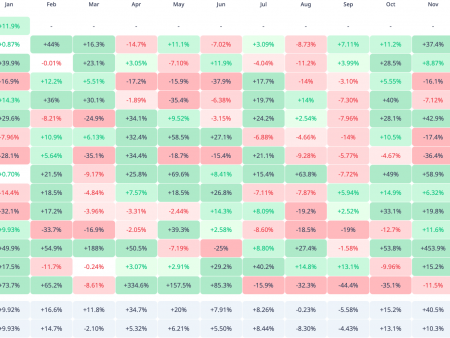

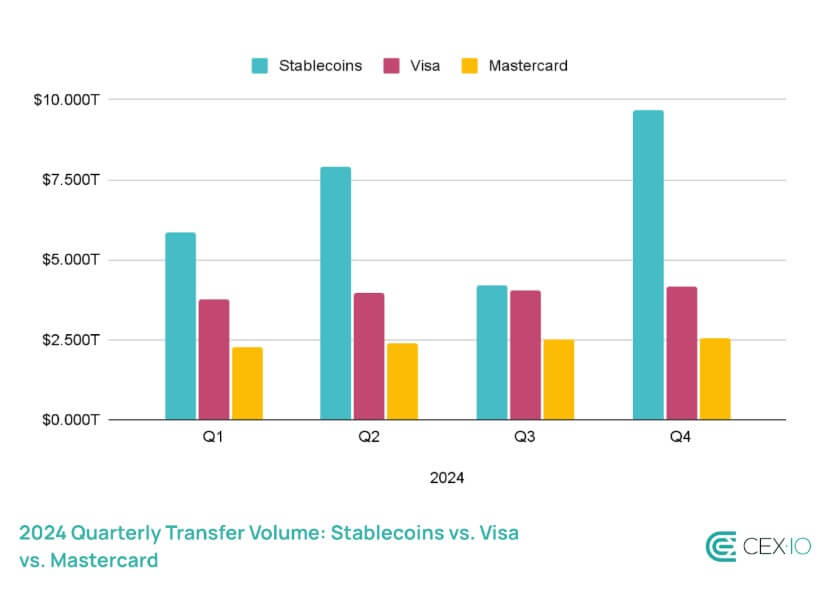

According to Crypto Exchange Cex.io, the Stablecoin transfer has reached 27.6 trillion.Field

The report indicated that StableCoins constantly exceeds traditional payments of payments during the year, despite the fall in the 3rd quarter from the wider market slowdown.

This trend signals a change in global money transfers, since inherited suppliers, such as Western Union and Moneygram, are fighting for adaptation to the growing demand for digital assets.

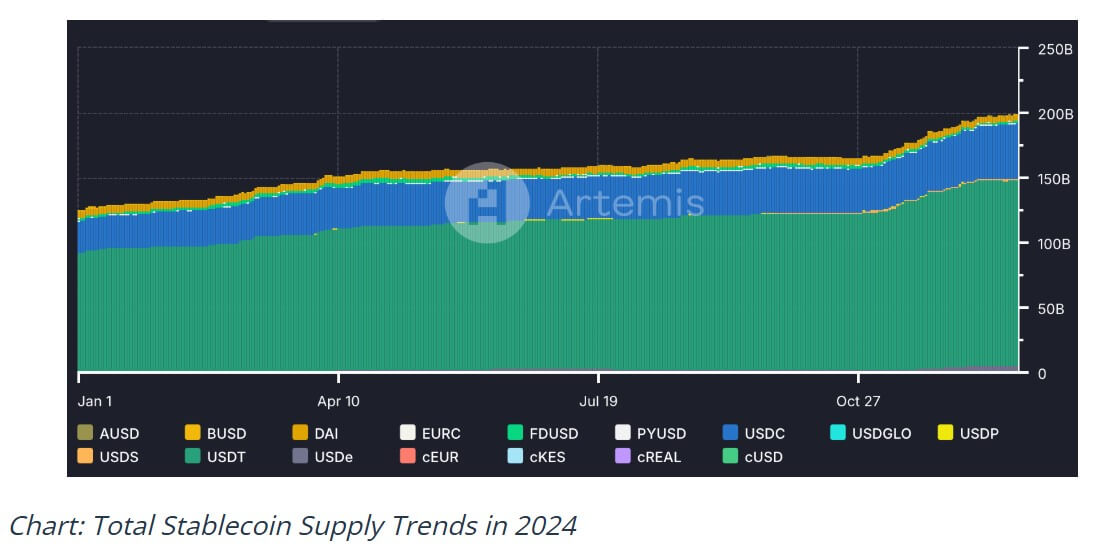

During this period, the supply of Stablecoin expanded by 59%, exceeding $ 200 billion. This growth was pushed by Stablecoins by 1% of the total supply in US dollars, which increased significantly from 0.63% at the beginning of the year.

