- Storj Price expands its profits on Tuesday after 5%rallies on the previous day.

- The metrics on the chain draw a bull -clicking picture, since the open interest of Storj and the daily trading volume grow.

- A daily candlestick, closed below 0.33 dollars, would be invalid on bullses.

Storj (Storj), an open source platform that uses a blockchain for providing a through encrypted cloud storage, continues to bargain by 4.4% higher, about 0.39 dollars. On Tuesday, after rallying by 5% on the previous day. The metrics on the chain additionally confirm the recent rain of prices, since the open percentage of Storj and the volume of daily trade are growing. Technical prospects proposed a continuation of the rally, aimed at two -digit profits forward.

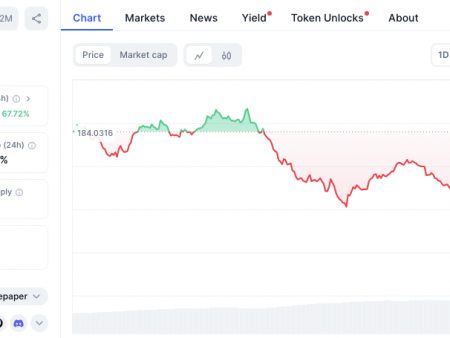

The price action of Storj involves the continuation of the rally

Storage Price is traded inside the descending line of the trend (drawn by connecting several maximums from the beginning of December). On Monday, the price of Storja was faced with the abandonment of the descending trend line after reaching a maximum of $ 0.47 and gaining 5%. At the time of writing on Tuesday, he continues to trade higher by 4.4%, about 0.39 dollars.

If Storj continues its upward impulse, it can expand the rally by 18% of its current level to re -check its weekly resistance level at 0.46 US dollars. Successful closure above this level will increase additional profit by 35%to reach January 6 in the amount of $ 0.62.

The relative force (RSI) index on the daily diagram reads 53, above its neutral level 50 and indicates up, which indicates a bull impulse. Moreover, the divergence of the convergence of the sliding medium (MACD) also showed the bull crosser last week, giving purchase signals and the increase in the increase.

Storj/USDT Daily Chart

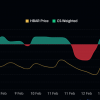

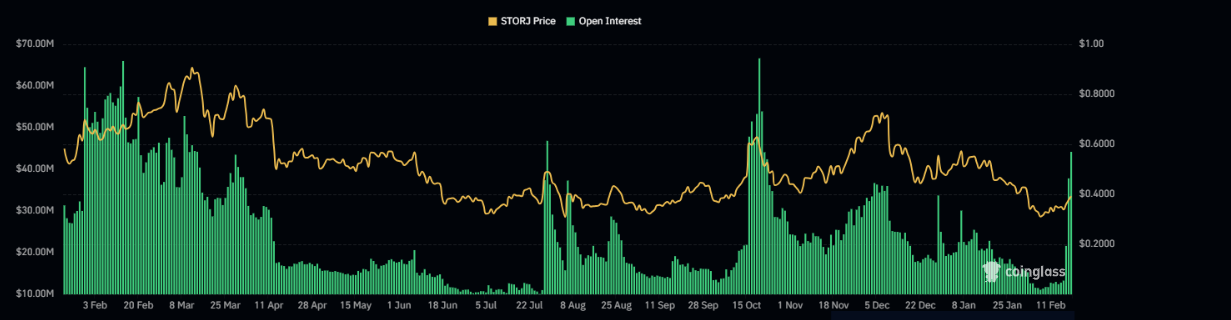

The open interest of Storj (OI) additionally supports the forecast of the bull. Coinglass data show that Futures’ OI in Storj on exchanges increased from $ 13.32 million. USA on Sunday up to 43.70 million dollars. The United States on Tuesday, which is the highest level from October 22, 2024. An increase in OI is a new or additional money entering the market and new purchases, which implies a rally ahead at the price of Storj.

Storj open interest. Source: Coinglass

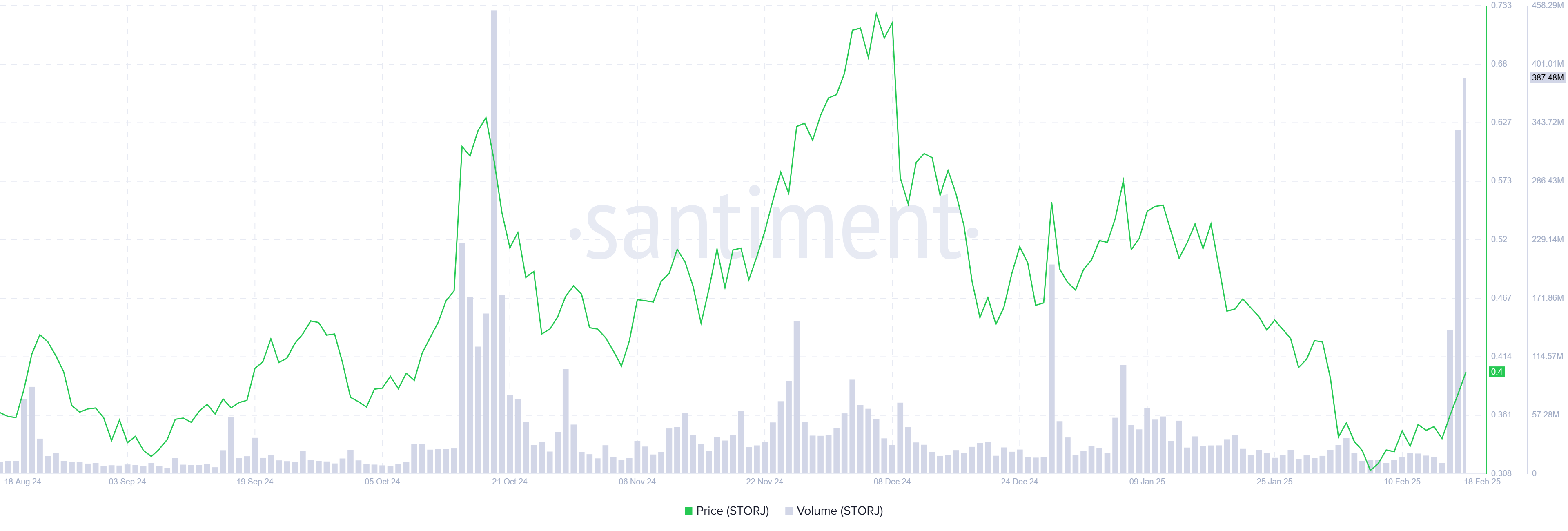

Another aspect supporting the optimistic forecast of the platform is the recent surge in the interests and liquidity of traders in the Storj network. Santiment data show that the Storj trading volume has grown from $ 10.52 million. USA on Saturday up to 387.48 million dollars. USA on Tuesday, which has been the highest since mid -October.

Table Dry Diagram. Source: Santiment

However, if the STORJ daily candlestick closes below $ 0.33, the bull thesis will be invalid, which leads to a descending movement to re -conduct it at least on February 3 at $ 0.25.