and Mantra rallied in two -digit indicators this week. Technical analysis and analysis on the chain suggests that two altcoins are ready for further profit next week. The flash car of Bitcoin is less than $ 100,000, and its income of more than $ 104,000 caused optimism among crypto -traders.

The US macroeconomic data, the performance of technological promotions and promotions, as well as development in the field of artificial intelligence are key engines of market for bitcoins. Altcoins, such as LTC and OM, carefully follow bitcoins, since the correlation remains high.

Table of contents

Litecoin and Mantra can expand profit, technical analysis shows

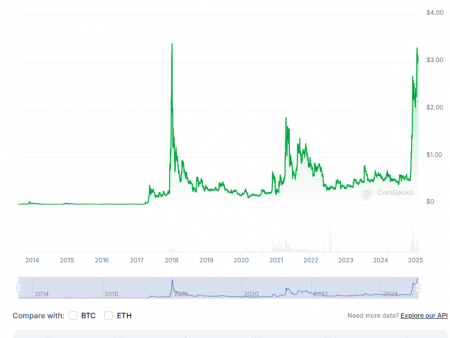

Technical analysis supports profit in LTC and OM, for daily terms. Mantra (OM) is consolidated in the range for several weeks since mid -December and January. OM escaped from the range from 4.5352 to $ 3.1730.

At the time of writing, on Friday, OM is traded at a price of $ 5.6263, close to its maximum of $ 5,9,500, as was observed in the TradingView table below.

In daily terms, OM formed a support zone from 4.443 to $ 4.069. This is a key imbalance area, and the correction can see how the mantra bounces from this range.

Two key technical indicators, a relative force index and an indicator of divergence of the convergence of a sliding average, confirm the bull thesis for OM. RSI reads 76 and leans up. While the sale signal usually generates, in combination with the green Macd Gistogram rods above the neutral line, it emphasizes the basic positive impulse in the trend of OM.

A second test throughout the maximum of OM, probably next week, if the token supports its ascending impulse.

Litecoin was consolidated within the upper and lower boundaries of the range of $ 129.11 and $ 92.57. LTC completed its consolidation and escaped from the support zone, by less than 8% as part of its peak in 2025 at $ 141.22.

Litecoin is traded at 131.64 dollars at the time of writing, at the beginning of Friday.

The LTC/USDT daily price diagram shows an imbalance zone from $ 102.57 to 114.04 US dollars, two key levels for Litecoin in case of correction in Altcoin.

RSI and MACD show the main positive impulse in the price trend of Litecoin. RSI reads 61 and leans up, and the MACD shows the green stomogram rods above the neutral line.

Traiders must monitor the recall to the peak of 2025 and an attempt to rally by 2024 at the maximum of $ 147.06.

