Cryptoquant’s cryptocurrency analytical company has published a new analysis that suggests that the cryptocurrency market may enter the later stages of the current bull cycle, which began in January 2023.

From the beginning of the current bull cycle, Bitcoin has demonstrated a significant increase in both the price and activity of investors. The growth of new investments and additional funds from existing holders increased the BTC growth pulse. However, Cryptoquant analysts now believe that the market is approaching the turning point.

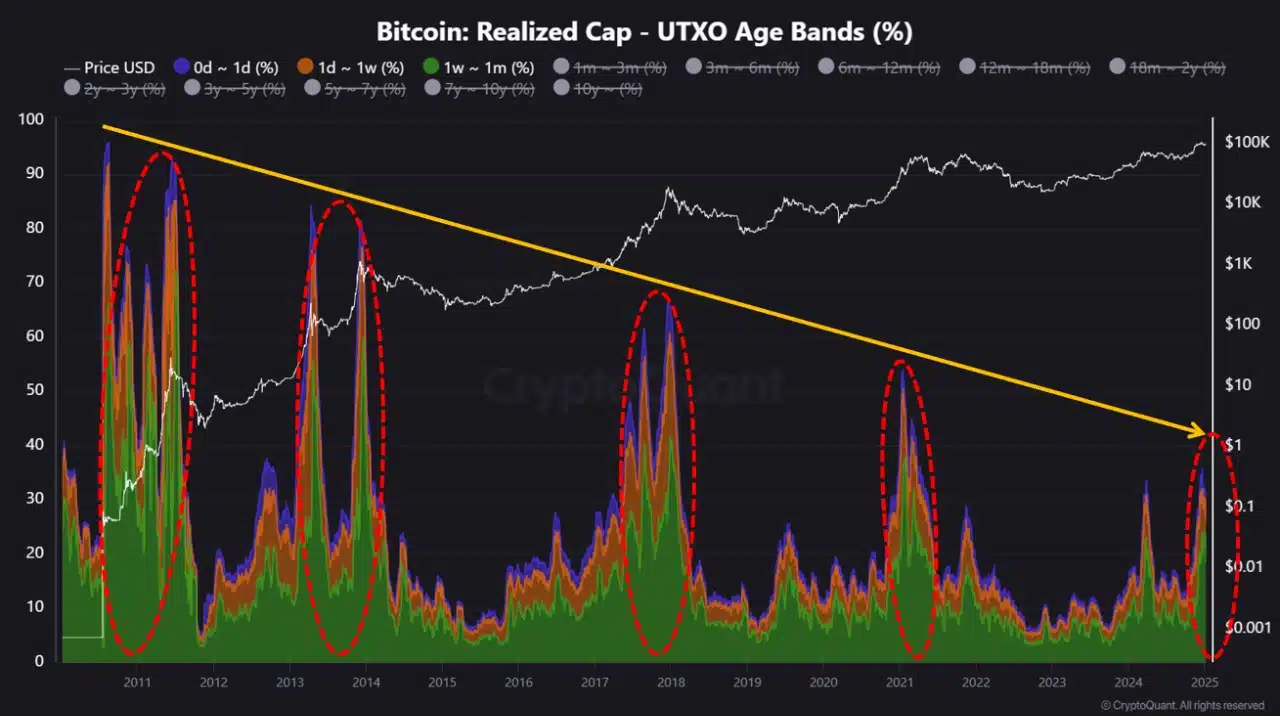

One of the tricks of the report is the percentage of bitcoins sold in the last month, measured by realized market capitalization and UTXO (output of inexplicable transactions). Currently, this figure is 36%, which is below the peaks observed in previous bull cycles.

Despite this, a long -term trend, according to analysts, shows a decrease in this indicator, which indicates a possible peak of the market in the first or second quarter of 2025. Cryptoquant analysts expect an increase in this indicator by 2-4 times at the final stage. The cycle, which is usually a sign of overheating of the market and the beginning of the bear cycle.

Although the report calls for caution, it also leaves a place for optimism, assuming that before the end of the cycle there can still be significant growth potential for bitcoins and altcoins. However, Cryptoquant notes that risk management is important because the market is approaching the potential peak.

*This is not an investment council.