USDC leads how Solana receives dominance

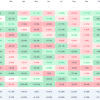

The USDC Circle has become a dominant stable for transactions to the chain, which amounted to 70% of the total transfer. Nevertheless, its influence slightly weakened in the 3rd quarter from a temporary decrease in Defi activity.

USDT Tether, the largest stabi from market capitalization, observed significant growth, with the total transfer volume more than doubled. Despite this, its market share decreased from 43% to 25% last year.

Solan has become the most active blockchain for stabcks, overtaking Tron and Ethereum in January 2024. Soon, in the framework of the SOLANA, the USDC market is share, and the 73% of the Stab APOCH network became tied to USDC transactions.

According to CEX.IO:

“This increase coincides with the overall growth of the Solana ecosystem, since the stabules on the network were mainly used for Defi and other DAPP actions.”

Fuel bots for stablein volume

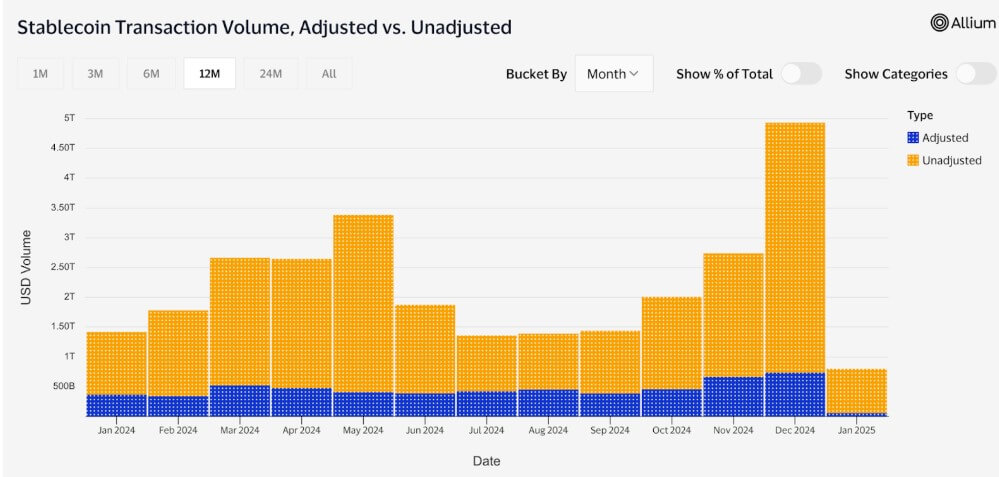

CEX.IO noted that last year, trading trade played an important role in Stablecoin transactions, while automated systems are responsible for 70% of the total.

According to the company’s study, bots have been especially dominant on Ethereum, Base and Solana.

Crypto Exchange said that the discomforted transaction volumes, primarily reflecting the BOT activity, presented 77% of all Stublek transfers in 2024. This marked a four -fold increase compared to 2023, and the basic smooth overtaking of Ethereum in the 4th quarter of Stablecoin from the growth of automated trade.

He continued that the discomforted transactions accounted for more than 98% of the total stable activity in networks, where USDC dominates, such as SOLANA and BASE.

This surge was caused by high transactions of these networks, low costs, a frame of the Defi ecosystem and a quick proliferation of memes. In December alone, Memecoins accounted for 56% of the volume of decentralized SOLANA (DEX).

Despite the concern about the bots manipulating the markets with the help of leading and the sandwich, CEX.IO noted that they also increase efficiency. These automated systems facilitate arbitration, perform repeated transactions of smart contracts and help cover the user gas fee.

CEX.IO added:

“As a result, the dominance of the bot in the transactions of Stablecoin can also be the ripening of certain networks.”

What is next for stablers?

The exchange said that Stablecoins secured their role as the main liquidity sources in Defi, Trade and cross -border payments in 2024. It is expected that this trend will remain in 2025, especially in the cycles after burning, which historically causes an increase in the volume of trade and capital flow.

The expansion of the supply can also continue. The company noted that previous market cycles have shown that the growth of stabi goes beyond the bull phases, often preserved even in early decline. For example, in 2022, the supply of Stablecoin continued to grow until March – a few months after the peak of the market. This suggests that demand can remain stable, even if wider market conditions weaken.

Another key development may include a shift outside the networks in which USDT dominated, such as Tron. The report notes that the USDT is faced with growing competition and an increased check of regulation, which can destroy its market share and influence the dominance of the throne in Stablecoin transactions.

Meanwhile, the upcoming Pectra update from Ethereum, which was expected in March 2025, can strengthen the network appeal as a stabish concentrator. The update is aimed at improving scalability, reducing gas fees and improving user experience in Ethereum Layer 1 networks and level 2.