Analysis on the chain supports bull thesis

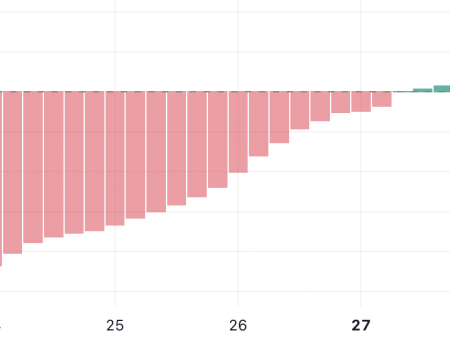

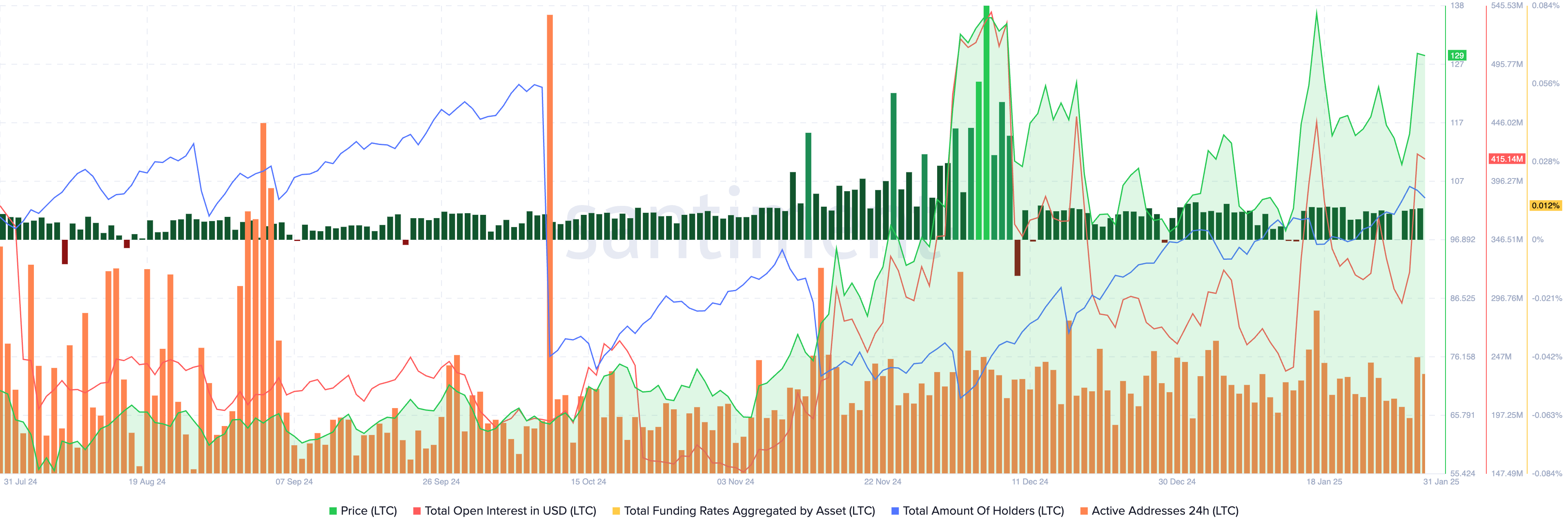

Santiment metrics emphasize the growing relevance and demand for Litecoin among traders this week. The total open percentage of derivatives exchange in LTC rose to almost 420 million dollars on January 30, marking the surge on the table below.

According to Santiment, the total number of LTC holders steadily rose from December 2 to January 31. On Friday, the metric rose to 8.13 million people.

The number of active addresses remains higher than the average indicator of 2024, and the total funding indicators aggregated using LTC.

