Bitcoin (BTC) has entered an uncharacteristic period of calm, but there are signs of an impending surge in volatility, according to a recent analysis.

According to the latest weekly data report According to analytics company Glassnode, key indicators suggest that the cryptocurrency market is experiencing a rare equilibrium, and it may not last long.

“Historically, periods of calm and measured market structure are short-lived and often precede the expectation of increased volatility,” the report said.

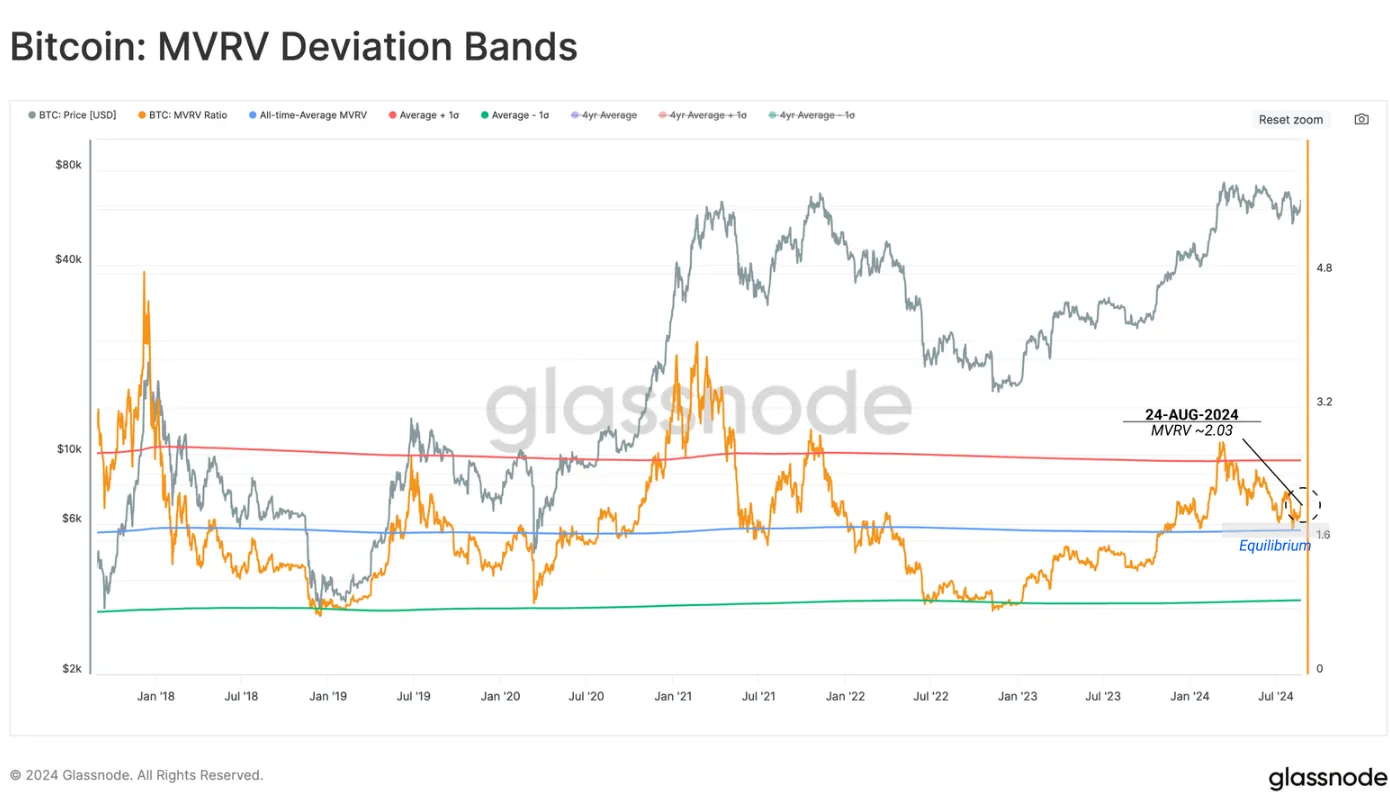

One of the most telling metrics highlighted in the report is the market value to realized value (MVRV) ratio. This metric compares the value of bitcoin current market price to average price where the coins were last moved, which effectively measures the average profit or loss of all Bitcoin holders.

“Over the past two weeks, the MVRV ratio has tested its historical average of 1.72,” the report said. “This critical level has historically marked the transition point between a macroeconomic bull market and a bear market trend.”

Notably, an MVRV ratio above 1 indicates that the current market value exceeds the realized value, suggesting that the average holder is in the black. Conversely, a ratio below 1 implies that the average holder is in the black. The current test of 1.72 is especially significant following the excitement surrounding the launch of Bitcoin spot ETFs.

