The popular Stablecoin payment application has recently expanded to the US market. The application will allow us, residents, use our stables for daily transactions using VISA cards.

Like Wirex, many other Web3 platforms are increasingly striving to enter the American market, since lawmakers are striving for the clarity of regulation for stablers.

Using StableCoins for Eternal Private purchases of 80 million merchants

The WIEX entry into the US market is supported by his cooperation with Bridge, a leading supplier of infrastructure of payments in Stub.

Thanks to this partnership, Wirex Pay allows users to be broadcast directly from incorrect wallets using cards and bank transfers while maintaining full control over their assets.

“Despite the fact that the clarity of regulation is always useful for innovation, our expansion to the US market is primarily due to the growing consumer demand for payment for stabricans and the growing introduction of digital assets for everyday transactions,” said Beincrypto Wiex Pavel Matvev and Dmitry Lazarichev.

Earlier in 2024, the American payment giant strip acquired Bridge in a transaction with a delight of $ 1.1 billion. With the expansion of Wirex, US consumers can now use stubs of more than 80 million visa merchants in 200 countries.

The co -founder of Wiex Pay allocated the United States as a key market due to its large Crypto users base. They expect strong acceptance in 2025, since stabiles are wider recognition.

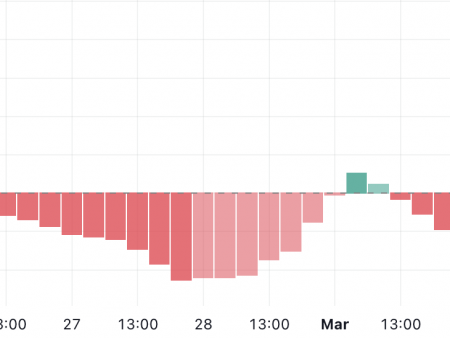

It is expected that this step will stimulate higher transaction volumes and significantly contribute to the growth of income.

“Despite the fact that it is too early to provide accurate forecasts, we are sure that the launch of Wiex Pay’s US will be a key factor in growth for our company in the coming years,” the fellow citizens said.

Regulating events that form the US Stablegel market

US lawmakers are increasingly focused on stables that can accelerate market growth.

In February, the CFTC Commissioner Karoline FAM announced the forum of the General Director for the development of cryptographic norms, stubbornly emphasizing Stubki.

The leading players of the industry, including Circle, Coinbase and Ripple, participate in discussions to help form a policy through a normative structure.

Meanwhile, Bank of America also carefully monitors events. General Director Brian Moynikhan said that the bank could introduce Stublekin if favorable rules are adopted.

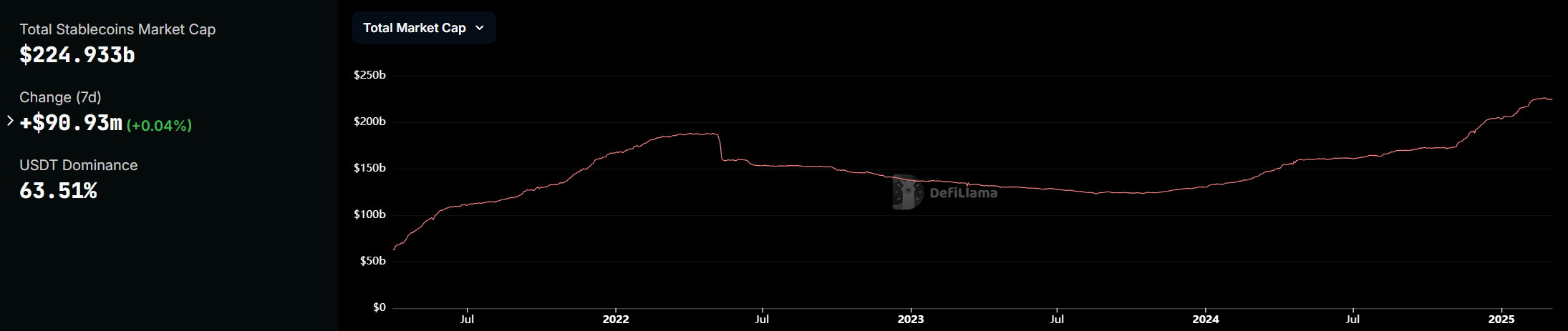

In addition, the Stablecoin market recently surpassed the record market capitalization of $ 225 billion. The regulatory clarity can advance adoption further.

Ultimately, this will help to more deeply integrate StableCoins into basic finances. More WEB3 enterprises will probably strive to expand to the US market, since regulatory events continue to unfold.