The analyst conducted a provocative comparison between Ethereum and Nokia, the once dominant technical platform, which could not adapt quickly enough to the changing competitive market.

The comparison occurs among the ongoing debates Ethereum against SOLANA. This goes back and reflects a deeper tension between the next generation inherited dominance and the result of the next generation. This applies which platform is better suited to become the basis of Web3, Defi, NFTS and wider crypto economics.

Analyst compares Ethereum with Nokia

The analyst warns that, like Nokia, Ethereum can be a slow decrease, just as the once dominant mobile phone manufacturer, which Apple overtook in the late 2000s.

“Ethereum = Nokia,” wrote the analyst Crypto Curb.

The analyst shared two diagrams: the price of Nokia shares, which fell from the peak of 2007, and the market capitalization of Ethereum decreased from the maximums of 2021.

The analogy is rooted more than just market graphs. Curb claims that the restrictions on the aging architecture and scalability of Ethereum reflect the fall of Symbian Os Nokia, which cannot compete with iOS Apple and Google Android.

The data on the statist show that by 2013 the share of the Nokia mobile phone market fell to 3.1% from the peak of 49.4% in 2007.

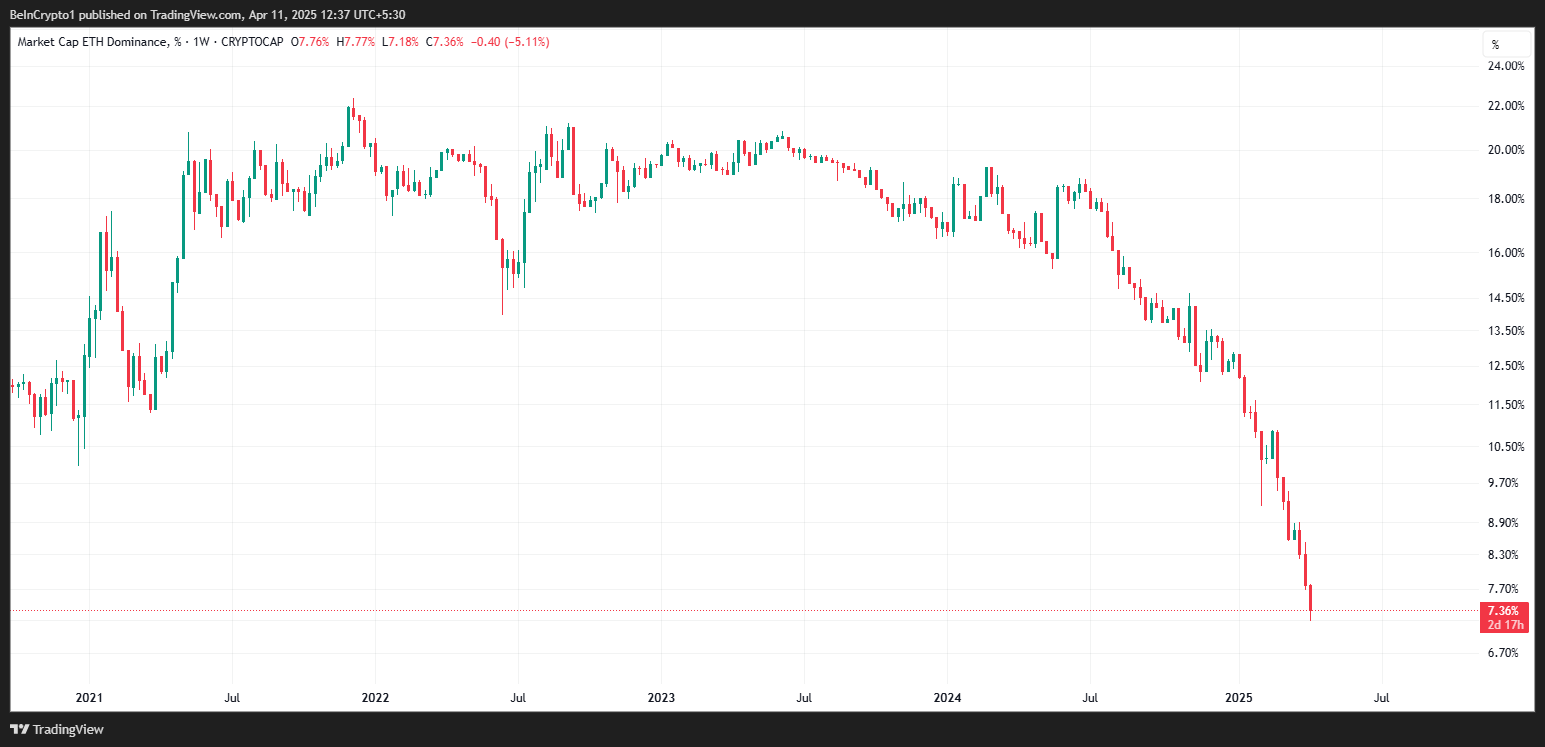

Meanwhile, data about TradingView show that Ethereum, who once ordered more than 20% of the total market capitalization of crypto -capitalization, at the time of writing this article owns less than 10%.