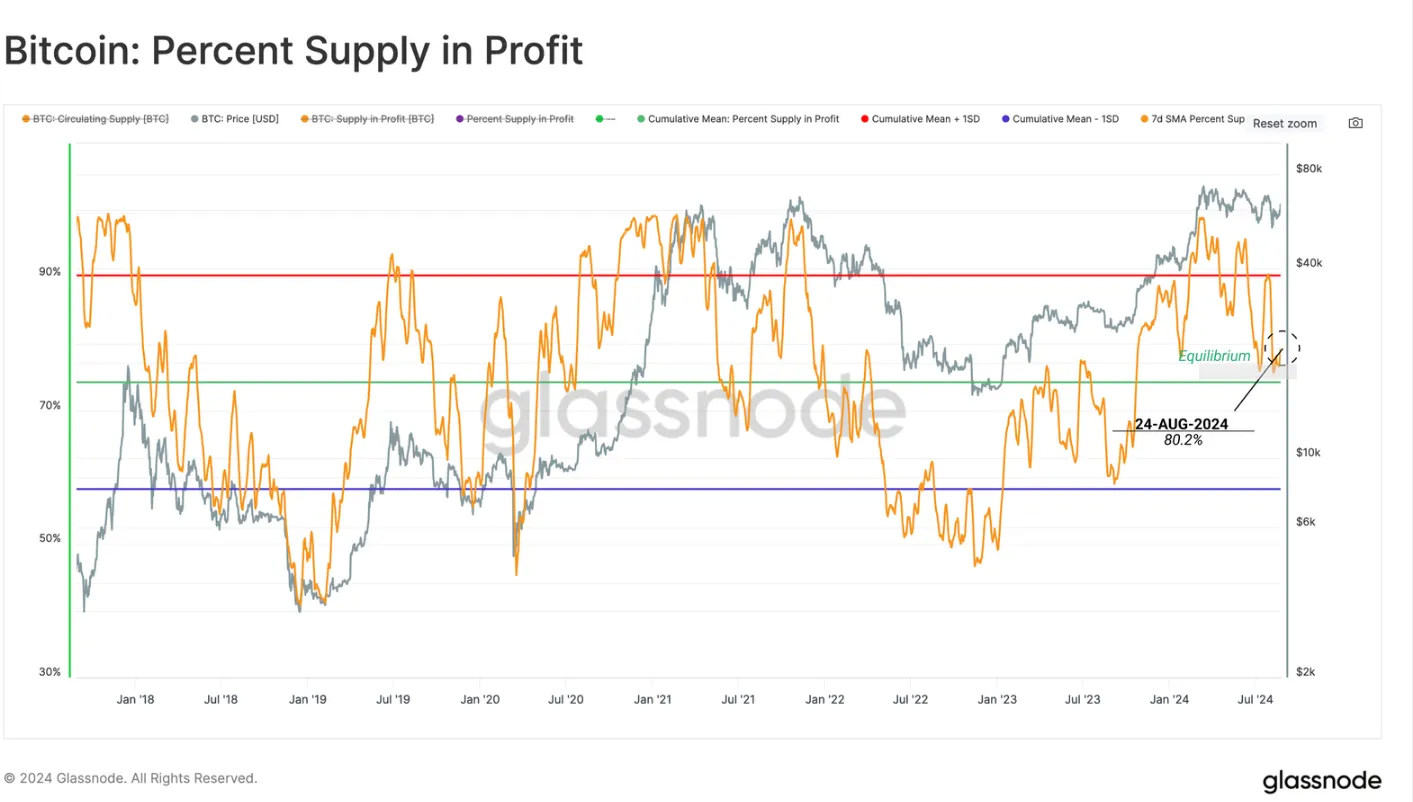

“This suggests that investor returns have essentially returned to equilibrium and the excitement and euphoria following the ETF launch has completely died down,” Glassnode reports.

Adding to the intrigue, the report notes a noticeable cooling net capital inflows into Bitcoin assetswhile investors only engage in activities that generate small gains and losses. Glassnode notes that “89% of days have capital inflows greater than today, with the exception of bear markets where losses predominate.”

Further complicating matters is the fact that a significant portion of the Bitcoin stock held by short-term investors is on the verge of transitioning to long-term holders holding it for at least 155 days – a shift that could also impact market movements in the near future.

Glassnode adds that the derivatives market is speculating on perpetual swaps experienced a complete reboot. The price volatility to net liquidation volume ratio is approaching levels not seen since February 2022, indicating a significant reduction in trader appetite for leveraged positions.

“Usually this indicator returns to a neutral value level near inflection points “For example, a continuation of the trend or a reversal into a macro-scale bearish trend,” the report says.