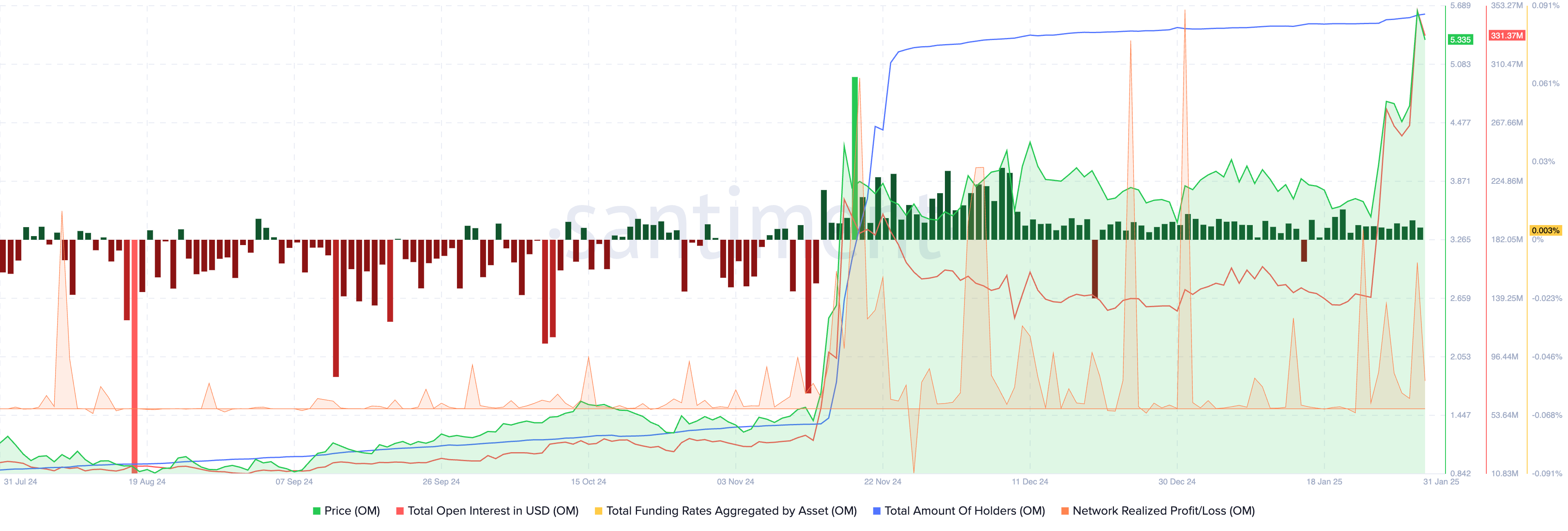

In the case of Mantra (OM), the total number of holders slowly rises, reached almost 44,000 on Friday. Key indicators, such as the level of financing, show their bull -dedication and positive value for almost two weeks, confirming the relevance and demand of token in the derivatives market.

The network has implemented a profit/loss metric used to track net profit/loss of all tokens moving along a chain on a certain day, shows several positive peaks in January, signaling the profit. Traiders should monitor large positive spikes, as this implies a large sale of traders who neutralize their portfolio, and this can lead to correction in the price of OM.

The total open share in OM reached the highest level on January 30 above 348 million dollars.

Market engines and mantra higher

The expectation of the approval of the Litecoin Exchange Foundation in the United States is one of the key market engines that increased the price of LTC this week. Since the SEC officially recognizes the 19B-4 application from Canary Capital for the point Litecoin ETF, traders hope for approval.

As a rule, the point approval of ETF leads to demand and interest among institutional investors and large wallet traders. Events in the ETF can fuel further winning in Litecoin next week.

Eric Balchunas, Analyst Bloomberg Intelligence commented on the development on X:

News, but expected. Even the SEC Hensler will approve this. However, they approved in 45 days against waiting 240 days. I really want to interpret this as a sign that the new SEC will be faster, but in fact it cannot find out. Litecoin on the deck, know more soon https://t.co/xqlxushuyn

– Eric Balchunas (@ericbalchunas) January 31, 2025

The recent Mantra announcement of partnership with The Damac Group, a real estate giant, in order to focus on their chain, is the key engine of the Om Token market this week. JP Mullin, co -founder and general director Mantra, said:

“This partnership with Damac Group is an approval for the RWA industry. We are pleased to cooperate with such a prestigious group of leaders who share our ambitions and see the incredible possibilities for providing traditional financing opportunities in the chain. ”

Another key market is the restoration of Bitcoin after a flash aircraft on Monday of $ 100,000. The correlation between tokens and bitcoins remains relatively high, supporting their profit.

Bitcoin catalyzes a rally in Litecoin and Mantra

The three -month correlation between the bitcoins and Litecoin is 0.84, and between bitcoins and mantra is 0.87. A relatively high correlation suggests that the price trend of Bitcoin affects the prices of LTC and OM, so BTC further growth can raise assets above.

A flash car in Bitcoins can push traders on the edge, as BTC can pull out assets, correlating with it, destroying millions of dollars in market capitalization. The macroeconomic issues of the United States, the movement of American technological actions and stocks and promotions and institutional activities of investors usually influenced the price of bitcoins.

Owners of LTC and OM should observe Bitcoin’s daily price trends in order to predict sudden movements in two altcoins.

Strategic considerations

Traiders who have accumulated LTC in accordance with the level of $ 100, could consider the possibility of making a profit by percent of their shares at least 30% before correction in Litecoin. Stunned profit is recommended, while Litecoin is maintained steadily higher than the consolidation zone.

The traders who own OM acquired less than $ 3.87 should ideally consider chess profit, while Altcoin is trading from more than $ 5. The absence of buyers can enter when OM will be closer to 4 dollars and waited for re -testing the record maximum of $ 5.95 before making a profit.

Disclosure: This article does not submit investment tips. The content and materials presented on this page are intended only for educational purposes.