The post implies that Ethereum, like Nokia, can slowly lose relevance against the background of faster, more scalable competitors, the main SOLANA among them.

Meanwhile, the rise of Solan was difficult to ignore. In the period from October 2023 to November 2024, it grew from 23 to 264 dollars, increasing to almost a third of Ethereum market capitalization.

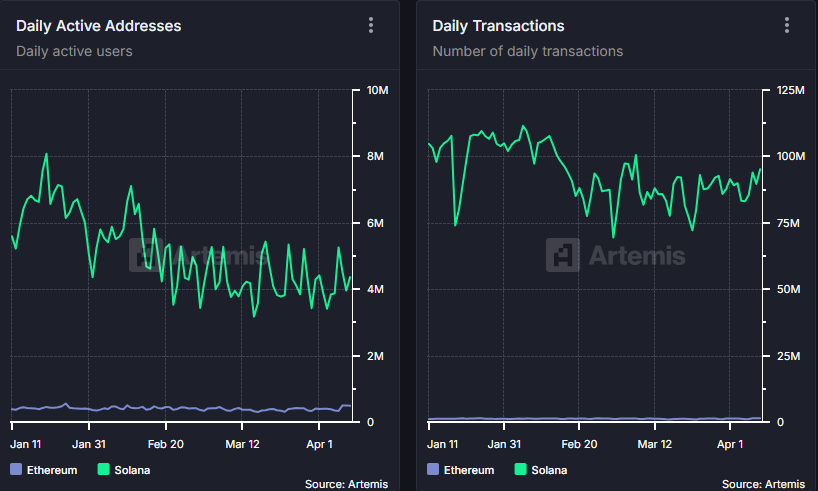

According to the chain data, Solana now exceeds Ethereum in several key indicators. Among them are daily active addresses and daily transactions, emphasizing its attractiveness for developers and users.

The parallels are sharply. Apple jumped Nokia with a smooth user interface and ecosystem, convenient for developers.

Similarly, the technical advantages of Solana, including higher bandwidth, lower fees and the best user experience (UX), position it as a serious opponent of Ethereum in decentralized finance (Defi) and Web3.

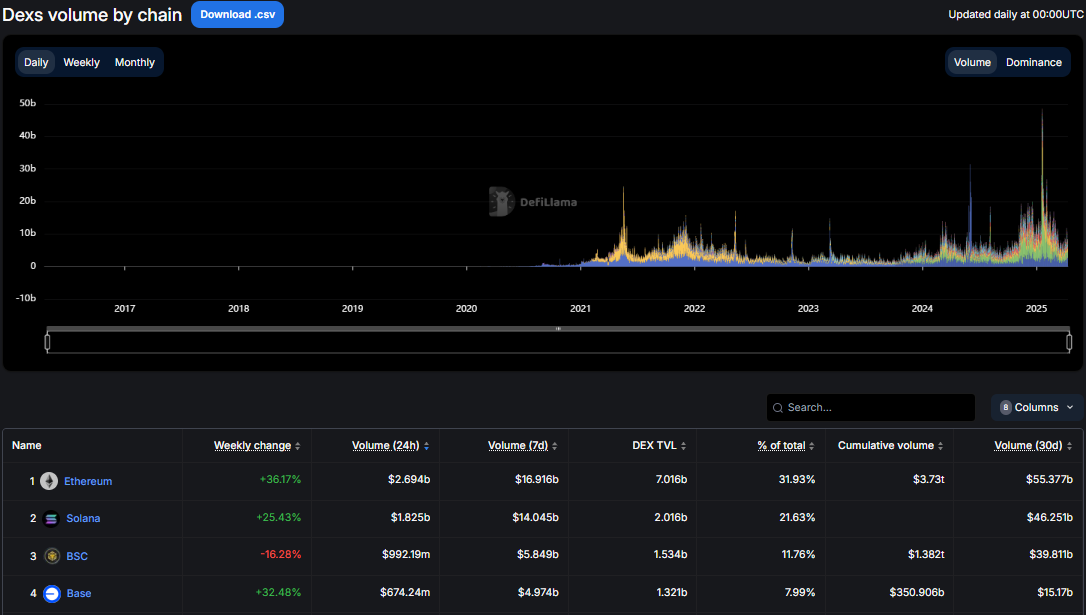

However, not everyone is convinced that the days of the Ethereum are numbered. A week ago, Ethereum turned Solan in the volume of decentralized exchange (DEX).

Beincrypto announced this milestone, which occurred for the first time in six months. DEFILLAMA data show that Ethereum continues to maintain this leadership.

