XRP decreased by 7% from Monday, for a large week for crypto. Crypto -culmin of President Donald Trump David Sax held a press conference and called it the “golden age in digital assets”. SACKS is still focused on stating a clearer regulation for stablers, and RPlusD Ripple can benefit from development.

The XRP (XRP) price is usually influenced by the lawsuit of the US Commission on Securities and Exchanges against the Ripple payment company, adoption and partnerships of Rlusd Stablecoin and Xrpledger events.

Table of contents

XRP can receive from the first Trump business order Crypto Czar

The American crypto -tsar David Saks marked the legislation on Stublekan as his first priority, according to his first presser to take this week, CNBC reports. Since Sacks is working to open the golden age in digital assets and cryptocurrencies, XRP holders can receive from events, and Altcoin may begin its restoration.

XRP wiped almost 7% of its cost from an open Monday of $ 2.5801 to $ 2.4060 dollars. Sacks set the schedule of six months to regulate Stublek and offered it as the main item of the agenda.

RPiple’s RLUSD has recently announced many partnerships with crypto -foreigns and institutions. Stablecoin Rlusd is now available on 14 exchanges, including Archax, Bitso, Bitstamp, Bollyish, B2C2, Coinmena, Independent Reserve, JST Digital, Keyrock, MB, MoonPay, Revoulut, Support and Zero Hesh.

Ripple Stablecoin can be traded, used for payments and within the framework of financial applications through 14 exchange platforms.

Ripple a lawsuit may end, in CTO it has an optimistic forecast

The SEC lawsuit against Ripple in 2020 led to some partial victories for the payment company, according to the decision of the Anaalisa Torres judge. From the ruling secondary market sales of XRP as “harsh security” and ending with the use of Hawi test, Ripple victories catalyzed the increase in the price of XRP.

Positive events that can lead to the end of the trial and further victories for Ripple include two key updates:

- Judge Terrairo (signing the SEC notification on the SEC lawsuit against Ripple) was postponed from the unit to ensure compliance with cryptography to the department of management of computer systems.

- Gary Gensler, the former Chairman of the SEC, was replaced by Mark Uyed, a shuttle-bride of the Trump administration for this position.

The Chief Technological Director of Ripple with optimism looks at the fact that changes can pave the path to positive regulation and express their bull moods on Twitter on X.

Throughout the war of the former cryptocurrency administration, the commissioner Payers remained a constant voice for regulatory sanity. Today’s memo is another fast step towards translating the page in the disorder that we all inherited (and suffered to the end). https://t.co/iqdmefhgyx

– Stuart Olderoti (@s_Alderoty) February 4, 2025

Ripple metrics support bull dissertations.

