In 2024, validators on Solana faced a noticeable shift in revenue distribution due to the rise of decentralized finance (DeFi) activity.

Data provided by Tom Wang from the Dune Analytics dashboard reflects changes in Solana validator income sources.

Distribution of income over time

In January 2024, Solana validators saw their revenue structure dominated by issuance, which accounted for 95% of their revenue. In contrast, minuscule extractable value (MEV) and fees accounted for only 1.9% and 3.1%, respectively.

Solana Validators Revenue Structure Changes Radically in 2024 Thanks to Rising DeFi Activity

1. At the beginning of January:

– 95% of the output

– 1.9% of the MEV

– 3.1% of the commission2. July 29:

– 78.2% of the output

– 15.3% of the MEV

– 6.5% of the commission pic.twitter.com/DLUks6b1nd— Tom Wang (@tomwanhh) August 29, 2024

However, by July 29 The landscape has changed dramatically. Issuance has fallen to 78.2%, while MEV revenue has risen to 15.3% and fees have increased to 6.5%. Notably, Wang said these shifts have been driven by the rise of decentralized finance.

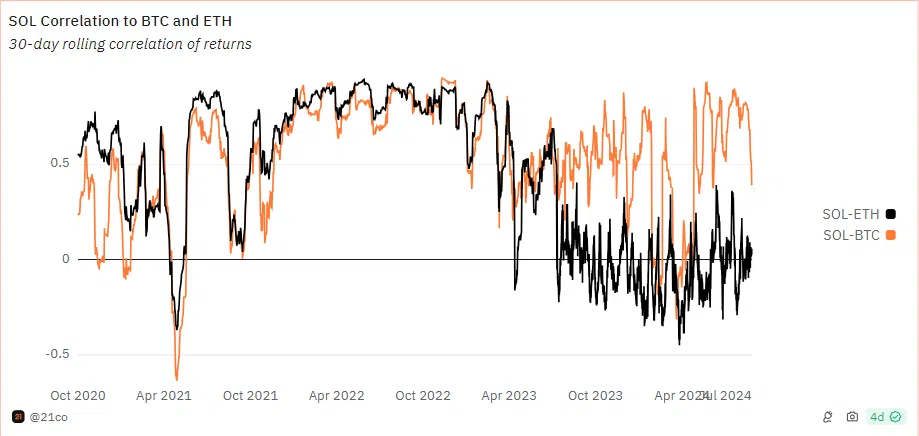

Correlation with major cryptocurrencies

Meanwhile, further data The analysis reveals interesting trends in the correlation between Solana (SOL) and two major cryptocurrencies: Bitcoin (BTC) and Ethereum (ETH).

The 30-day rolling return correlation shows significant volatility in the relationship between SOL and BTC, with notable dips into negative correlation around April 2021 and late 2023-early 2024.

Correlation SOL|BTC|ETH

This suggests that Solana’s price dynamics do not always align with Bitcoin’s price dynamics, reflecting changing market sentiment.

Meanwhile, the correlation between SOL and ETH has been more stable, indicating that Solana’s price often mirrors Ethereum’s price despite some independent movements in 2023 and 2024.

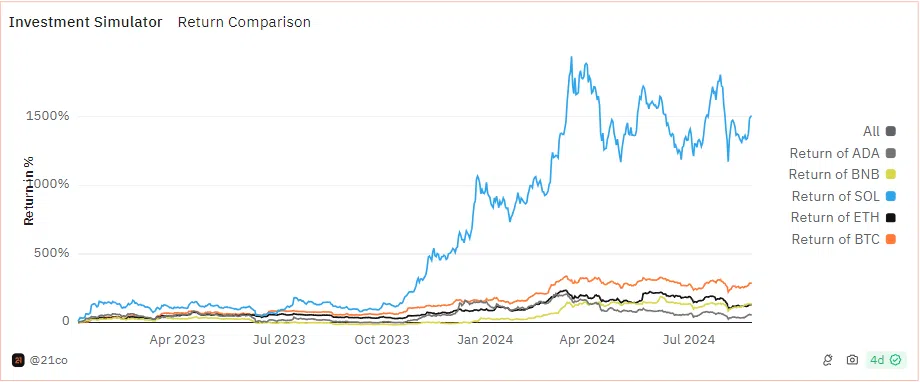

Comparison of investment efficiency

In addition, a comparison of the investment simulator from April 2023 to July 2024 shows Solana has significantly outperformed other major cryptocurrencies. Solana’s returns peaked at over 1,500% in early 2024, surpassing Bitcoin and Ethereum, which saw more moderate growth, peaking at around 200%.

Despite some volatility, Solana maintained its lead, while BNB and ADA showed more muted returns around 100%.

However, against the backdrop of Solana’s positive achievements, renowned TradingView analyst Alan Santana issued a warning forecastpredicting a sharper drop in Solana to $55.

Santana warns that the lack of significant support at this level could exacerbate the downturn, drawing parallels with Ethereum’s recent performance.