This is a segment from the information bulletin of the empire. To read full publications, SubscribeField

How is a good way to evaluate how cryptographs is not dependent on too much price?

If you ask Kaiko, this is L2S.

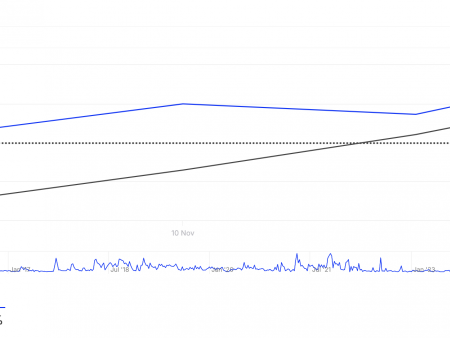

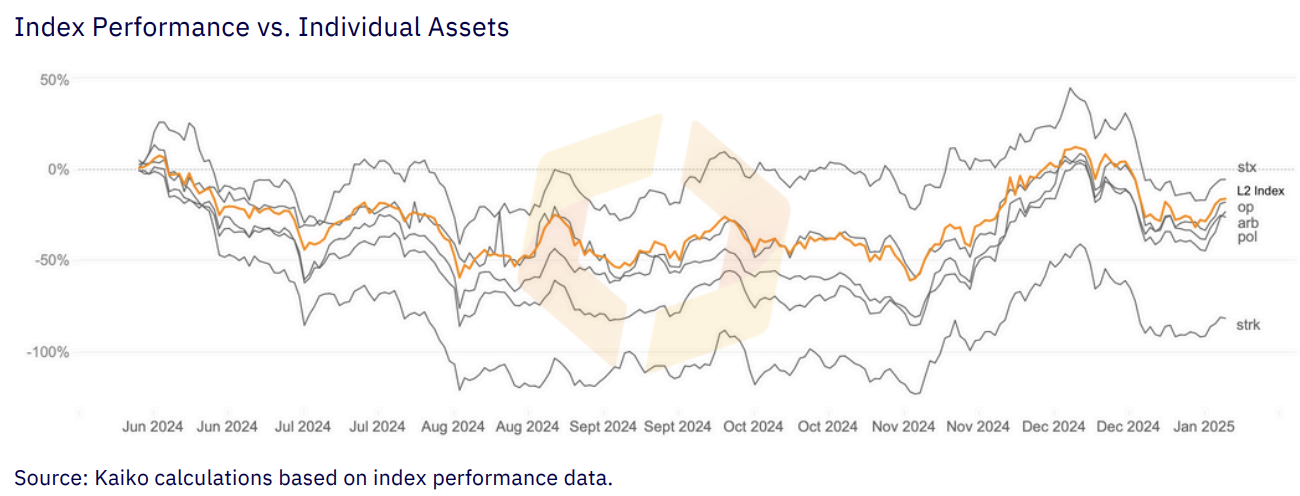

Until now, since the election, the L2 index of the research company has been traded above, which – by general recognition – perhaps not huge Surprisingly, given that all cryptography took on an optimistic forecast, starting in November.

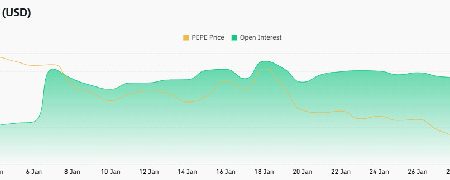

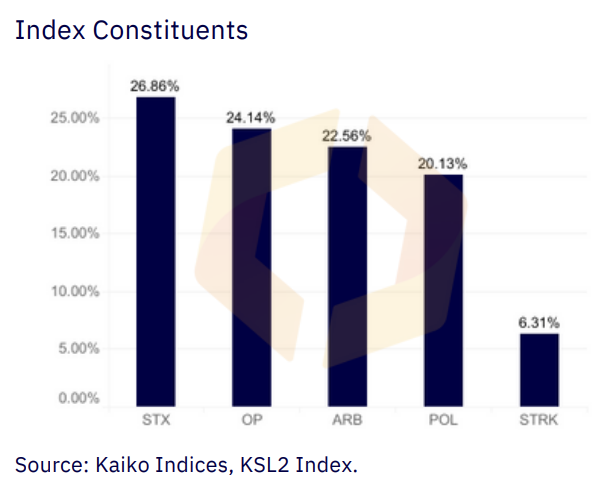

The index tracks five L2S in bitcoins and Ethereum. It also tracks a polygon.

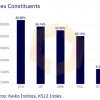

As you can see above, we have stacks, optimism, arbitration, a training ground and Starknet in the same bucket.

Keep in mind that L2S is still returning after they are behind the market last year. And there were a lot of discussions about whether we have too much L2 too much.

This does not mean that there is still no demand.

Take, for example, a report on the Galaxy since November, in which it is designed that 47 billion dollars of bitcoins can be “introduced into bitcoins L2 by 2030” – or about 2% of the Bitcoin circulating offer.

In any case, return to data: for L2S there can be several more positive catalysts, especially if Bitcoin does not dominate the narrative just like in the future.

“The rotation of the sector is another potential wind for L2 assets. BTC dominated the cryptography market in 2024, setting record maximums before and after elections in the United States, when institutional investors invested billions in point exchange funds of BTC. Nevertheless, the rally has not yet extended beyond the btc, as it was historically. While the structure of the crypto market has developed, the rotation on small assets remains likely, since investors are looking for a higher growth potential with a high level of beta, ”said the analyst Kaiko Adam McCarthy.

Taking into account that changing regulatory winds play a huge factor here, especially in the case of a landfill, given that the SEC previously called Matic Security – and, perhaps, the future looks a little brighter.

While investments in bitcoins are available for masses, it is difficult to find opportunities outside this, McCarthy wrote.

“While the wider crypto -bye market has not yet extended to the altcoins, the developing regulatory dynamics can serve as a catalyst to resume interest. Since political shifts in Washington and investors explore the possibilities outside the bitcoins, L2S “are located for significant growth in 2025,” he continued.

Dude, now it’s hard to be pessimistic in Crypto.