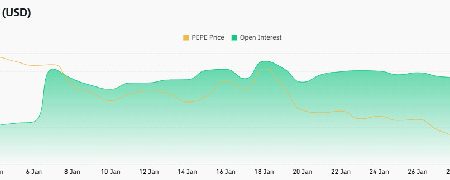

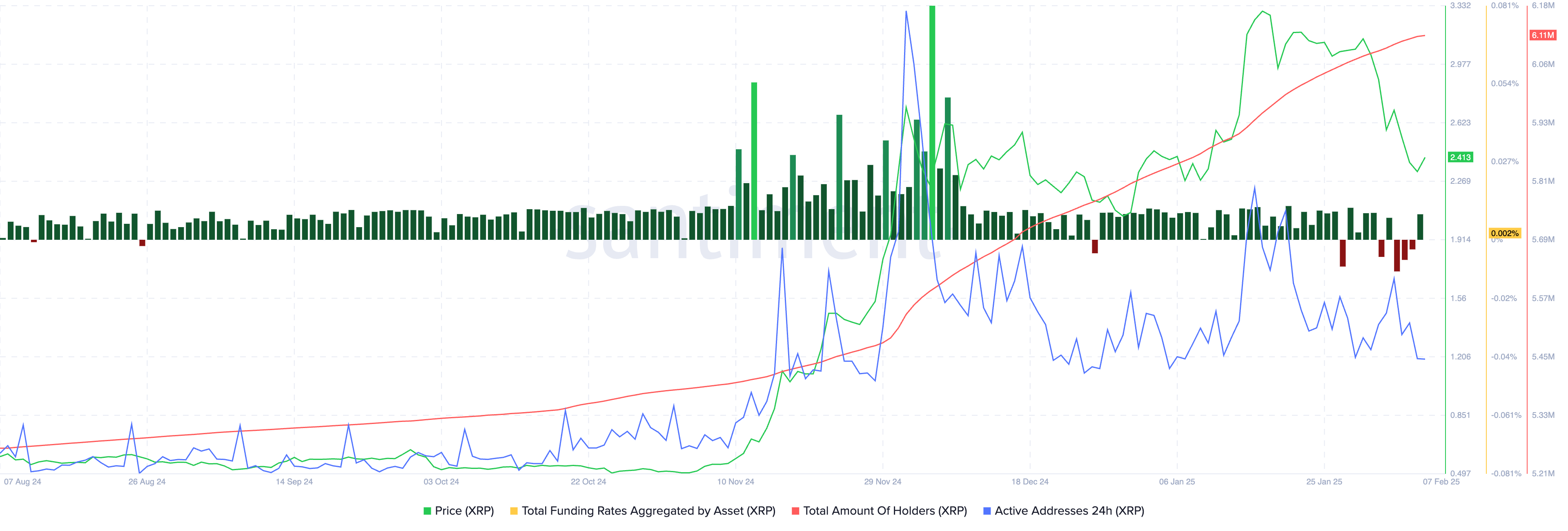

Metrics on the Ripple chain, such as general funding rates, aggregated XRP on exchanges, support recovery in the coming week. The financing level became positive on Friday after three days in a row of negative funding indicators this week.

As a rule, a negative level of financing is associated with bear moods among derivative merchants. The calculation of active addresses (24-hour period) remains higher than the average 2024, and the total number of XRP holders showed a constant increase during the second half of 2024 and 2025.

According to Defillama, the total value of the assets blocked by Xrpledger remained stable above $ 80 million. TVL is an indicator of the confidence of investors and the relevance of the blockchain and contributes to the Bye thesis for the native chain token, XRP.