This revival in trading activities suggests that Ethereum remains deeply built into the crypto -ecosystem, especially among complex Defi users.

Moreover, some institutional voices remain carefully optimistic on Ethereum. In March, Franklin Templeton analysts noted that although Defi SroLane’s Defi Surge is impressive and can challenge the market value of Ethereum, ETH still has the key advantages of the infrastructure.

“SOLANA has yet to go a long way before it can surpass Ethereum,” Intototheblock analyst said Beincrypto.

Similarly, some analysts see the potential for a strong increase in Ethereum prices, referring to bull -free basic foundations, such as ETF modernization of Pectra and Ethaking ETF (exchange funds).

Nevertheless, the CURB comparison reflects the critical moment in the growth of Ethereum. With competitors such as Solana Racing ahead in the convenience of use and performance, Ethereum should speed up its roadmap so as not to overshadow.

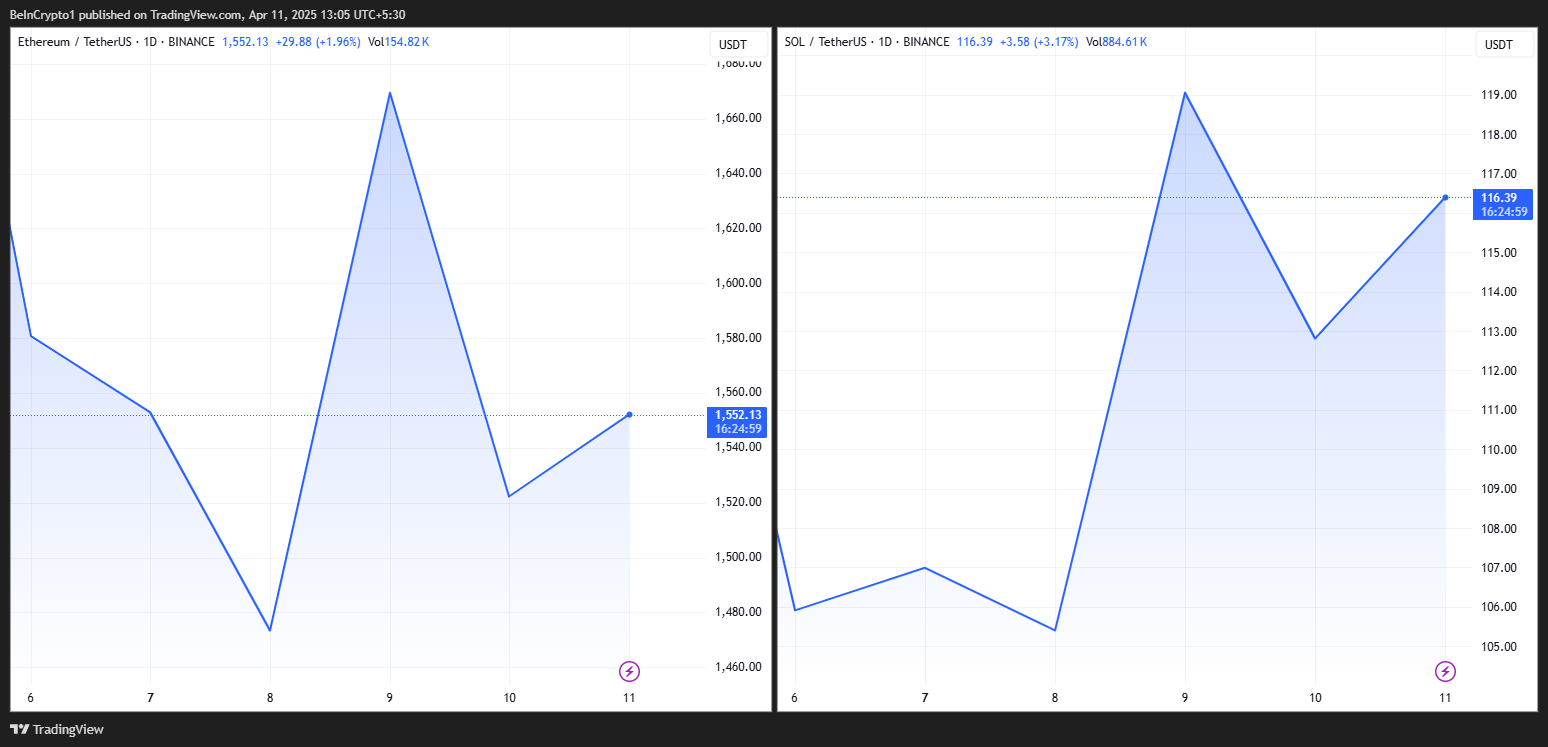

The data show that ETH is traded for $ 1552 at the time of writing this article, decreasing by more than 4% over the past 24 hours. Meanwhile, Solan was traded for 116.39 dollars, having recorded a modest increase of 1.01% per day.