Technical analysis and target price XRP

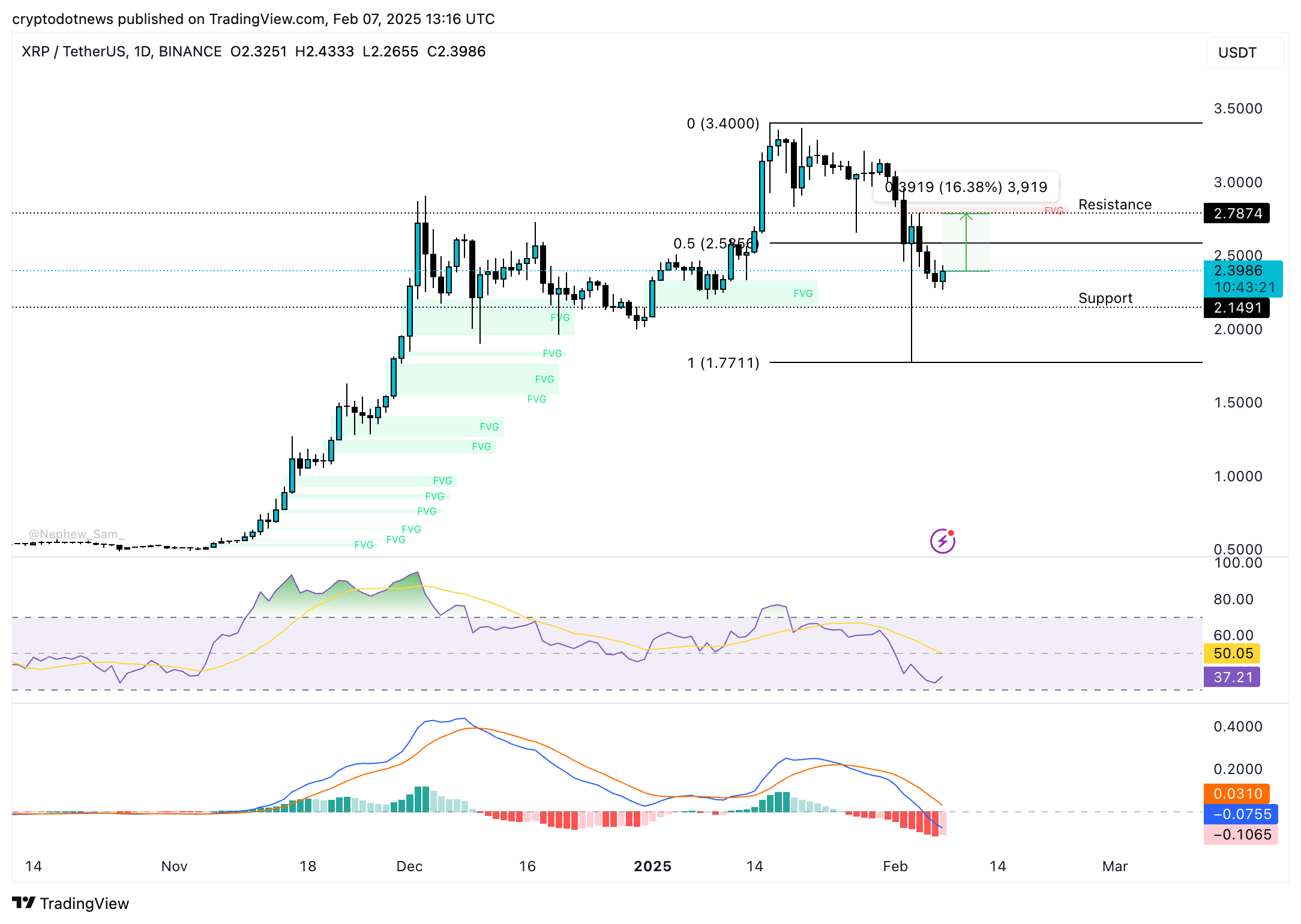

XRP began its tendency to reduce January 16. Altcoin is traded at $ 2.3986 at the time of writing. The technical indicator for daily terms, RSI points to the bull thesis for XRP. RSI reads 37 and leans up.

MACD on the price of XRP/USDT prices shows a basic negative impulse in the XRP Price trend, however, red histograms have a decrease in intensity and are shorter, that is, traders must monitor the change.

XRP may encounter resistance at the lower border of the gap in fair value (FVG) from 2.7874 to $ 2.8281. This marks a 16% rally in the price of XRP. Altcoin can find support in the amount of $ 2.491, a maximum of December 31 for XRP.

Bitcoin correlation and strategic consideration

A three -month correlation between XRP and bitcoins (BTC) is 0.83, according to macrours. A relatively high correlation with bitcoins implies the movement of the price of XRP in response to Bitcoin, and the accident in BTC removes altcoin, as you can see earlier this week.

Traiders must remember the correlation and carefully monitor the Bitcoins price table in order to anticipate the volatility in the price of XRP.

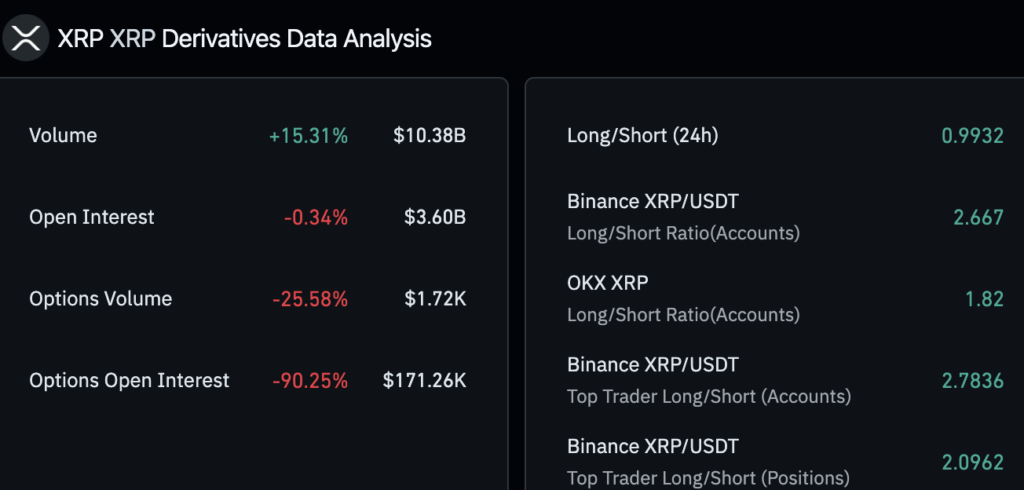

A long/short ratio for XRP exceeds 1 on keys, such as Binance and OKX. Derivatives merchants support the bull position in the field of Altcoin.

Options Open Interests of Notes do not have significant changes over the past 24 hours and vary above 3.6 billion dollars. USA, according to Coinglass.

Disclosure: This article does not submit investment tips. The content and materials presented on this page are intended only for educational purposes.